Is Mammoth Energy Services (NASDAQ:TUSK) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Mammoth Energy Services, Inc. (NASDAQ:TUSK) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Mammoth Energy Services

How Much Debt Does Mammoth Energy Services Carry?

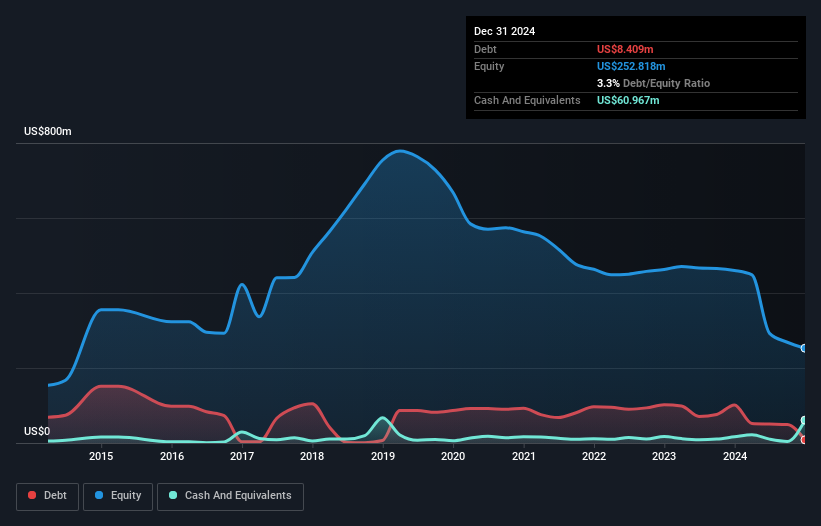

You can click the graphic below for the historical numbers, but it shows that Mammoth Energy Services had US$8.41m of debt in December 2024, down from US$101.6m, one year before. But on the other hand it also has US$61.0m in cash, leading to a US$52.6m net cash position.

A Look At Mammoth Energy Services' Liabilities

According to the last reported balance sheet, Mammoth Energy Services had liabilities of US$114.5m due within 12 months, and liabilities of US$16.7m due beyond 12 months. Offsetting this, it had US$61.0m in cash and US$79.0m in receivables that were due within 12 months. So it can boast US$8.77m more liquid assets than total liabilities.

This surplus suggests that Mammoth Energy Services has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Mammoth Energy Services boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Mammoth Energy Services's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Mammoth Energy Services had a loss before interest and tax, and actually shrunk its revenue by 39%, to US$188m. To be frank that doesn't bode well.

So How Risky Is Mammoth Energy Services?

While Mammoth Energy Services lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow US$164m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Mammoth Energy Services insider transactions.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English