SIGN UP

LOG IN

Wall Street's Most Accurate Analysts Give Their Take On 3 Tech And Telcom Care Stocks Delivering High-Dividend Yields

Benzinga·03/17/2025 12:58:27

Listen to the news

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the communication services sector.

Verizon Communications Inc. (NYSE:VZ)

- Dividend Yield: 6.22%

- Scotiabank analyst Maher Yaghi maintained a Sector Perform rating and raised the price target from $47.5 to $48 on March 3, 2025. This analyst has an accuracy rate of 61%.

- Tigress Financial analyst Ivan Feinseth maintained a Buy rating with a price target of $55 on Jan. 30, 2025. This analyst has an accuracy rate of 73%.

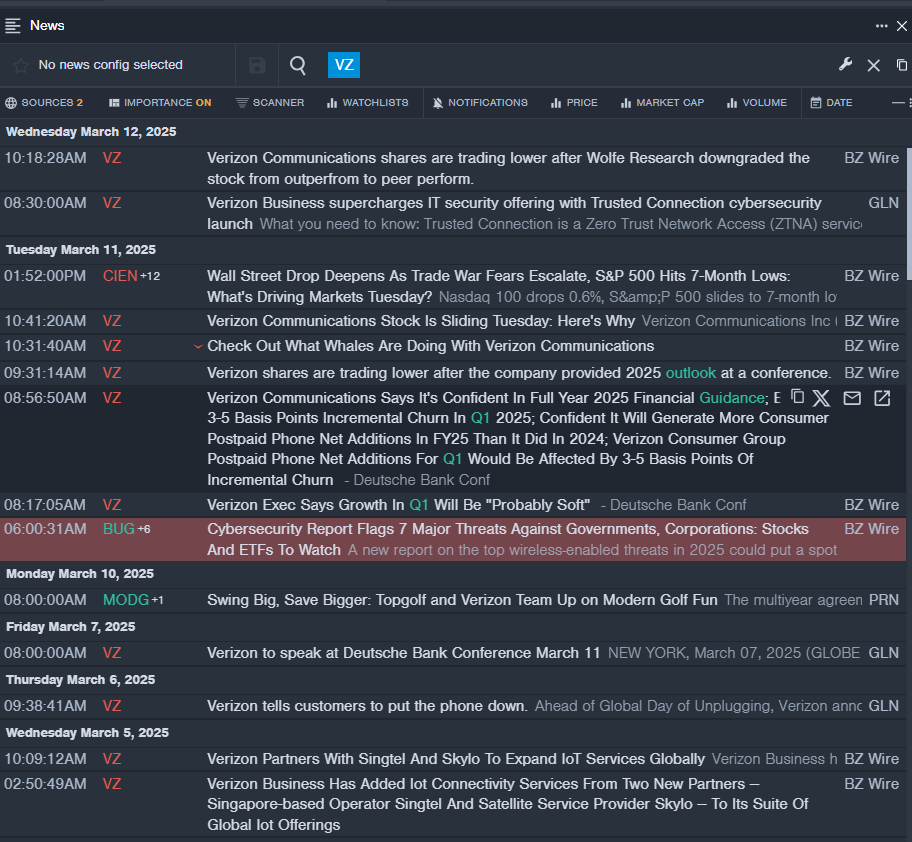

- Recent News: Speaking at a Deutsche Bank conference on March 11, a Verizon executive said first-quarter growth will be "probably soft," according to Benzinga Pro.

- Benzinga Pro’s real-time newsfeed alerted to latest VZ news.

Shutterstock, Inc. (NYSE:SSTK)

- Dividend Yield: 6.75%

- Needham analyst Bernie McTernan maintained a Buy rating and cut the price target from $45 to $30 on March 7, 2025. This analyst has an accuracy rate of 63%.

- JMP Securities analyst Andrew Boone reiterated a Market Perform rating on Jan. 6, 2025. This analyst has an accuracy rate of 75%.

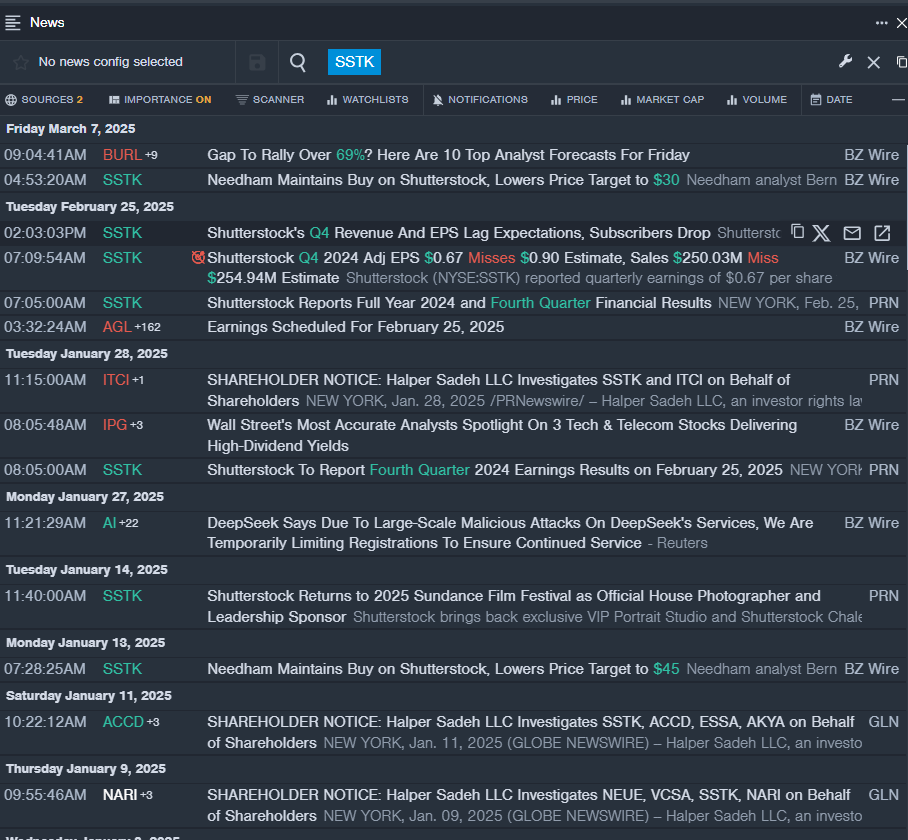

- Recent News: On Feb. 25, the company reported fourth-quarter FY24 sales growth of 15.1% year-on-year to $250.03 million, missing the analyst consensus estimate of $254.94 million.

- Benzinga Pro's real-time newsfeed alerted to latest SSTK news

AT&T Inc. (NYSE:T)

- Dividend Yield: 4.18%

- Scotiabank analyst Maher Yaghi maintained a Sector Outperform rating and raised the price target from $26 to $28.5 on March 3, 2025. This analyst has an accuracy rate of 61%.

- Tigress Financial analyst Ivan Feinseth maintained a Buy rating and raised the price target from $30 to $32 on Feb. 4, 2025. This analyst has an accuracy rate of 73%.

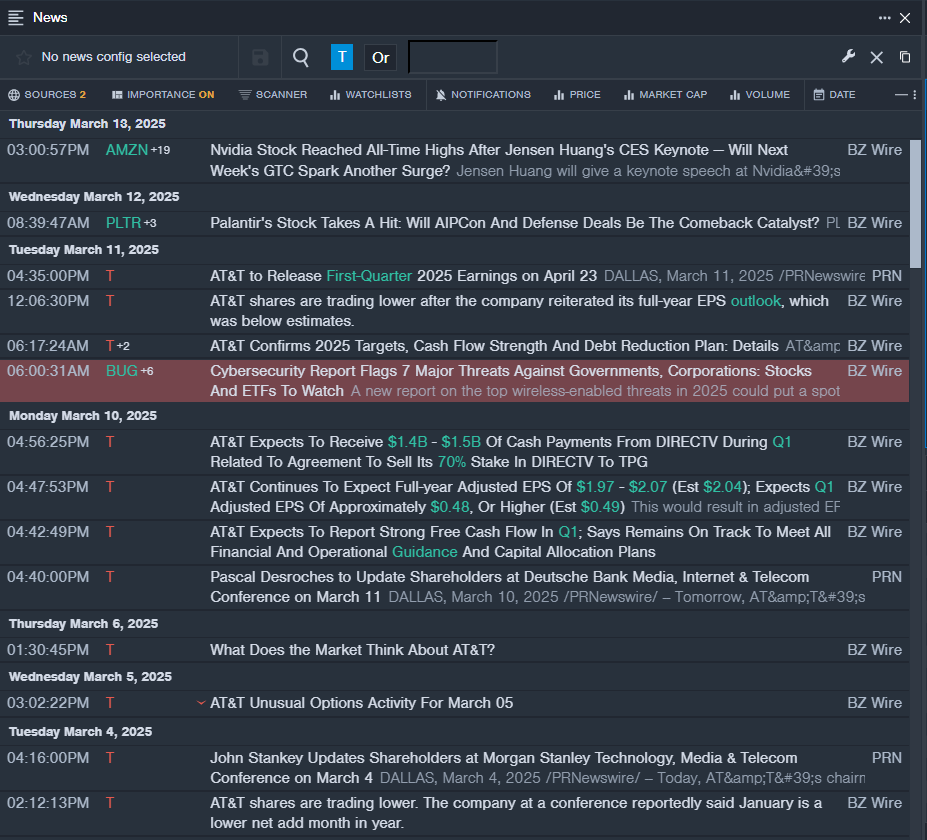

- Recent News: On March 10, AT&T confirmed it is on track to meet its 2025 financial targets and execute its long-term strategic plan.

- Benzinga Pro’s real-time newsfeed alerted to latest T news

Read More:

Risk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.