Palantir Technologies (NasdaqGS:PLTR) Collaborates To Revolutionize Healthcare Aviation and Maritime AI

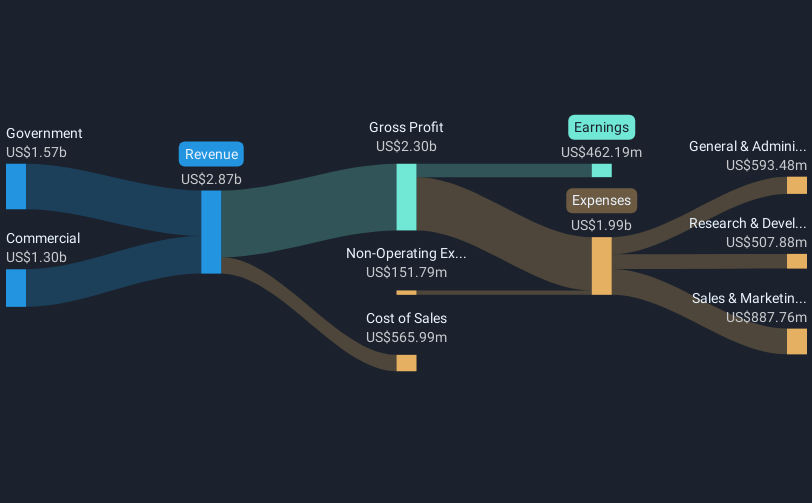

Palantir Technologies (NasdaqGS:PLTR) recently announced significant partnerships, such as launching the R37 AI lab with R1 to address administrative cost pressures in healthcare and securing six new customers for its Warp Speed platform in manufacturing and fleet management. These strategic moves underscore Palantir's focus on leveraging AI across sectors, potentially enhancing operational efficiencies. This aligns with broader tech sector strength, as evident from a recent rebound in the Nasdaq Composite. The company's share price increased by 4.67% over the last quarter, possibly influenced by these developments amidst a challenging market environment where the S&P 500 experienced a 4.1% weekly decline. Additionally, Palantir's inclusion into the NASDAQ-100 Index, alongside internal financial measures like share buybacks, further solidified its market position. The broader market dynamics included a tech sector rally led by companies like Nvidia, which, combined with Palantir's announcements, bolstered its investor sentiment and market performance.

Over the past three years, Palantir Technologies' shares have achieved a very large total return of 546.27%, capturing significant investor interest. This performance starkly contrasts with broader industry challenges, significantly outperforming the US Software industry's 4.3% decline in the past year. One key factor in this growth has been Palantir's rapid earnings expansion, witnessing a 120.3% increase over the past year alone. Additionally, ongoing partnerships, such as the December 2024 renewal of the Army Vantage program valued at over $400 million, have reinforced its revenue base. The company's addition to the NASDAQ-100 Index in late December 2024 also contributed to heightened visibility and investor confidence.

Corporate moves, including the August 2023 US$1 billion share buyback program, have underscored Palantir's confidence in its market valuation and future growth. Meanwhile, its strategy of integrating AI solutions across diverse sectors has continued to bolster its market position, as seen with its partnership expansions like the collaboration with Eaton in June 2024. These elements collectively underscore the broad-based factors driving Palantir's substantial shareholder returns over recent years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English