D-Wave Quantum (NYSE:QBTS) Reports US$86M Q4 Loss Despite Slight Annual Sales Increase

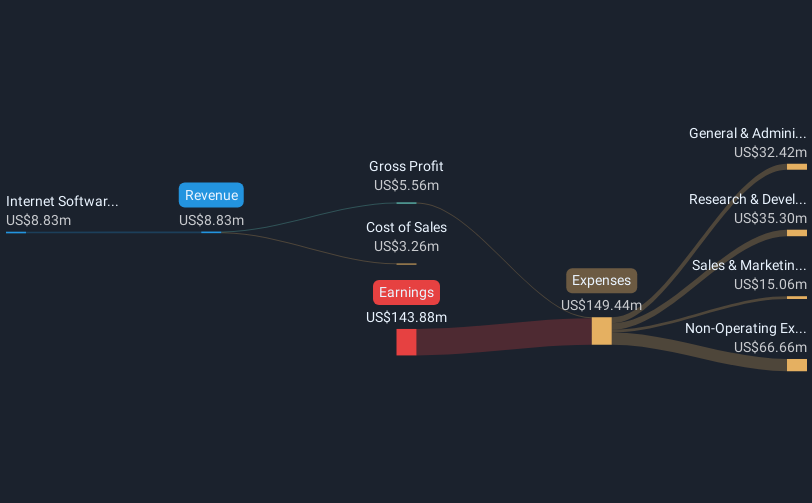

D-Wave Quantum (NYSE:QBTS) recently reported its fourth-quarter 2024 earnings, revealing increased net losses despite a slight year-over-year rise in annual sales. The quarterly sales dipped to USD 2.31 million from USD 2.91 million, alongside a steep rise in net loss to USD 86 million, contributing to a 38% decline in share price performance over the last quarter. The company's significant scientific breakthrough in quantum computing, announced just before the earnings report, possibly influenced its stock price performance as it demonstrated D-Wave's advancements in the quantum realm. In a broader context, while the tech sector experienced a rally, including substantial gains for companies like Nvidia and Palantir, overall market sentiment has been mixed with significant fluctuations, reflecting both the general market rebound and sector-specific challenges amid an ongoing sell-off and tariff concerns. Despite these challenges, D-Wave’s inclusion in the S&P Software & Services Select Industry Index could bolster its profile amid market volatility.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past year, D-Wave Quantum achieved a remarkable total shareholder return of 235.44%, a significant outperformance compared to both the broader US market and the US Software industry. This impressive performance comes despite not yet being profitable. Key developments that likely underpinned this performance include the company's public offering completed in January 2025, raising US$150 million, which bolstered its financial position. Additionally, its revolutionary breakthrough announced in March 2025—where D-Wave's quantum computing capabilities surpassed classical supercomputing for material simulations—solidified its technological prestige.

The company's inclusion in the S&P Software & Services Select Industry Index in December 2024 enhanced its investment appeal and visibility in the market. Furthermore, partnerships with major organizations such as Japan Tobacco Inc. for quantum AI projects and Jülich Supercomputing Centre's acquisition of a D-Wave system helped reinforce its standing in the quantum landscape, driving substantial investor interest and contributing to the strong return over the past year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English