Robinhood Markets (NasdaqGS:HOOD) Reports Revenue Doubling To US$1,014M Despite 1% Stock Dip

Robinhood Markets (NasdaqGS:HOOD) recently announced strong gains for the fourth quarter of 2024, with revenue doubling to USD 1,014 million and net income rising significantly to USD 916 million. Despite these robust financial results and the completion of a share repurchase program comprising over 1% of total shares, the company's stock price saw a modest decline of 1.04% over the last quarter. This movement occurs amid broader market volatility, where indexes like the S&P 500 and Nasdaq Composite have experienced downturns of 8.9% and 12.5% from their December highs. Factors such as the souring investor sentiment due to economic uncertainties and general declines in major tech stocks may have overshadowed Robinhood's otherwise positive performance and strategic buyback efforts, reflecting a cautious market stance on tech-related equities.

Upon reviewing our latest valuation report, Robinhood Markets' share price might be too optimistic.

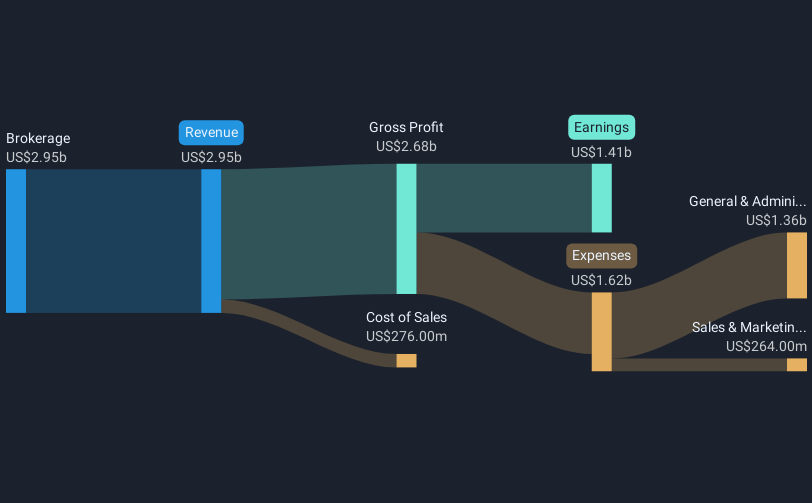

The past three years have seen Robinhood Markets achieve a remarkable total shareholder return of 204.54%, significantly outpacing the broader market. Despite recent short-term stock price fluctuations, this period has been characterized by meaningful developments. Notably, Robinhood's financial performance was transformed with substantial revenue and profit growth as seen in its latest earnings figures for 2024, where revenue increased to US$2.95 billion and net income reached US$1.41 billion.

Key factors contributing to this growth include Robinhood's active share repurchase program, with over 10 million shares bought back, and its strategic initiatives such as pursuing mergers and acquisitions. The company also surpassed the US Capital Markets industry with a one-year return exceeding 16.1%, underlining its successful transition to profitability alongside growth in operational metrics. While the market grapples with volatility, Robinhood's long-term trajectory demonstrates resilience and a continued commitment to enhancing shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English