Astera Labs And 2 Other Stocks That May Be Priced Below Their Estimated Value

In the current U.S. market environment, major indices like the S&P 500 and Nasdaq Composite have experienced declines due to economic uncertainties and fluctuating investor sentiment. As investors seek opportunities amidst this volatility, identifying stocks that may be undervalued becomes crucial, as these can offer potential value when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WesBanco (NasdaqGS:WSBC) | $30.99 | $60.61 | 48.9% |

| MINISO Group Holding (NYSE:MNSO) | $20.96 | $40.99 | 48.9% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $26.05 | $52.03 | 49.9% |

| Valley National Bancorp (NasdaqGS:VLY) | $8.69 | $17.28 | 49.7% |

| German American Bancorp (NasdaqGS:GABC) | $37.97 | $75.38 | 49.6% |

| Gilead Sciences (NasdaqGS:GILD) | $113.99 | $227.05 | 49.8% |

| Reddit (NYSE:RDDT) | $130.68 | $260.40 | 49.8% |

| Verra Mobility (NasdaqCM:VRRM) | $19.76 | $38.69 | 48.9% |

| First Advantage (NasdaqGS:FA) | $12.71 | $25.36 | 49.9% |

| Sotera Health (NasdaqGS:SHC) | $11.28 | $22.13 | 49% |

Here's a peek at a few of the choices from the screener.

Astera Labs (NasdaqGS:ALAB)

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of $10.71 billion.

Operations: The company generates revenue of $396.29 million from its semiconductor-based connectivity solutions segment.

Estimated Discount To Fair Value: 16.5%

Astera Labs, trading at US$68.82, is undervalued compared to its estimated fair value of US$82.46. Despite recent volatility and significant insider selling, the company shows strong revenue growth of 242.2% over the past year and forecasts suggest a 24.9% annual increase, outpacing market expectations. Although currently unprofitable with a net loss of US$83.42 million for 2024, profitability is anticipated within three years alongside substantial earnings growth projections of 61.1% annually.

- Our comprehensive growth report raises the possibility that Astera Labs is poised for substantial financial growth.

- Get an in-depth perspective on Astera Labs' balance sheet by reading our health report here.

Ready Capital (NYSE:RC)

Overview: Ready Capital Corporation is a real estate finance company in the United States with a market cap of approximately $831.61 million.

Operations: The company's revenue segments include Small Business Lending at $131.83 million and Lmm Commercial Real Estate at -$361.02 million.

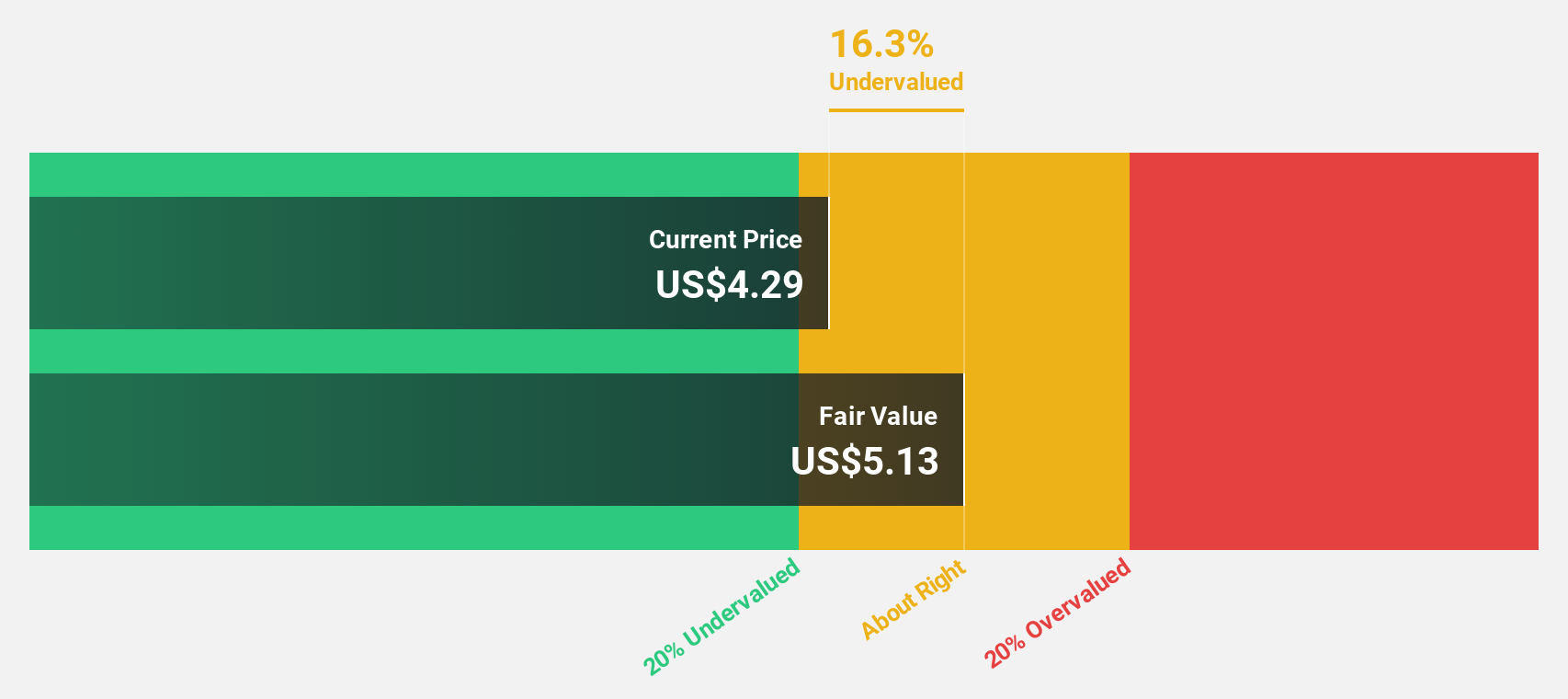

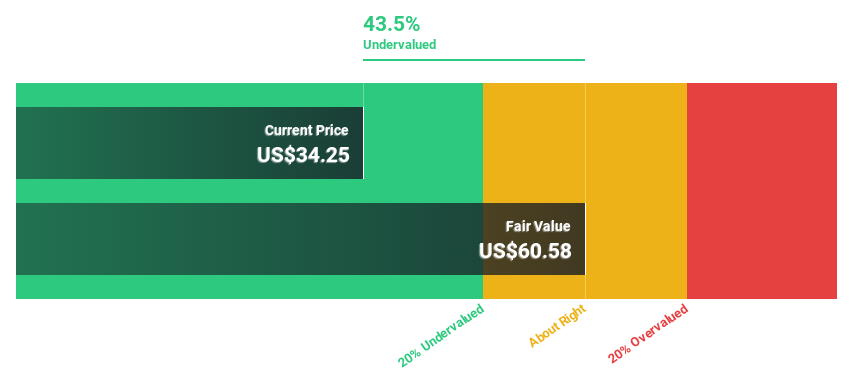

Estimated Discount To Fair Value: 43.5%

Ready Capital is trading at US$5.07, significantly undervalued compared to its estimated fair value of US$8.97, despite recent legal challenges and a net loss of US$435.76 million in 2024. The company has taken steps to stabilize its balance sheet, including reserving for non-performing loans and completing a share buyback program worth US$100 million. Revenue growth is forecasted at 94.6% annually, with profitability expected within three years, indicating potential for future financial recovery.

- Our growth report here indicates Ready Capital may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Ready Capital.

Range Resources (NYSE:RRC)

Overview: Range Resources Corporation is an independent company in the United States focused on the exploration and production of natural gas, natural gas liquids (NGLs), and oil, with a market cap of approximately $9.04 billion.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, which generated $2.36 billion.

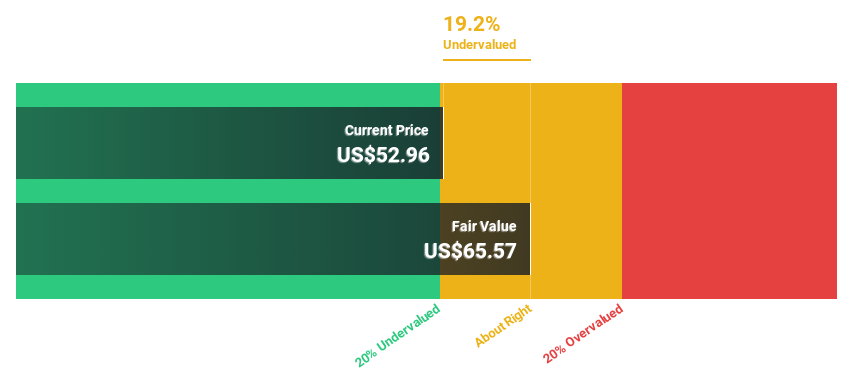

Estimated Discount To Fair Value: 19.5%

Range Resources is trading at US$37.6, below its estimated fair value of US$46.71, with earnings projected to grow significantly by 22.5% annually over the next three years. Despite a decline in net profit margins from 33.5% to 11.2%, the company has increased its quarterly dividend by 12.5%. Recent share buybacks and stable production levels underscore strategic financial management, while revenue growth is expected to outpace the broader US market at 14.2% annually.

- According our earnings growth report, there's an indication that Range Resources might be ready to expand.

- Take a closer look at Range Resources' balance sheet health here in our report.

Seize The Opportunity

- Reveal the 195 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English