Affirm Holdings (NasdaqGS:AFRM) Dips 18% Post Equity Offering Announcement

Affirm Holdings (NasdaqGS:AFRM) recently announced several new partnerships, including with StockX and Stitch Fix, aiming to enhance its position in the flexible payment solutions market. Despite these strategic collaborations, Affirm's share price dropped 18% over the past week. This decline coincided with the company's announcement of a follow-on equity offering of 22 million shares, which can often lead to a short-term decrease in stock value due to concerns about dilution. Meanwhile, the broader market experienced a 3.7% decline amidst ongoing economic uncertainties. Although technology stocks saw a boost later in the week due to moderating inflation expectations, Affirm's payment-focused business appears to have faced unique pressures. Factors such as its business model's exposure to consumer spending patterns and potential investor apprehension about the equity offering likely contributed to the company's underperformance compared to the tech sector rally experienced elsewhere.

Explore historical data to track Affirm Holdings' performance over time in our past results report.

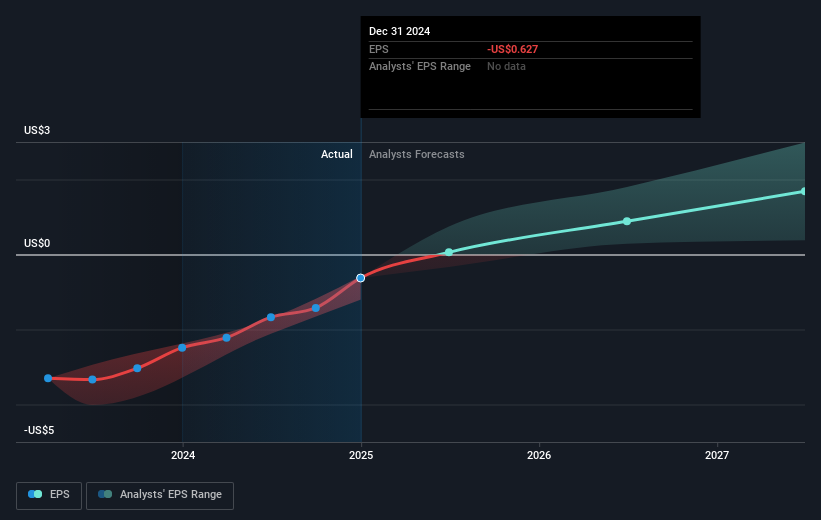

Over the past three years, Affirm Holdings has achieved a total shareholder return of 65.09%. This performance stands out, particularly over the last year, where Affirm has outpaced both the US Diversified Financial industry and the broader US market. A key driver was the recent significant earnings turnaround in Q2 2025, where the company reported US$866.38 million in revenue and transitioned from a net loss to a net income of US$80.36 million. This financial milestone likely buoyed investor confidence despite earlier equity offering-related pressures.

Furthermore, Affirm's strategic expansion of partnerships, such as with Shopify and WooCommerce, has likely contributed to its longer-term market appeal, by solidifying its presence as a flexible payment provider. An updated revenue guidance for FY2025, with expectations of robust growth in gross merchandise volume, also suggests a positive outlook that aligns with the company's historical returns. These elements underscore Affirm's broader narrative of growth and adaptation in a competitive financial landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English