Credo Technology Group Holding (NasdaqGS:CRDO) Stock Drops 22% Despite Strong US$135M Revenue Increase

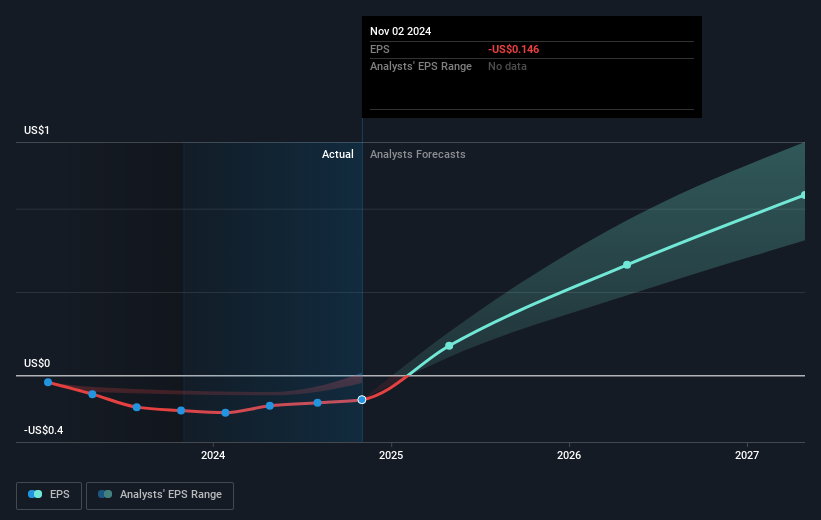

Credo Technology Group Holding (NasdaqGS:CRDO) experienced a 22% decrease in its share price over the last week despite reporting strong third-quarter results, including a revenue increase from USD 53 million to USD 135 million and a net income jump to USD 29 million. This performance might have been overshadowed by broader market concerns, including a significant downturn across major indices like the Nasdaq's 4% drop. This slide was fueled by uncertainties stemming from new tariffs imposed by the Trump administration, adding to investor apprehensions about potential economic slowdowns. Although Credo's advancements, such as compliance with PCIe 5.0 standards, were positive achievements, they did not shield the stock from the broader market volatility. The overall market trend saw a 4.6% decline in the past week, influenced by political and economic uncertainties, impacting investor sentiment across the sector.

Dig deeper into the specifics of Credo Technology Group Holding here with our thorough analysis report.

Over the last three years, Credo Technology Group Holding has achieved a total shareholder return of 188.59%, reflecting strong growth despite recent volatility. The company's success includes impressive revenue and net income increases, with revenue jumping from US$53 million to US$135 million and net income reaching US$29 million. This substantial growth is complemented by Credo's exceeding of the US Semiconductor industry’s returns over the past year, which stood at 11.6%. This differentiation highlights Credo's distinct positioning within the market.

Several key developments have likely contributed to Credo's longer-term performance. The introduction of PCIe 5.0 compatible products in March 2025 and successful compliance with testing standards are indicative of the company's technological advancements. Additionally, strategic partnerships, such as the collaboration with EFFECT Photonics in March 2023, have potentially strengthened Credo's market reach and capabilities. Furthermore, the expansion into the Japanese market through distribution deals with Net One Systems in November 2024 has likely bolstered Credo's international growth prospects.

- Learn how Credo Technology Group Holding's intrinsic value compares to its market price with our detailed valuation report.

- Gain insight into the risks facing Credo Technology Group Holding and how they might influence its performance—click here to read more.

- Is Credo Technology Group Holding part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English