The Market Doesn't Like What It Sees From Atlanticus Holdings Corporation's (NASDAQ:ATLC) Earnings Yet As Shares Tumble 26%

Atlanticus Holdings Corporation (NASDAQ:ATLC) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Looking at the bigger picture, even after this poor month the stock is up 38% in the last year.

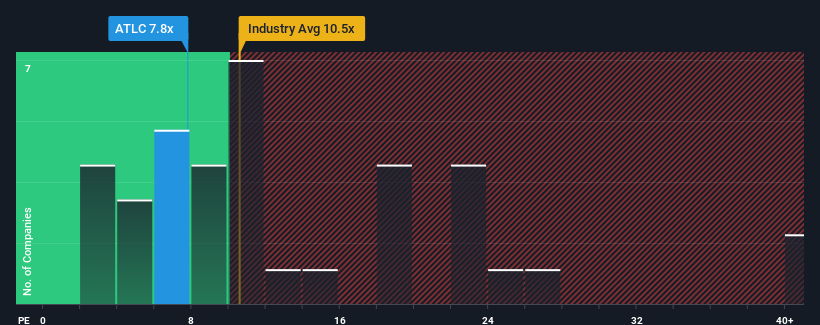

Although its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may still consider Atlanticus Holdings as a highly attractive investment with its 7.8x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent earnings growth for Atlanticus Holdings has been in line with the market. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Atlanticus Holdings

Is There Any Growth For Atlanticus Holdings?

In order to justify its P/E ratio, Atlanticus Holdings would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a decent 5.9% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen an unpleasant 38% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 2.8% during the coming year according to the seven analysts following the company. That's shaping up to be materially lower than the 14% growth forecast for the broader market.

With this information, we can see why Atlanticus Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Atlanticus Holdings' P/E

Shares in Atlanticus Holdings have plummeted and its P/E is now low enough to touch the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Atlanticus Holdings maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Atlanticus Holdings that we have uncovered.

Of course, you might also be able to find a better stock than Atlanticus Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English