Discover US Undiscovered Gems with 3 Promising Stocks

Over the last 7 days, the United States market has experienced a 2.7% drop, yet it remains up by 11% over the past year with earnings forecasted to grow by 14% annually. In this dynamic environment, identifying promising stocks that are not yet widely recognized can offer unique opportunities for investors seeking to capitalize on potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Gulf Island Fabrication | 20.41% | -7.88% | 41.10% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Target Hospitality (NasdaqCM:TH)

Simply Wall St Value Rating: ★★★★★★

Overview: Target Hospitality Corp. is a North American company specializing in rental and hospitality services with a market cap of $548.13 million.

Operations: Target Hospitality generates revenue primarily from its Government and Hospitality & Facilities Services - South segments, with the Government segment contributing $268.45 million and the latter $149.42 million.

Target Hospitality, a nimble player in the hospitality services sector, has seen its debt-to-equity ratio impressively drop from 279.4% to 43% over five years, reflecting prudent financial management. However, it faces challenges with a recent negative earnings growth of -42.3%, contrasting starkly with the industry's 2.6% average. Despite this, its interest payments are comfortably covered by EBIT at 7.9 times coverage. Recent strategic moves include securing a lease agreement for the Dilley Facility and a $140 million Workforce Housing Contract linked to Lithium Americas' Thacker Pass Project, indicating potential revenue streams amid political uncertainties impacting government contracts.

Photronics (NasdaqGS:PLAB)

Simply Wall St Value Rating: ★★★★★★

Overview: Photronics, Inc. is a company that specializes in the manufacture and sale of photomask products and services across various international markets, with a market cap of approximately $1.32 billion.

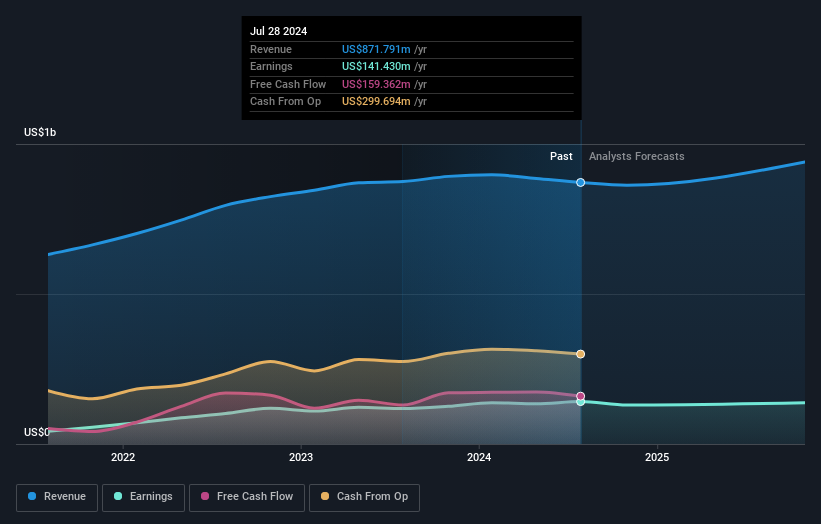

Operations: Photronics generates its revenue primarily from the manufacture of photomasks, with reported sales amounting to $862.75 million. The company's market cap is approximately $1.32 billion.

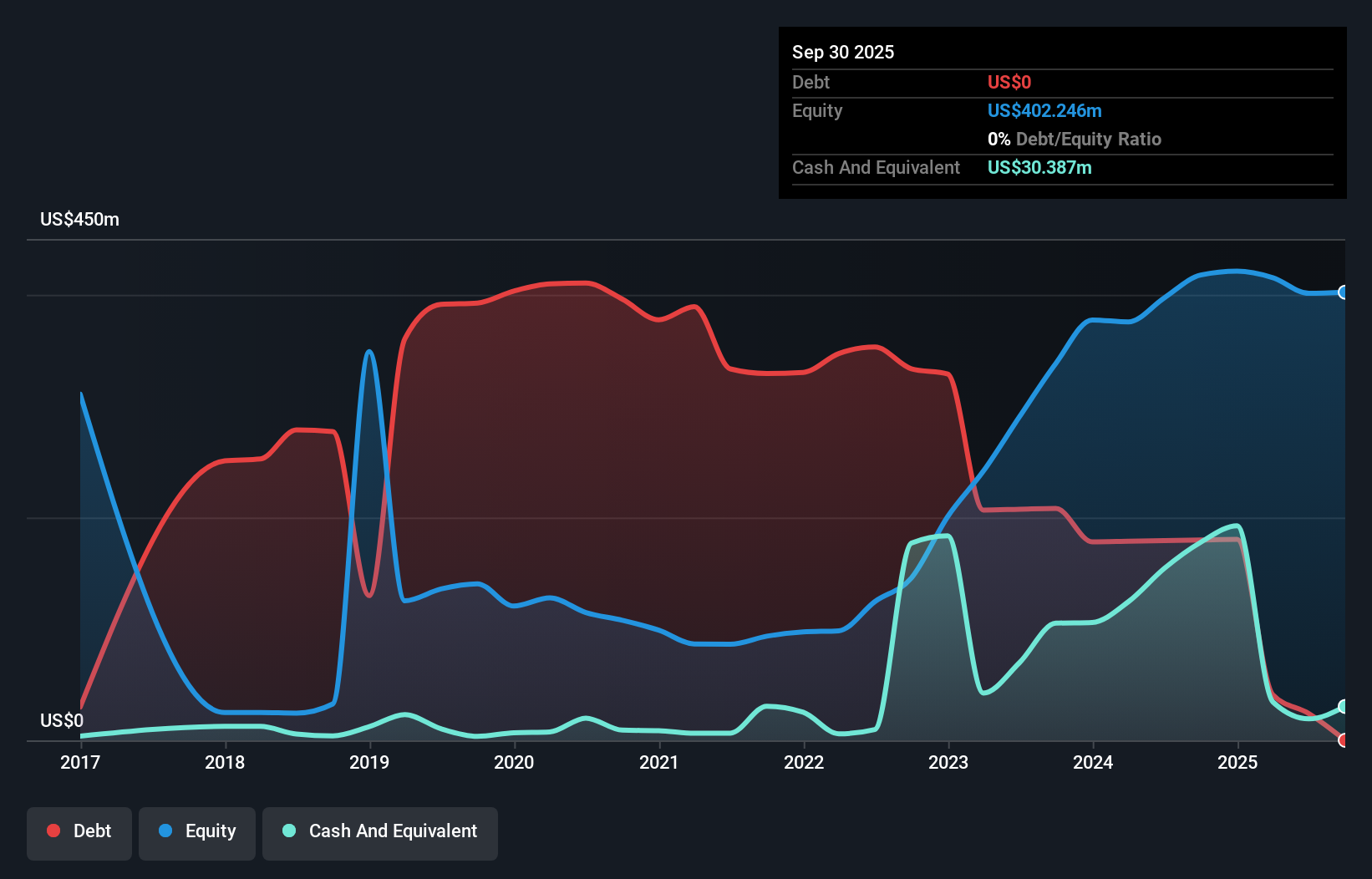

Photronics, a nimble player in the semiconductor sector, recently reported robust financials with net income climbing to US$42.85 million from US$26.18 million year-over-year, reflecting solid earnings quality. The company is debt-free now compared to a 6% debt-to-equity ratio five years ago, enhancing its financial flexibility. Despite significant insider selling over the past quarter, Photronics remains undervalued at 47% below its estimated fair value and trades favorably against industry peers. With free cash flow positive and strategic investments in photomasks underway, the firm seems well-positioned for growth despite potential margin pressures from competitive markets.

Strategic Education (NasdaqGS:STRA)

Simply Wall St Value Rating: ★★★★★★

Overview: Strategic Education, Inc. offers campus-based and online post-secondary education services aimed at developing job-ready skills, with a market cap of approximately $1.99 billion.

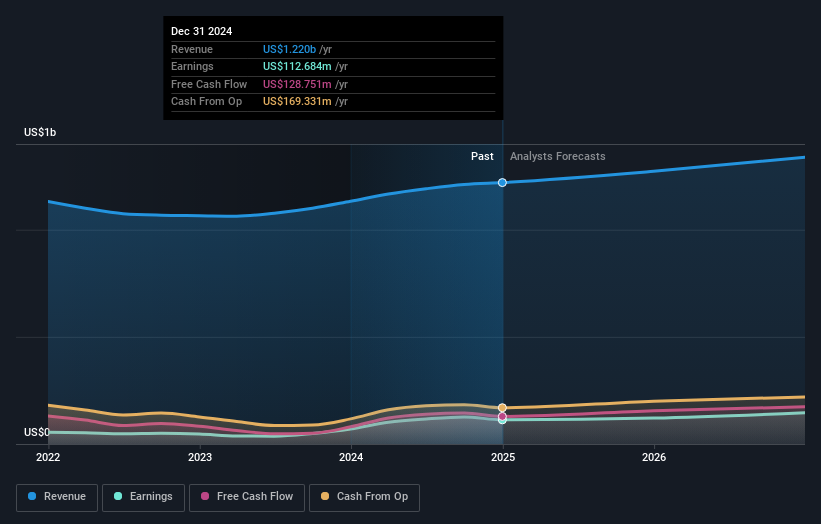

Operations: Strategic Education, Inc. generates revenue primarily from U.S. Higher Education ($857.89 million), Australia/New Zealand operations ($257.12 million), and Education Technology Services ($104.92 million). The company has a market cap of approximately $1.99 billion, reflecting its scale in the education sector.

Strategic Education is carving a niche in the education sector with its robust earnings growth, which outpaced the industry at 61.5% over the past year. The company is debt-free, enhancing its financial stability and making it a solid contender for value seekers. Despite reporting US$311.46 million in sales for Q4 2024, net income fell to US$25.34 million from US$39.13 million a year prior, impacting EPS which decreased from US$1.67 to US$1.08 per share year-over-year. A quarterly dividend of $0.60 per share underscores its commitment to returning value to shareholders amidst these fluctuations.

Make It Happen

- Gain an insight into the universe of 280 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English