March 2025's High Insider Ownership Growth Stocks

As the U.S. market grapples with tech stock sell-offs and tariff uncertainties, investors are keeping a close eye on how these factors might impact economic growth and inflation. In such volatile times, companies with strong insider ownership can be appealing as they often indicate confidence from those most familiar with the business's potential for growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.1% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.9% |

| Kingstone Companies (NasdaqCM:KINS) | 17.7% | 24.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

We're going to check out a few of the best picks from our screener tool.

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc. is a digital asset technology company operating in the United States with a market cap of approximately $1.33 billion.

Operations: The company's revenue primarily comes from digital currency mining, amounting to $140.05 million.

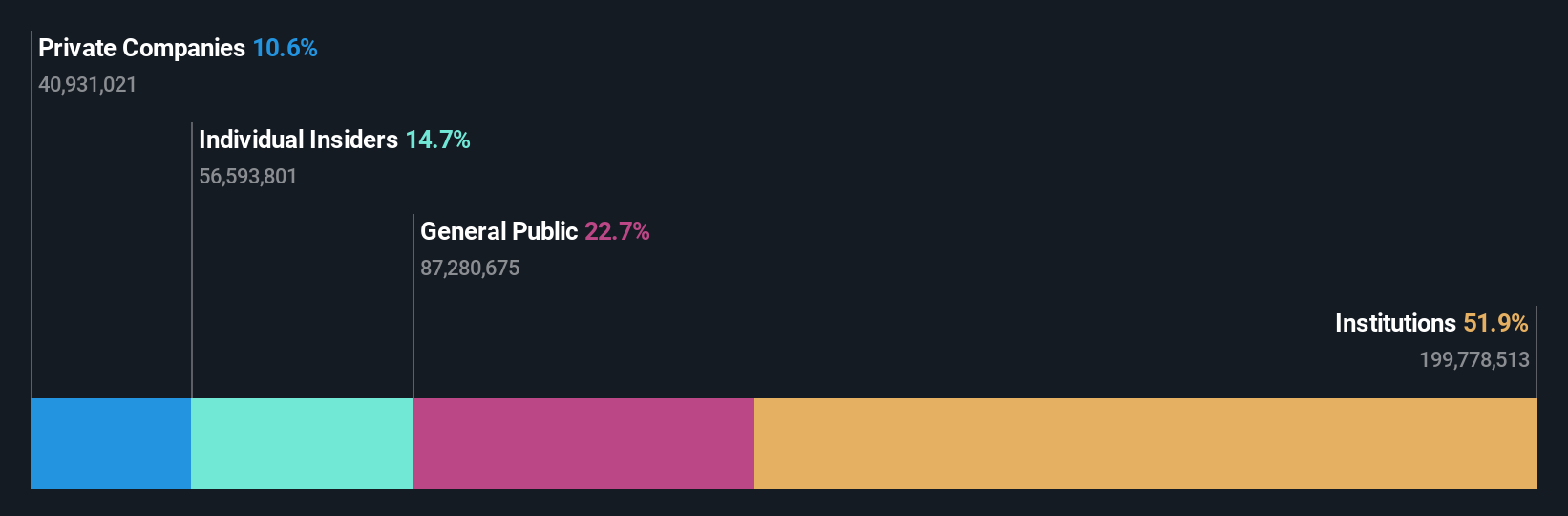

Insider Ownership: 14.7%

Revenue Growth Forecast: 50.4% p.a.

TeraWulf shows strong growth potential with revenue expected to increase 50.4% annually, surpassing market averages. Despite a net loss of US$72.42 million in 2024, earnings are projected to grow significantly, becoming profitable within three years. Recent buybacks and insider buying indicate confidence, though past shareholder dilution is a concern. The company’s strategic expansion into AI-driven computing complements its Bitcoin mining operations, supported by recent data center lease agreements with Core42 for scalable infrastructure solutions.

- Click here to discover the nuances of TeraWulf with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of TeraWulf shares in the market.

New Fortress Energy (NasdaqGS:NFE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: New Fortress Energy Inc. is an integrated gas-to-power energy infrastructure company offering energy and development services globally, with a market cap of approximately $2.66 billion.

Operations: New Fortress Energy Inc.'s revenue segments include energy infrastructure and development services provided to global end-users.

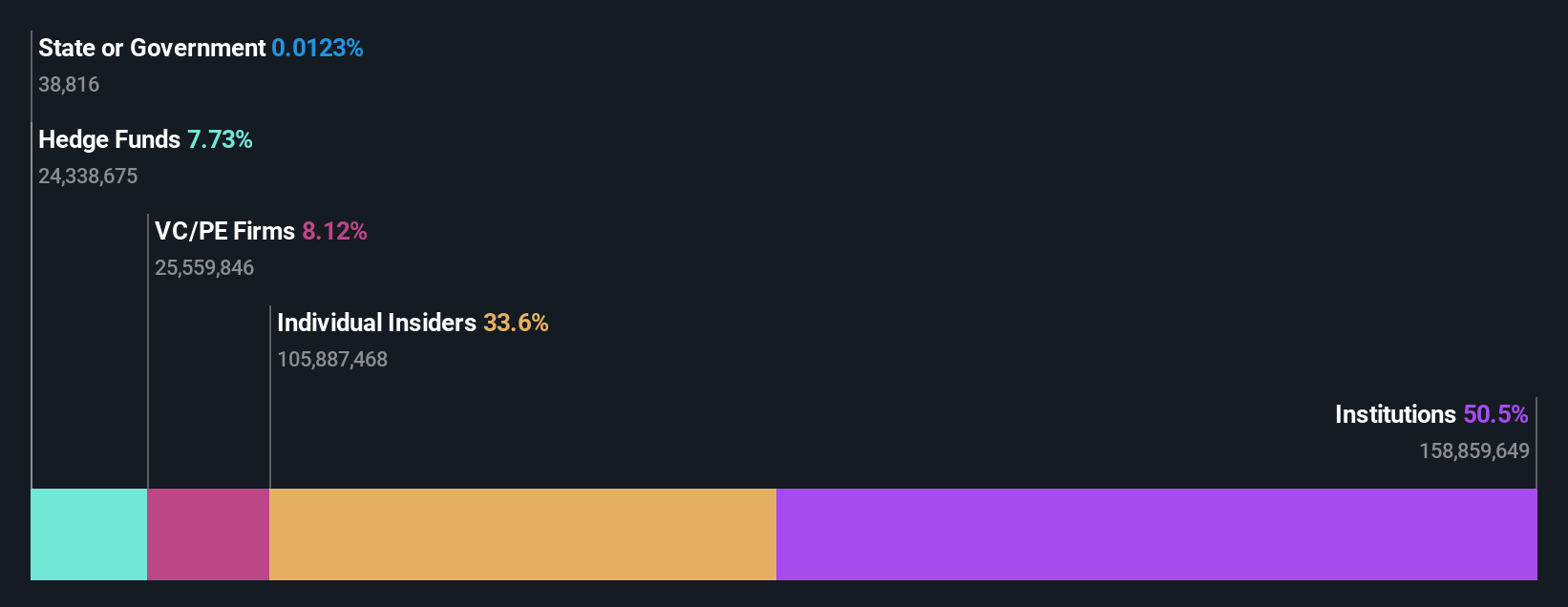

Insider Ownership: 30%

Revenue Growth Forecast: 18.4% p.a.

New Fortress Energy's insider ownership aligns with its strategic initiatives, including a one-year extension of its gas supply contract with PREPA and a 20-year agreement in Puerto Rico. Despite recent financial challenges, such as a US$242.14 million net loss in Q4 2024 and delayed SEC filings, the company is forecast to achieve profitability within three years. However, significant past shareholder dilution and high dividend payouts not covered by free cash flow present risks.

- Get an in-depth perspective on New Fortress Energy's performance by reading our analyst estimates report here.

- The analysis detailed in our New Fortress Energy valuation report hints at an deflated share price compared to its estimated value.

Vasta Platform (NasdaqGS:VSTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vasta Platform Limited offers educational printed and digital solutions to private schools in Brazil's K-12 education sector, with a market cap of approximately $250.14 million.

Operations: The company's revenue is primarily derived from its Educational Services segment, specifically in Education & Training Services, which generated R$1.53 billion.

Insider Ownership: 10%

Revenue Growth Forecast: 11.8% p.a.

Vasta Platform's growth potential is underscored by insider confidence, with substantial insider buying and no significant selling in the past three months. The company is trading at 52% below its estimated fair value, suggesting good relative value. Revenue growth of 11.8% annually outpaces the US market average and profitability is expected within three years, though its future return on equity remains low at 3.2%.

- Unlock comprehensive insights into our analysis of Vasta Platform stock in this growth report.

- Our comprehensive valuation report raises the possibility that Vasta Platform is priced lower than what may be justified by its financials.

Summing It All Up

- Click this link to deep-dive into the 202 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English