Ceragon Networks (NasdaqGS:CRNT) 12.75% Drop Despite Improved Q4 Earnings

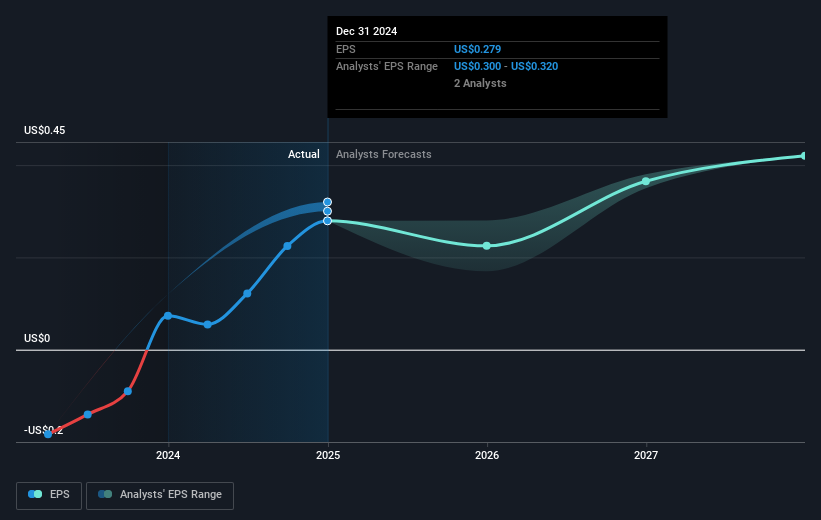

Ceragon Networks (NasdaqGS:CRNT) recently launched next-generation products at the 2025 Mobile World Congress, as well as reported improved fourth-quarter earnings, suggesting strategic advances for the company. However, these developments coincided with a 12.75% decline in its share price over the last week. This drop can be attributed to general market trends, with the broader market experiencing a 2.5% decline amidst investor concerns about newly imposed U.S. tariffs on various goods, impacting global supply chains and investor sentiment. Despite the impressive product announcements and potential revenue growth forecasted by Ceragon, the market's overall downward movement and economic uncertainties, such as predicted rate hikes and inflation concerns, overshadowed Ceragon’s favorable earnings news. As the sector faced broader challenges, such as rising costs and shifting geopolitical relations, Ceragon's stock was unable to evade the prevailing bearish market sentiment.

Click here to discover the nuances of Ceragon Networks with our detailed analytical report.

Ceragon Networks has achieved a total return of 75.68% over the past five years, a notable feat considering various impactful events during this period. The announcement of significant product innovations, such as the dual-carrier E-band solution and high-capacity millimeter-wave backhaul, marked crucial technological advancements. These initiatives likely played a role in strengthening the company's market position. Additionally, securing significant orders, like the multi-million-dollar contract from a major U.S. ISP in 2024, contributed to revenue growth and investor interest.

Corporate actions provided further context to Ceragon's performance. The offer of comprehensive corporate guidance and revenue forecasts underscored its growth ambitions. However, periodic executive changes, like the addition of Mr. Robert Wadsworth to the Board, might have influenced governance stability positively. Despite challenges posed by economic pressures and geopolitical uncertainties, these strategic maneuvers and financial outcomes underscored Ceragon's capacity to generate returns, even amid broader market adversities.

- Learn how Ceragon Networks' intrinsic value compares to its market price with our detailed valuation report.

- Discover the key vulnerabilities in Ceragon Networks' business with our detailed risk assessment.

- Already own Ceragon Networks? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English