Wolfspeed (NYSE:WOLF) Dips 15% As U.S. Tariff Concerns Pressure Tech Stocks

Wolfspeed (NYSE:WOLF) experienced a price decline of 15% over the past month, a period marked by significant market volatility. This downturn coincided with broad market pressure, as the Dow Jones and S&P 500 indices faced declines due to investor apprehension over newly imposed U.S. tariffs impacting trade with major partners. Technology stocks were notably affected, with major companies experiencing losses, highlighting sector-wide challenges that likely contributed to Wolfspeed's lower performance. Additionally, financial services and retail sectors also showed weakness due to tariff concerns, compounding investor unease across various market segments. While Wolfspeed's recent performance reflects broader market trends rather than isolated company issues, it underscores the interconnected nature of market reactions to geopolitical and economic pressures. Despite market fluctuations, the company's long-term prospects remain tied to broader economic conditions and industry-specific developments.

Dig deeper into the specifics of Wolfspeed here with our thorough analysis report.

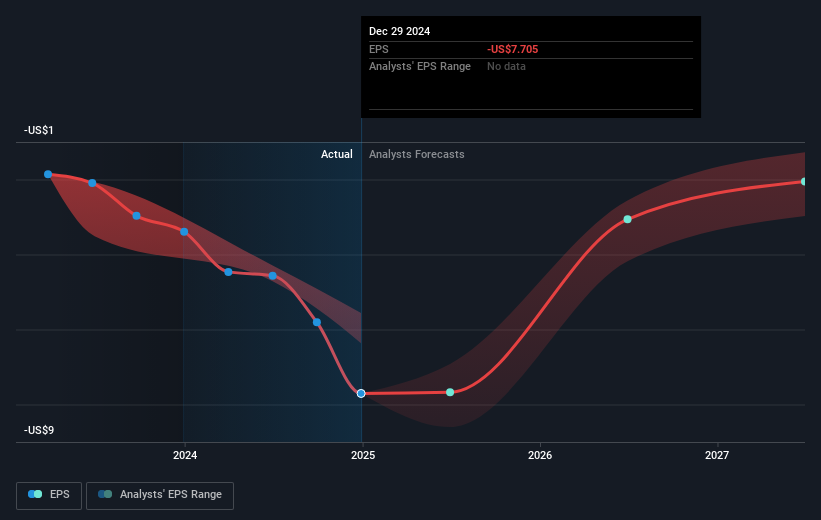

Over the past year, Wolfspeed's total shareholder return, including share price and dividends, saw an 81.14% decline. This performance significantly lagged both the US Semiconductor industry, which returned 19.3%, and the broader US market, which saw a 15.3% return. A series of financial results painted a challenging picture, as reported on January 29, 2025. Q2 sales decreased to US$180.5 million from US$208.4 million year-over-year, accompanied by a net loss of US$372.2 million, widening from US$144.7 million the previous year.

Further complicating investor sentiment, a follow-on equity offering raised US$200 million in mid-January 2025, resulting in shareholder dilution. Leadership changes added to uncertainty, including the departure of CEO Gregg Lowe in November 2024. The launch of the Gen 4 Technology Platform was a potential positive, yet it was overshadowed by ongoing losses and a lack of profitability forecast for the upcoming years.

- Get the full picture of Wolfspeed's valuation metrics and investment prospects—click to explore.

- Analyze the downside risks for Wolfspeed and understand their potential impact—click to learn more.

- Already own Wolfspeed? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English