Returns Are Gaining Momentum At Tower Semiconductor (NASDAQ:TSEM)

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, we've noticed some promising trends at Tower Semiconductor (NASDAQ:TSEM) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Tower Semiconductor is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.066 = US$185m ÷ (US$3.1b - US$285m) (Based on the trailing twelve months to December 2024).

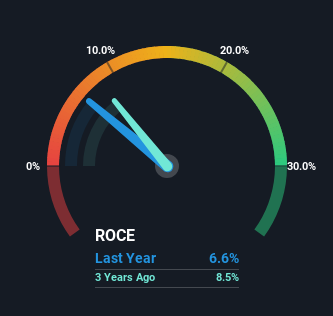

So, Tower Semiconductor has an ROCE of 6.6%. On its own that's a low return on capital but it's in line with the industry's average returns of 7.3%.

Check out our latest analysis for Tower Semiconductor

In the above chart we have measured Tower Semiconductor's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Tower Semiconductor for free.

What The Trend Of ROCE Can Tell Us

We're glad to see that ROCE is heading in the right direction, even if it is still low at the moment. Over the last five years, returns on capital employed have risen substantially to 6.6%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 66%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

The Bottom Line On Tower Semiconductor's ROCE

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Tower Semiconductor has. And a remarkable 122% total return over the last five years tells us that investors are expecting more good things to come in the future. Therefore, we think it would be worth your time to check if these trends are going to continue.

Tower Semiconductor does have some risks though, and we've spotted 1 warning sign for Tower Semiconductor that you might be interested in.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English