Undiscovered Gems Featuring None And 2 More Promising Stocks

In the current global market landscape, small-cap stocks are navigating a challenging environment marked by geopolitical tensions and consumer spending concerns, with key indices like the S&P 600 feeling the pressure. As investors seek stability amidst fluctuating economic indicators such as contracting U.S. Services PMI and rising inflation expectations, identifying potential opportunities in lesser-known stocks becomes increasingly appealing. A good stock in this context often exhibits resilience to broader market volatility and possesses strong fundamentals that can withstand economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Novabase S.G.P.S (DB:NVQ)

Simply Wall St Value Rating: ★★★★★★

Overview: Novabase S.G.P.S., S.A. is a company that, through its subsidiaries, offers IT consulting and services across Portugal, Europe, Africa, the Middle East, and internationally with a market capitalization of approximately €250.99 million.

Operations: Novabase's primary revenue stream is derived from its Next-Gen segment, generating €134.18 million, while the Value Portfolio contributes minimally with €0.01 million.

Novabase S.G.P.S. has demonstrated a mixed financial performance, with earnings surging by 77% over the past year, outpacing the IT sector's 8.5% growth. Despite this impressive growth, earnings have declined by an average of 10% annually over the last five years. The company’s debt-to-equity ratio improved significantly from 21.4% to 11.3%, indicating better financial health, and it maintains more cash than its total debt, suggesting robust liquidity management. However, recent results show net income dropping to €6.42 million from €47 million previously, highlighting potential challenges despite high-quality earnings and positive free cash flow trends.

LEPU ScienTech Medical Technology (Shanghai) (SEHK:2291)

Simply Wall St Value Rating: ★★★★★★

Overview: LEPU ScienTech Medical Technology (Shanghai) Co., Ltd. is an investment holding company involved in the research, development, manufacture, and commercialization of interventional medical devices globally, with a market cap of HK$6.24 billion.

Operations: The company generates revenue from the development and sale of interventional medical devices. It operates with a focus on research and manufacturing, contributing to its financial performance.

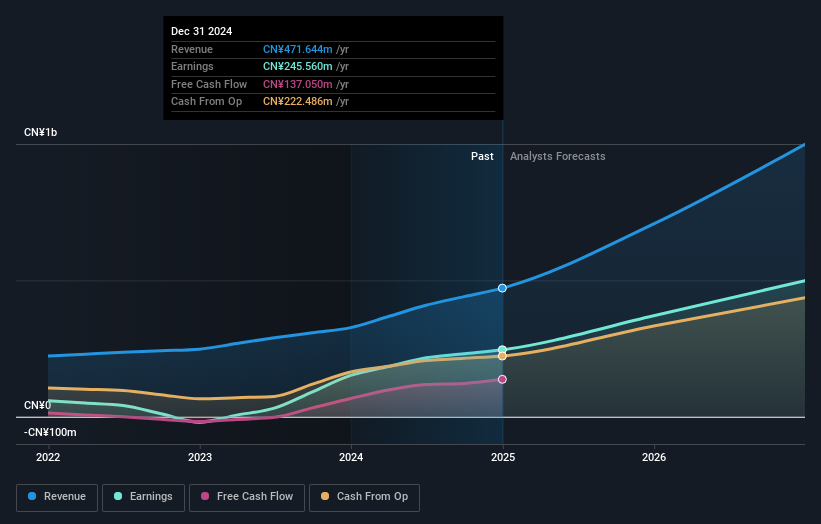

LEPU ScienTech Medical Technology (Shanghai) stands out with its impressive earnings growth of 586% over the past year, significantly surpassing the Medical Equipment industry's -4.3%. The company operates debt-free, a position it has maintained for five years, and trades at 13% below its estimated fair value. Despite some fluctuations in free cash flow—ranging from US$38 million in 2019 to US$118 million recently—the firm remains profitable with high-quality earnings and forecasts suggest a robust annual growth rate of 33%. Recent leadership changes include Mr. Zhu's appointment as a non-executive director, potentially bringing fresh perspectives to the board.

Guangdong Huicheng Vacuum Technology (SZSE:301392)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Huicheng Vacuum Technology Co., Ltd. specializes in the production of vacuum equipment and solutions, with a market cap of CN¥9 billion.

Operations: Huicheng Vacuum Technology generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to CN¥564.79 million.

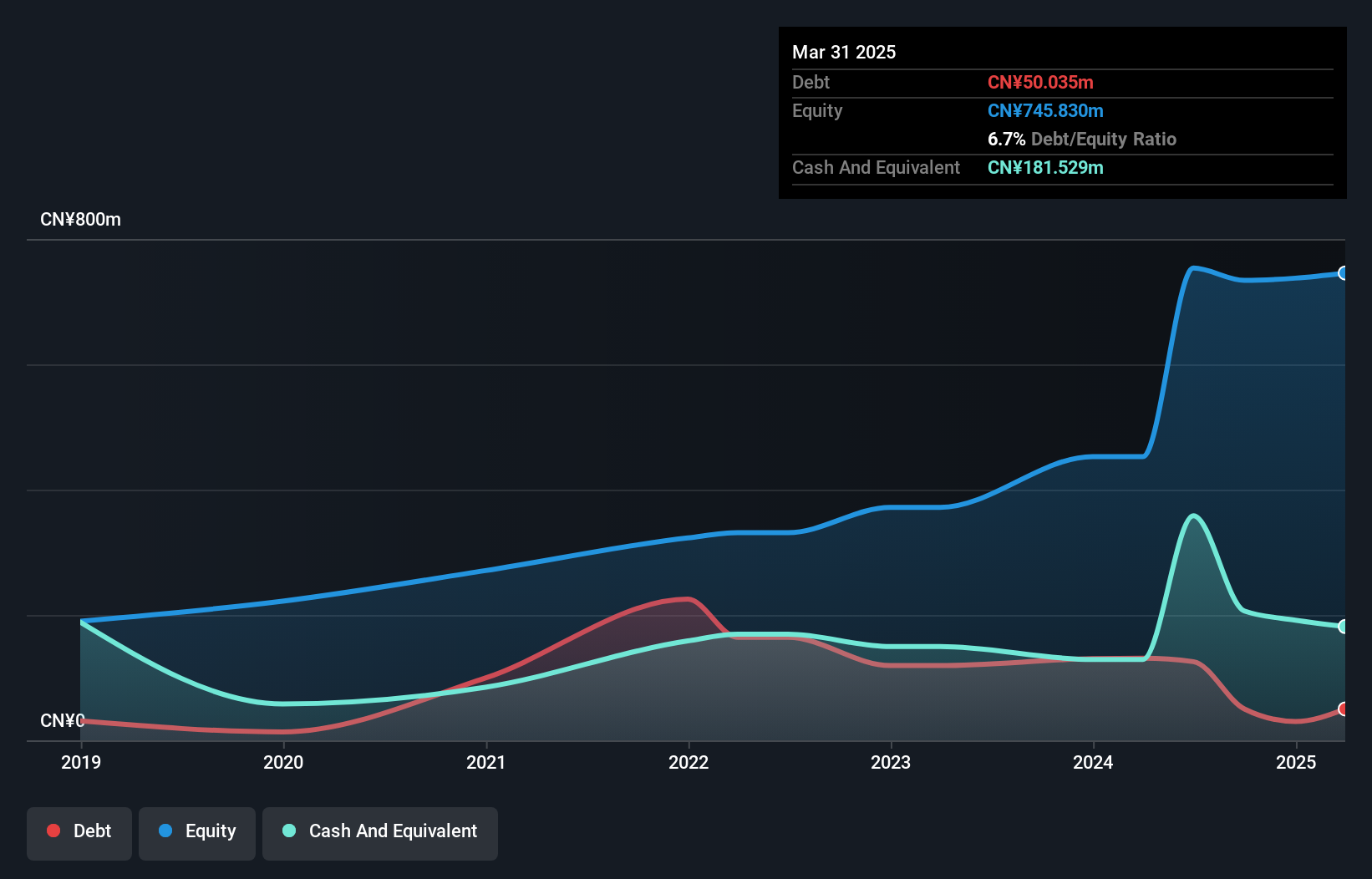

Guangdong Huicheng Vacuum Technology, a smaller player in its field, is showing promising signs of growth. Over the past year, earnings increased by 12.4%, outpacing the machinery industry's -0.06%. The company’s debt situation appears manageable with a reduction in its debt-to-equity ratio from 8.3 to 6.8 over five years, and interest payments are comfortably covered by EBIT at 24.9 times coverage. Despite recent share price volatility, it trades slightly below fair value and was recently added to the S&P Global BMI Index, suggesting potential recognition and future growth prospects within its sector.

Make It Happen

- Embark on your investment journey to our 4752 Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English