3 Promising Penny Stocks With At Least US$20M Market Cap

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming their value counterparts. In this context, identifying promising investment opportunities requires a keen eye for financial strength and potential growth. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still offer significant returns when built on solid financials. We'll explore several penny stocks that combine balance sheet strength with long-term potential, offering investors a chance to discover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.43B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.84 | MYR278.83M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR411.2M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$144.95M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.15 | £313.29M | ★★★★☆☆ |

Click here to see the full list of 5,690 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

NZ Windfarms (NZSE:NWF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NZ Windfarms Limited, with a market cap of NZ$44.03 million, generates and sells renewable electricity to the national grid in New Zealand.

Operations: The company derives its revenue from the generation and sale of renewable electricity, amounting to NZ$15.46 million.

Market Cap: NZ$44.03M

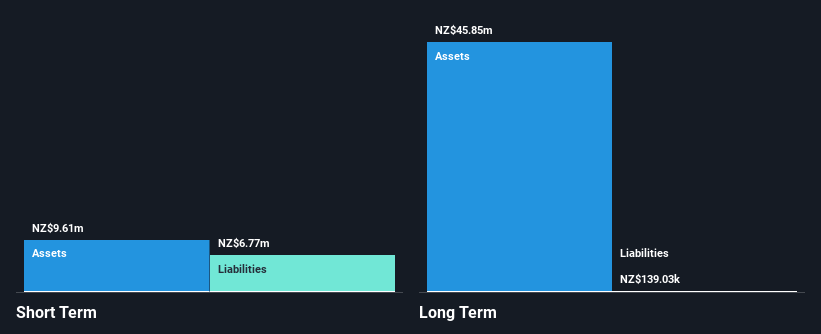

NZ Windfarms Limited, with a market cap of NZ$44.03 million, has recently turned profitable, generating NZ$15.46 million in revenue from renewable electricity sales. The company is debt-free and its short-term assets significantly exceed both short and long-term liabilities, indicating strong financial stability for a small-cap stock. However, the low Return on Equity at 0.3% suggests limited efficiency in generating profits from shareholders' equity. While recent profitability is promising, it was impacted by a large one-off gain of NZ$5.3 million, which may not reflect ongoing operational performance accurately for potential investors evaluating this stock's prospects within the penny stock category.

- Unlock comprehensive insights into our analysis of NZ Windfarms stock in this financial health report.

- Learn about NZ Windfarms' historical performance here.

Grandshores Technology Group (SEHK:1647)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grandshores Technology Group Limited is an investment holding company that offers integrated building services across Singapore, Hong Kong, and the People's Republic of China, with a market capitalization of HK$125.48 million.

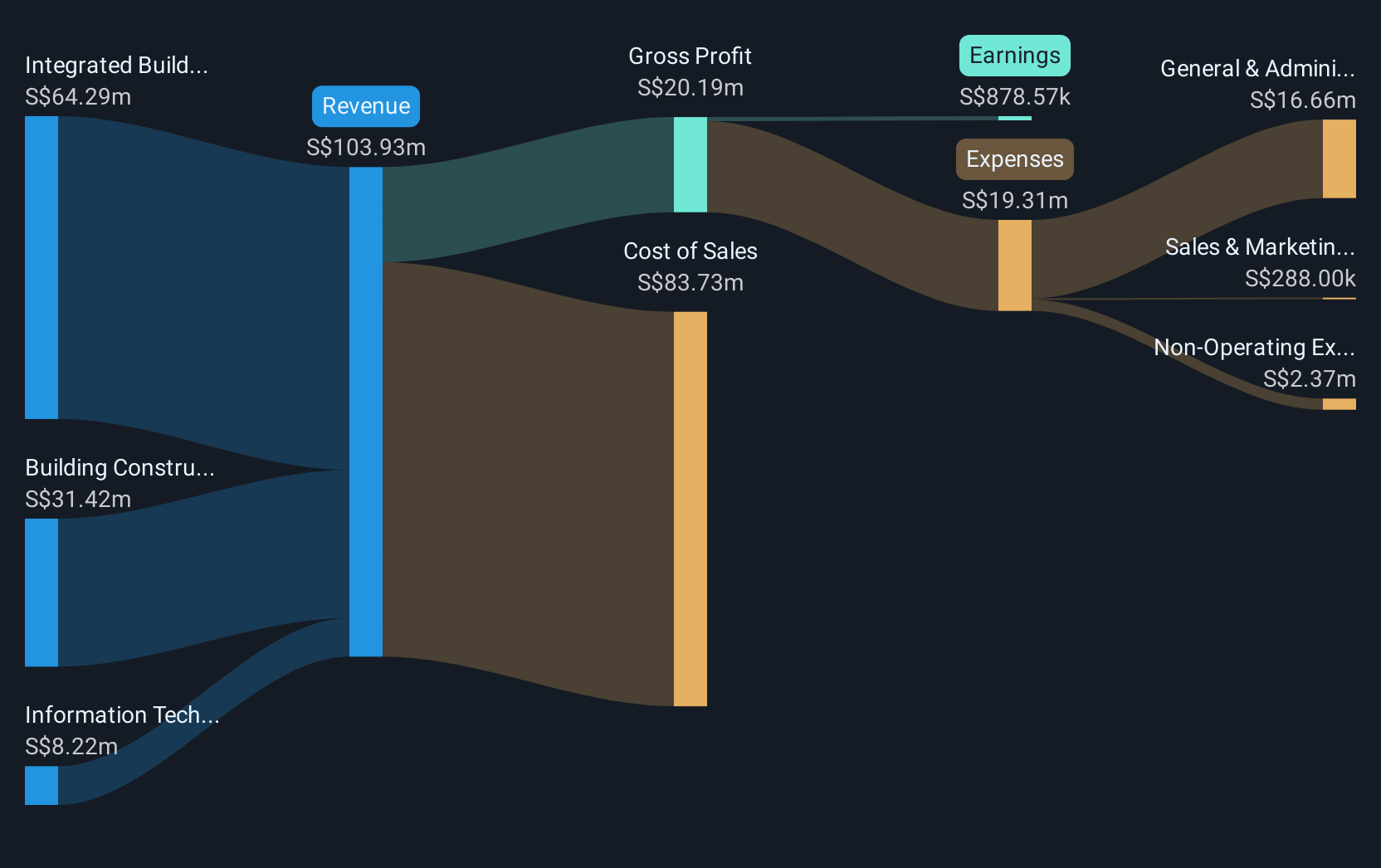

Operations: The company's revenue is derived from Building Construction Works (SGD 31.42 million), Integrated Building Services (SGD 64.29 million), and Information Technology Development and Application (SGD 8.22 million).

Market Cap: HK$125.48M

Grandshores Technology Group Limited, with a market cap of HK$125.48 million, has recently become profitable despite earnings declining by 29.1% annually over the past five years. The company reported half-year sales of SGD 48.58 million, up from SGD 29.18 million the previous year, yet still faced a net loss of SGD 2.87 million. Its financial position is bolstered by short-term assets (SGD 51.2M) exceeding both short and long-term liabilities, while maintaining no debt enhances its stability in the volatile penny stock space despite low Return on Equity at just 1%.

- Get an in-depth perspective on Grandshores Technology Group's performance by reading our balance sheet health report here.

- Explore historical data to track Grandshores Technology Group's performance over time in our past results report.

TK Group (Holdings) (SEHK:2283)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TK Group (Holdings) Limited is an investment holding company involved in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components with a market cap of HK$1.61 billion.

Operations: The company's revenue is primarily derived from two segments: Mold Fabrication, contributing HK$767.37 million, and Plastic Components Manufacturing, generating HK$1.47 billion.

Market Cap: HK$1.61B

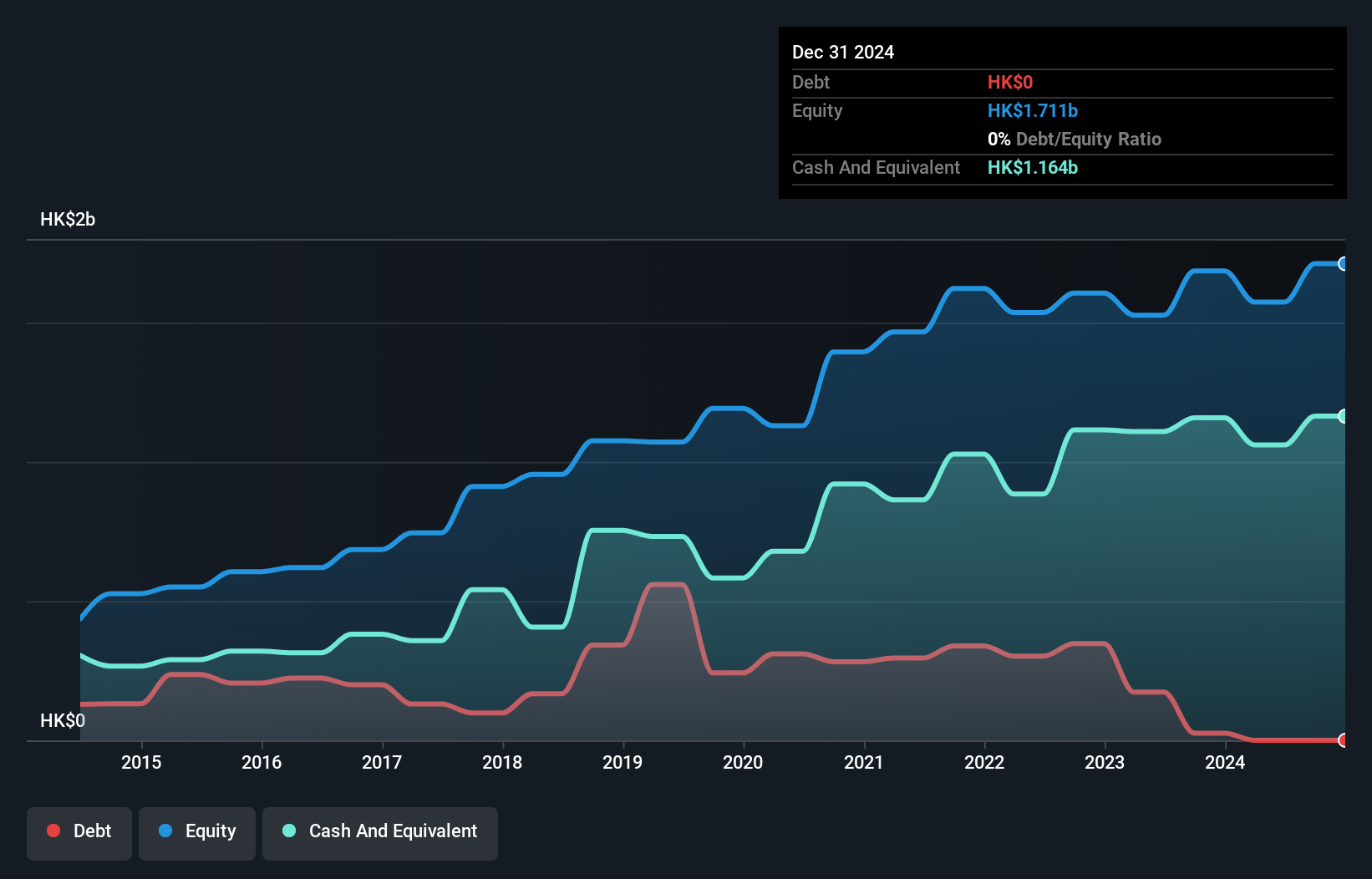

TK Group (Holdings) Limited, with a market cap of HK$1.61 billion, is experiencing a positive trajectory with an expected profit increase of at least 20% for 2024, driven by strong revenue growth in its plastic components manufacturing segment. The company's financial health is robust, with short-term assets of HK$2 billion comfortably covering both short and long-term liabilities. Although earnings have declined by 6.5% annually over the past five years, recent improvements in operational efficiency and a rebound in overseas business suggest potential for future growth. The company benefits from being debt-free and has not diluted shareholders recently.

- Take a closer look at TK Group (Holdings)'s potential here in our financial health report.

- Learn about TK Group (Holdings)'s future growth trajectory here.

Make It Happen

- Discover the full array of 5,690 Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English