Positive Sentiment Still Eludes MV Oil Trust (NYSE:MVO) Following 40% Share Price Slump

The MV Oil Trust (NYSE:MVO) share price has fared very poorly over the last month, falling by a substantial 40%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

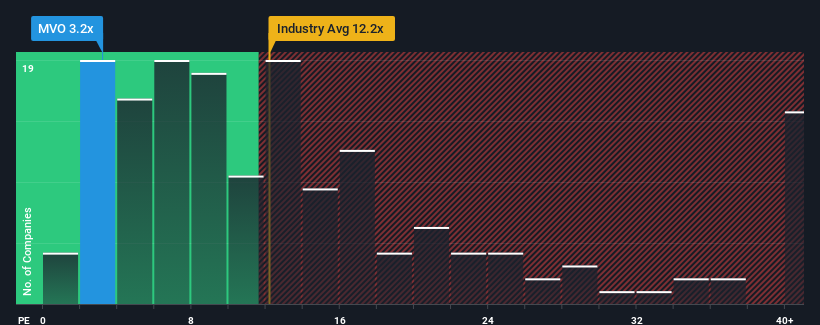

Even after such a large drop in price, MV Oil Trust's price-to-earnings (or "P/E") ratio of 3.2x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 35x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

As an illustration, earnings have deteriorated at MV Oil Trust over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for MV Oil Trust

Is There Any Growth For MV Oil Trust?

The only time you'd be truly comfortable seeing a P/E as depressed as MV Oil Trust's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 10%. Still, the latest three year period has seen an excellent 122% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that MV Oil Trust is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

MV Oil Trust's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of MV Oil Trust revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 2 warning signs for MV Oil Trust that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English