3 Promising Penny Stocks With At Least US$80M Market Cap

Global markets have shown resilience, with U.S. stocks reaching record highs amid optimism surrounding potential trade deals and AI investment initiatives. In this context, identifying promising investment opportunities becomes crucial for investors looking to capitalize on market trends. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still present valuable opportunities when built on solid financials. We'll explore three penny stocks that stand out for their financial strength and potential for growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

Click here to see the full list of 5,718 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Optima Automobile Group Holdings (SEHK:8418)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Optima Automobile Group Holdings Limited is an investment holding company offering after-market automotive services across Singapore, the People’s Republic of China, and other Asian countries, with a market cap of HK$484.50 million.

Operations: The company's revenue is primarily derived from its automotive supply business, generating SGD 65.03 million, followed by after-market automotive services at SGD 13.89 million and car rental services contributing SGD 3.85 million.

Market Cap: HK$484.5M

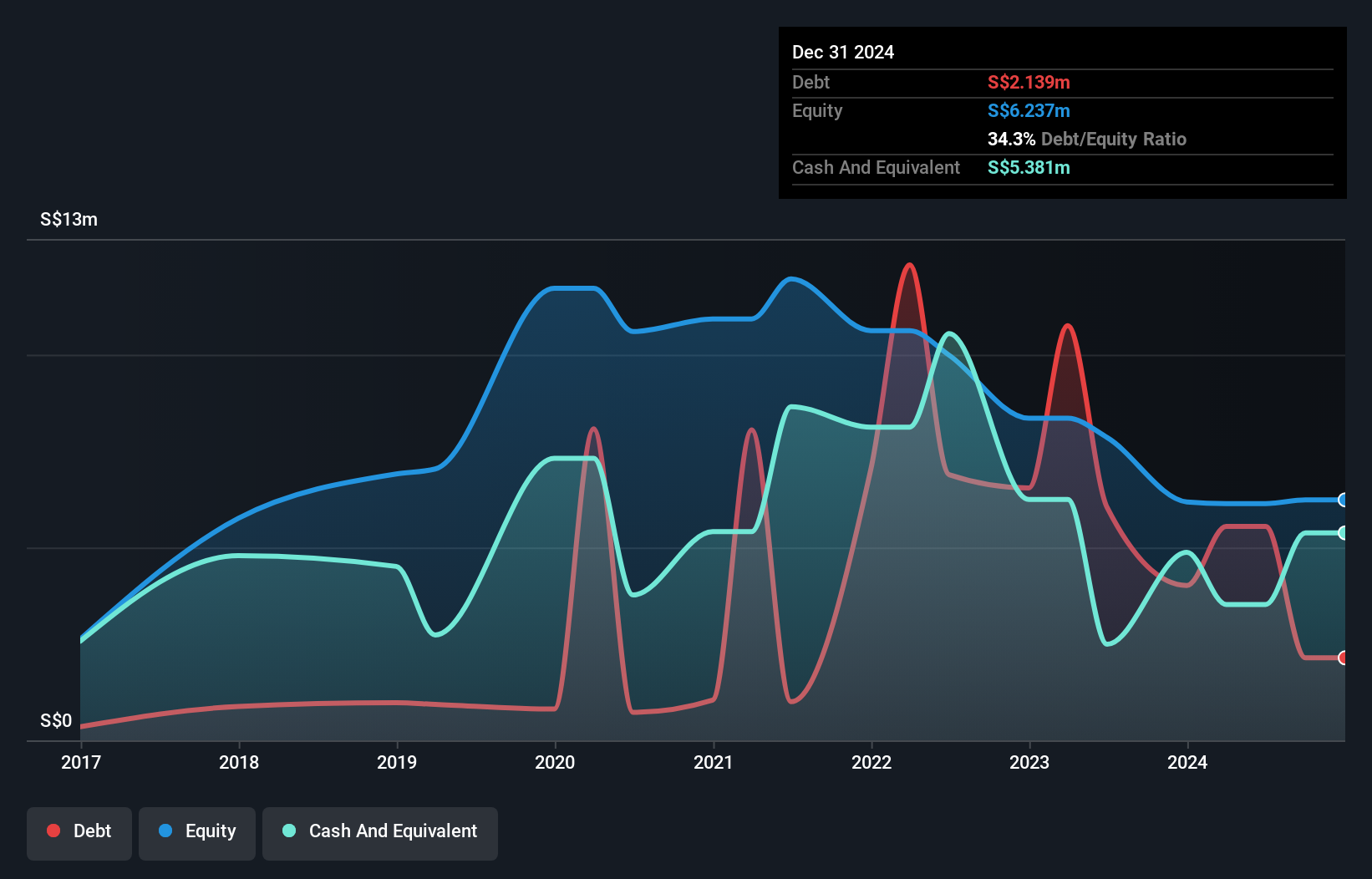

Optima Automobile Group Holdings, with a market cap of HK$484.50 million, generates significant revenue from its automotive supply business (SGD 65.03 million), followed by after-market services and car rentals. Despite being unprofitable, the company has reduced losses over the past five years and maintains a satisfactory net debt to equity ratio of 32.9%. Its short-term assets exceed both short and long-term liabilities, providing financial stability. While the share price is highly volatile and weekly volatility remains high compared to most Hong Kong stocks, Optima's positive free cash flow offers a cash runway exceeding three years.

- Click to explore a detailed breakdown of our findings in Optima Automobile Group Holdings' financial health report.

- Gain insights into Optima Automobile Group Holdings' past trends and performance with our report on the company's historical track record.

Lum Chang Holdings (SGX:L19)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lum Chang Holdings Limited operates in construction, project management, and property development and investment in Singapore and Malaysia, with a market cap of SGD112.39 million.

Operations: The company's revenue is primarily derived from its construction segment, which accounts for SGD477.30 million, followed by property development and investment at SGD23.39 million.

Market Cap: SGD112.39M

Lum Chang Holdings, with a market cap of SGD112.39 million, primarily generates revenue from its construction segment (SGD477.30 million). Despite becoming profitable recently, earnings have declined significantly over the past five years. The company has managed to reduce its debt to equity ratio from 76.8% to 39.2%, and interest payments are well covered by EBIT at 10.1 times coverage. While the dividend is not well supported by free cash flows, short-term assets exceed both short and long-term liabilities, indicating solid financial footing despite negative operating cash flow challenges.

- Dive into the specifics of Lum Chang Holdings here with our thorough balance sheet health report.

- Examine Lum Chang Holdings' past performance report to understand how it has performed in prior years.

Zhejiang Giuseppe Garment (SZSE:002687)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Giuseppe Garment Co., Ltd operates in China producing and selling business, men's, and casual wear under the George White brands, with a market cap of CN¥2.15 billion.

Operations: The company's revenue is derived entirely from its operations in China, totaling CN¥1.31 billion.

Market Cap: CN¥2.15B

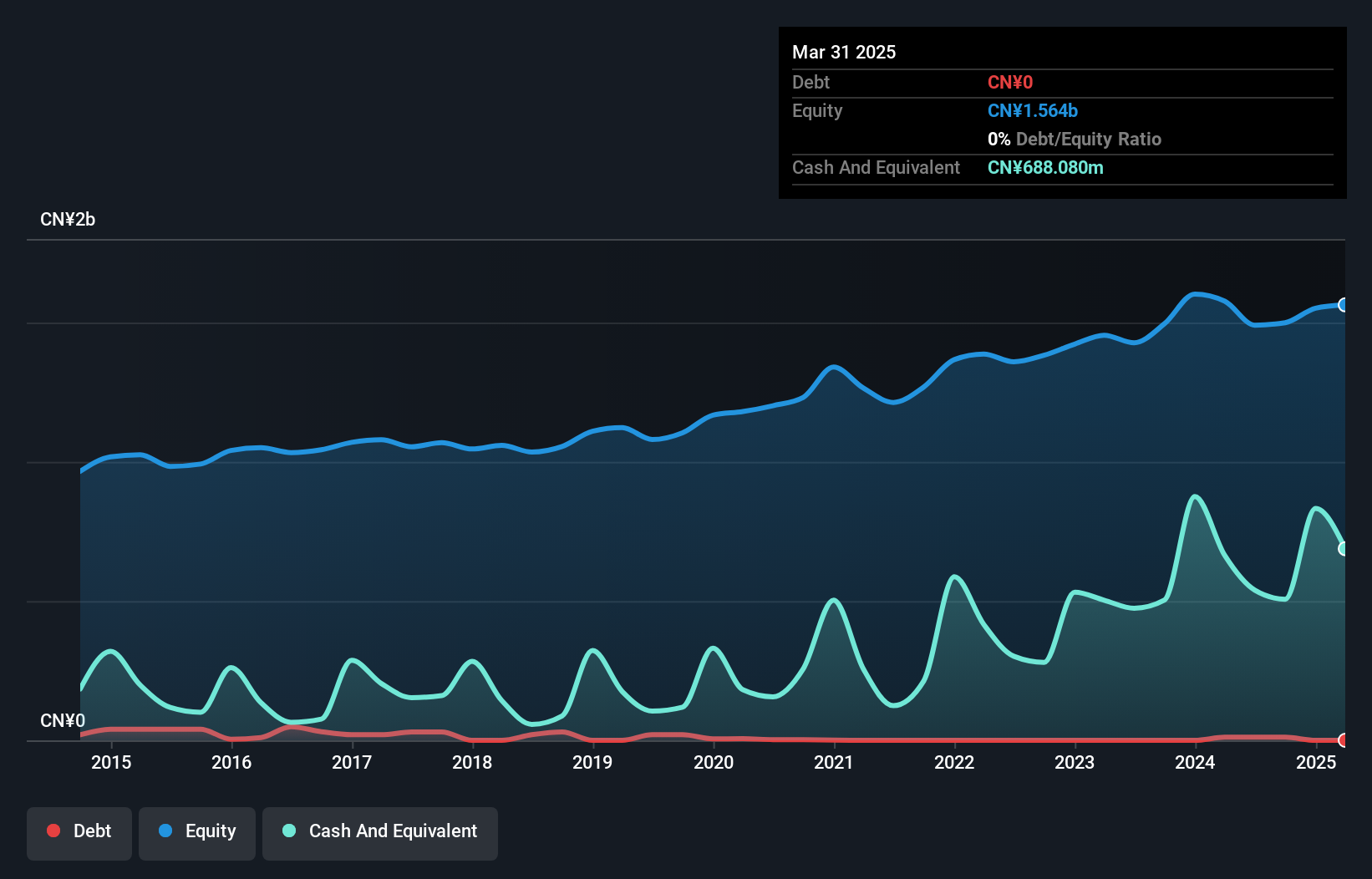

Zhejiang Giuseppe Garment Co., Ltd, with a market cap of CN¥2.15 billion, generates revenue solely from China, totaling CN¥1.31 billion. The company recently completed a share buyback program, repurchasing 20.2 million shares for CN¥80.04 million. Despite a decline in net income to CN¥52.88 million for the first nine months of 2024 compared to the previous year, it maintains strong financial health with short-term assets exceeding liabilities and more cash than debt. However, its earnings growth has been negative over the past year and is impacted by significant one-off items affecting quality assessments of past earnings.

- Unlock comprehensive insights into our analysis of Zhejiang Giuseppe Garment stock in this financial health report.

- Understand Zhejiang Giuseppe Garment's earnings outlook by examining our growth report.

Next Steps

- Unlock our comprehensive list of 5,718 Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English