3 US Stocks Estimated To Be Undervalued In January 2025

As the U.S. equities market takes a pause from its recent rally, with major indexes like the Dow Jones and S&P 500 hovering near record highs, investors are keenly observing opportunities in undervalued stocks. In this environment of optimism around strong corporate earnings and AI-driven growth prospects, identifying stocks that are priced below their intrinsic value can offer potential for long-term gains amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Heartland Financial USA (NasdaqGS:HTLF) | $66.30 | $129.89 | 49% |

| Afya (NasdaqGS:AFYA) | $15.84 | $30.77 | 48.5% |

| Camden National (NasdaqGS:CAC) | $43.43 | $83.71 | 48.1% |

| Array Technologies (NasdaqGM:ARRY) | $6.97 | $13.85 | 49.7% |

| Privia Health Group (NasdaqGS:PRVA) | $22.93 | $44.59 | 48.6% |

| Verra Mobility (NasdaqCM:VRRM) | $26.46 | $52.13 | 49.2% |

| BeiGene (NasdaqGS:ONC) | $222.24 | $435.57 | 49% |

| Equifax (NYSE:EFX) | $268.88 | $535.98 | 49.8% |

| Tenable Holdings (NasdaqGS:TENB) | $43.86 | $86.64 | 49.4% |

| RXO (NYSE:RXO) | $26.19 | $52.36 | 50% |

Let's explore several standout options from the results in the screener.

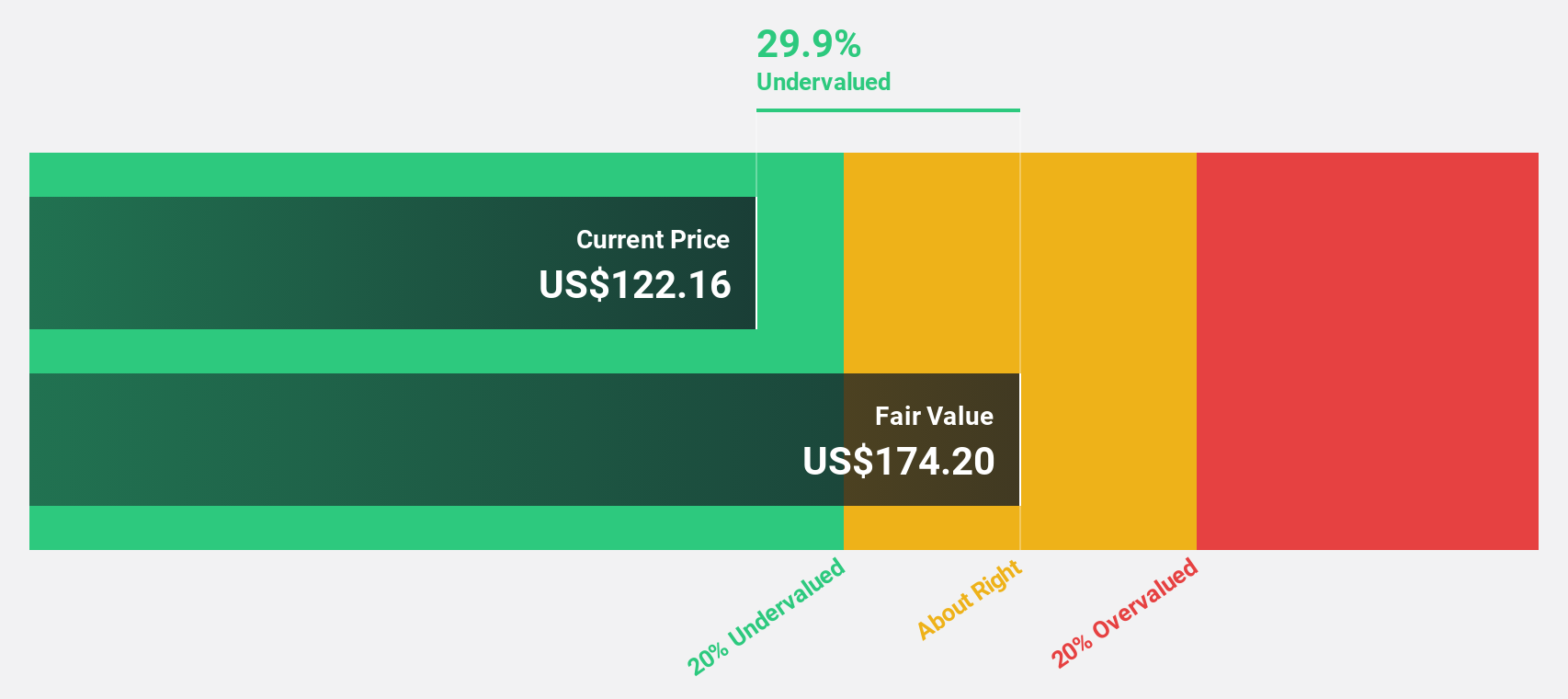

Datadog (NasdaqGS:DDOG)

Overview: Datadog, Inc. operates an observability and security platform for cloud applications both in North America and internationally, with a market cap of approximately $47.60 billion.

Operations: The company's revenue segment includes IT Infrastructure, generating $2.54 billion.

Estimated Discount To Fair Value: 43.2%

Datadog, Inc. appears undervalued based on cash flow analysis, trading at US$140.2 while its estimated fair value is US$246.63, a significant discrepancy of over 20%. The company has recently completed a convertible bond offering worth $870 million and announced innovative product enhancements like Cloud SIEM and Database Monitoring for MongoDB, potentially boosting operational efficiency and future cash flows despite recent insider selling activity.

- Our expertly prepared growth report on Datadog implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Datadog stock in this financial health report.

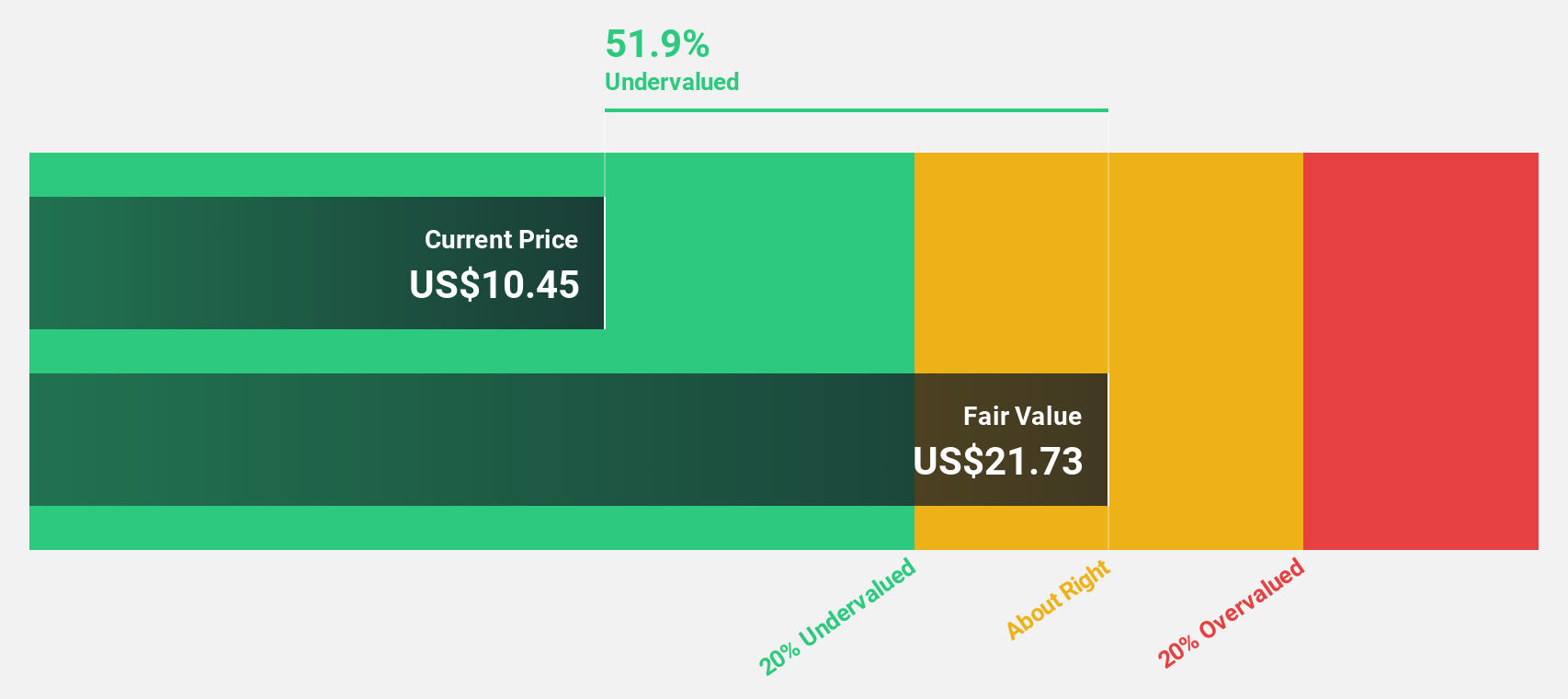

TAL Education Group (NYSE:TAL)

Overview: TAL Education Group offers K-12 after-school tutoring services in the People's Republic of China and has a market cap of approximately $5.53 billion.

Operations: TAL Education Group's revenue segments are not specified in the provided text.

Estimated Discount To Fair Value: 42.4%

TAL Education Group is trading at US$11.07, significantly below its estimated fair value of US$19.22, indicating substantial undervaluation based on cash flows. Recent earnings reports show a turnaround with net income reaching US$23.07 million in Q3 2024 from a loss the previous year, and strong revenue growth forecasted at 20.7% annually, outpacing the broader U.S. market's growth rate of 9.1%.

- The growth report we've compiled suggests that TAL Education Group's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of TAL Education Group.

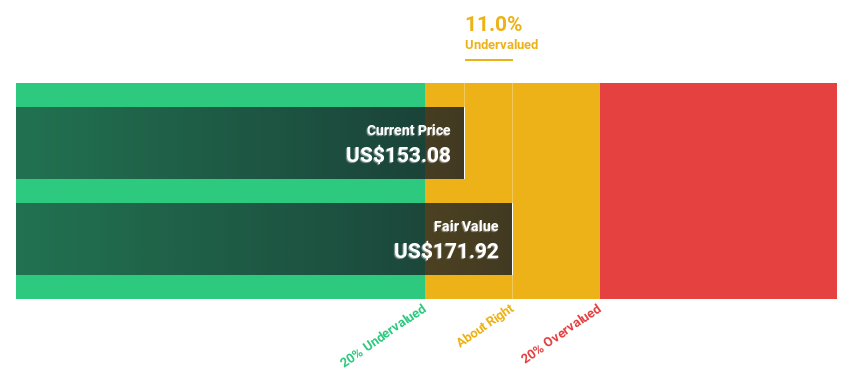

TKO Group Holdings (NYSE:TKO)

Overview: TKO Group Holdings, Inc. is a sports and entertainment company with a market cap of $24.42 billion.

Operations: The company generates revenue from its two main segments: UFC with $1.35 billion and WWE with $1.43 billion.

Estimated Discount To Fair Value: 11.5%

TKO Group Holdings is trading at US$151.97, slightly below its estimated fair value of US$171.73, suggesting a modest undervaluation based on cash flows. The company forecasts revenue growth of 14% annually, surpassing the U.S. market's 9%. Despite recent net losses, earnings are expected to grow significantly by 88.85% annually over the next three years. Recent initiatives include a share repurchase program worth up to $2 billion and a new quarterly dividend program starting March 2025.

- Our growth report here indicates TKO Group Holdings may be poised for an improving outlook.

- Navigate through the intricacies of TKO Group Holdings with our comprehensive financial health report here.

Where To Now?

- Click through to start exploring the rest of the 160 Undervalued US Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English