3 Companies That May Be Trading Below Their Estimated Value

As global markets experience a rebound driven by cooling inflation and strong earnings reports, investors are increasingly focusing on value stocks, which have recently outperformed their growth counterparts. In this environment, identifying companies that may be trading below their estimated value can offer opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1891.00 | ¥3777.22 | 49.9% |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.59 | 49.9% |

| Berkshire Hills Bancorp (NYSE:BHLB) | US$28.50 | US$56.99 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.04 | 49.9% |

| CYND (TSE:4256) | ¥1055.00 | ¥2104.74 | 49.9% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥14.00 | CN¥27.83 | 49.7% |

| QD Laser (TSE:6613) | ¥299.00 | ¥597.20 | 49.9% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.41 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

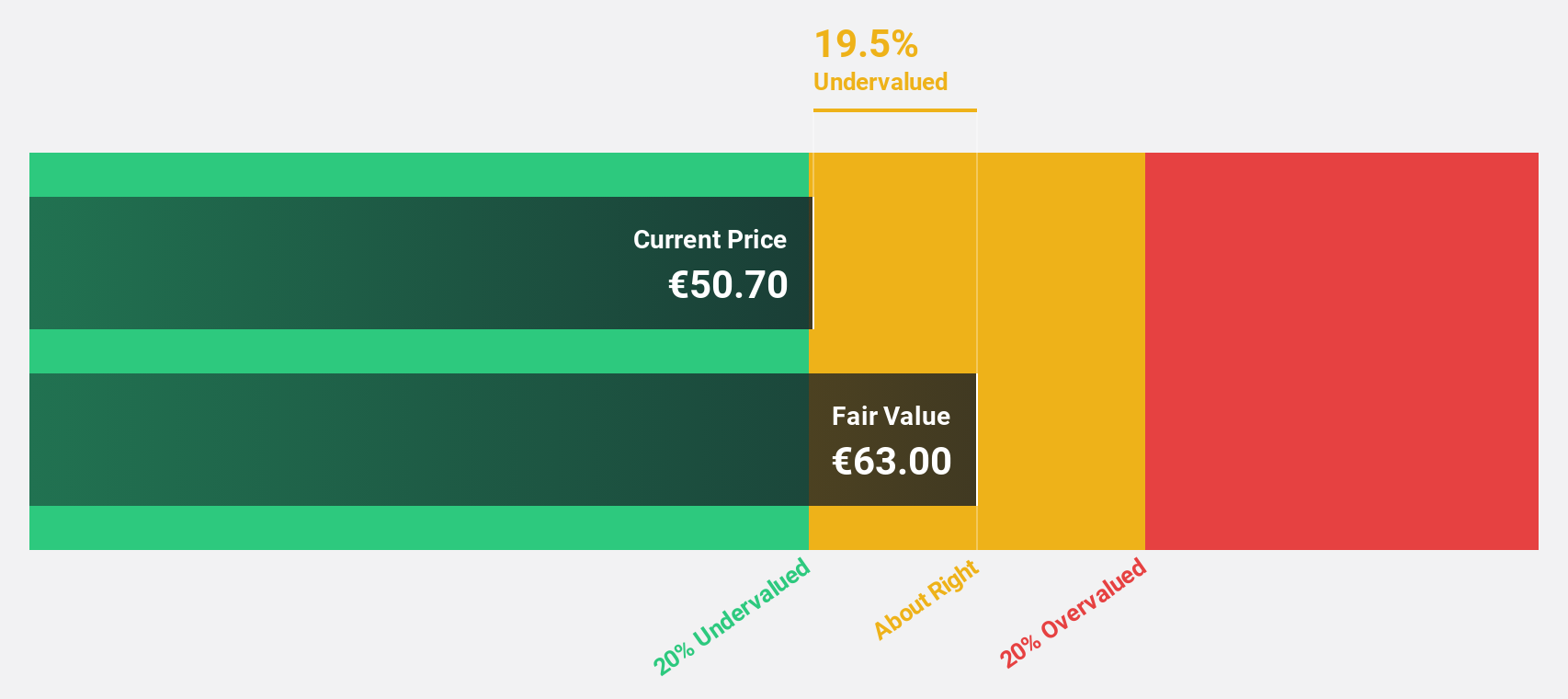

Admicom Oyj (HLSE:ADMCM)

Overview: Admicom Oyj provides ERP cloud-based solutions in Finland and has a market cap of €254.31 million.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating €34.78 million.

Estimated Discount To Fair Value: 36.3%

Admicom Oyj is trading at a significant discount, approximately 36.3% below its estimated fair value of €80.11, with a current price of €51. The company's earnings are expected to grow annually by 19.1%, outpacing the Finnish market's 14.7%. Despite revenue growth forecasts of 9.7% per year being modest, they still surpass the market average of 2.6%. Recent M&A discussions with Bauhub OÜ may impact future valuations positively or negatively depending on outcomes.

- Our earnings growth report unveils the potential for significant increases in Admicom Oyj's future results.

- Unlock comprehensive insights into our analysis of Admicom Oyj stock in this financial health report.

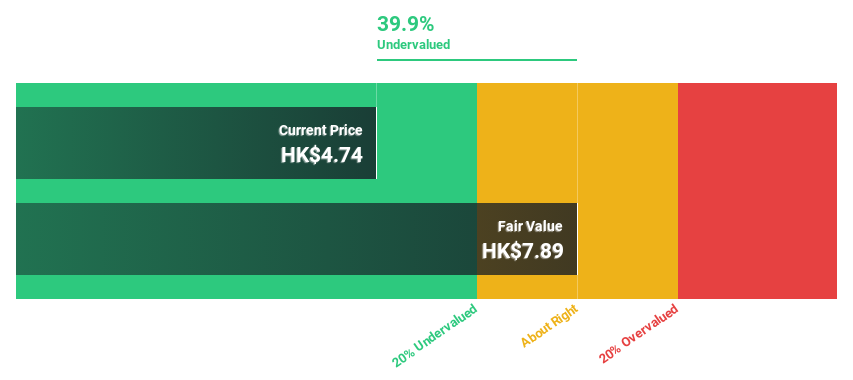

Newborn Town (SEHK:9911)

Overview: Newborn Town Inc., an investment holding company, operates in the global social networking sector with a market cap of HK$5.35 billion.

Operations: The company's revenue is primarily derived from its Social Networking Business, which generated CN¥3.80 billion, and its Innovative Business segment, contributing CN¥406.28 million.

Estimated Discount To Fair Value: 40.9%

Newborn Town is trading at a substantial discount, approximately 40.9% below its estimated fair value of HK$7.87, with a current price of HK$4.65. The company's earnings are projected to grow significantly at 21% annually, outpacing the Hong Kong market's average growth rate of 11.3%. Recent private placements raised nearly HK$989 million, potentially supporting future growth initiatives despite past shareholder dilution and large one-off items impacting results.

- According our earnings growth report, there's an indication that Newborn Town might be ready to expand.

- Dive into the specifics of Newborn Town here with our thorough financial health report.

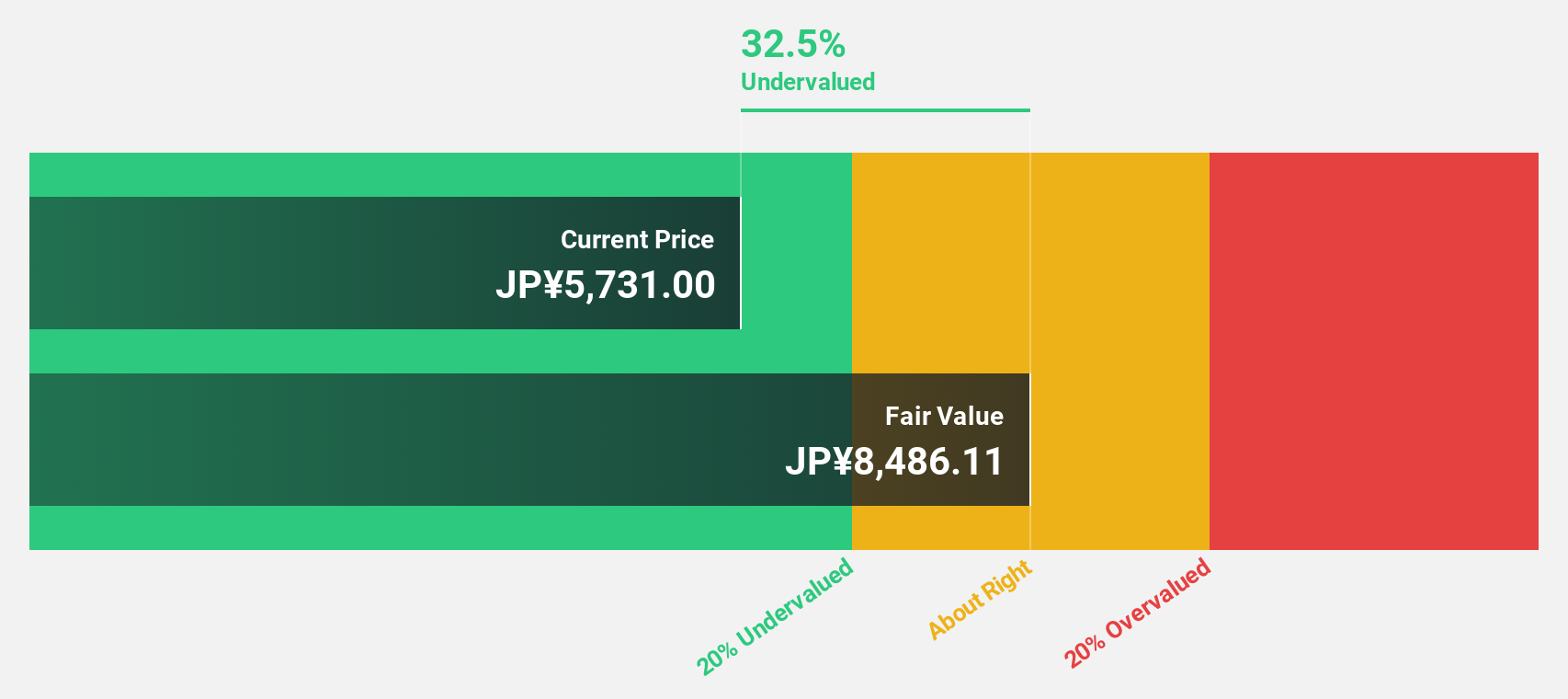

KOSÉ (TSE:4922)

Overview: KOSÉ Corporation is a company that manufactures and sells cosmetics and cosmetology products both in Japan and internationally, with a market cap of ¥381.48 billion.

Operations: The company's revenue segments include the Cosmetics Business, generating ¥253.43 billion, and Cosmetaries, contributing ¥64.22 billion.

Estimated Discount To Fair Value: 19.2%

KOSÉ is trading 19.2% below its estimated fair value of ¥8390.01, with a current price of ¥6779, suggesting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 22.3% annually, surpassing the JP market's average growth rate. However, recent guidance revisions indicate lower expected net sales and profits for 2024 than previously anticipated. Organizational changes aim to bolster manufacturing and international operations but may impact short-term financial performance amidst executive transitions.

- Our expertly prepared growth report on KOSÉ implies its future financial outlook may be stronger than recent results.

- Take a closer look at KOSÉ's balance sheet health here in our report.

Where To Now?

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 871 more companies for you to explore.Click here to unveil our expertly curated list of 874 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English