Phoenix Group Leads These 3 Promising Penny Stocks

Global markets have recently experienced a boost, with U.S. stocks climbing higher thanks to cooling inflation and strong bank earnings, while European indices also saw gains amid hopes for further interest rate cuts. For investors looking beyond established giants, penny stocks—often representing smaller or newer companies—remain an intriguing investment area despite the term's somewhat outdated nature. These stocks can offer affordability and growth potential when backed by solid financials, providing opportunities for those willing to explore this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.69 | HK$42.36B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.02 | £761.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$634.79M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR290.45M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,710 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Phoenix Group (ADX:PHX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Phoenix Group Plc, with a market cap of AED7.38 billion, is involved in the development, operation, and management of crypto mining and data centers across the United Arab Emirates, Oman, Canada, and the United States.

Operations: The company's revenue is derived from its data processing segment, which generated $214.72 million.

Market Cap: AED7.38B

Phoenix Group Plc, with a market cap of AED7.38 billion, is actively expanding its digital asset infrastructure through the recent energization of a 50MW mining facility in North Dakota, enhancing its global hash rate by over 2.7 EH. Despite revenue declines of 47.1% last year, the company maintains strong financial health with short-term assets exceeding liabilities and high net profit margins at 46.9%. The appointment of Munaf Ali as CEO signals strategic leadership focused on capitalizing on opportunities within the cryptocurrency sector while exploring dual listing possibilities internationally for further growth in 2025.

- Unlock comprehensive insights into our analysis of Phoenix Group stock in this financial health report.

- Gain insights into Phoenix Group's outlook and expected performance with our report on the company's earnings estimates.

China Lilang (SEHK:1234)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Lilang Limited, with a market cap of HK$4.67 billion, manufactures and sells branded menswear and related accessories in the People’s Republic of China.

Operations: The company generates revenue of CN¥3.65 billion from its menswear and accessories manufacturing and sales segment.

Market Cap: HK$4.67B

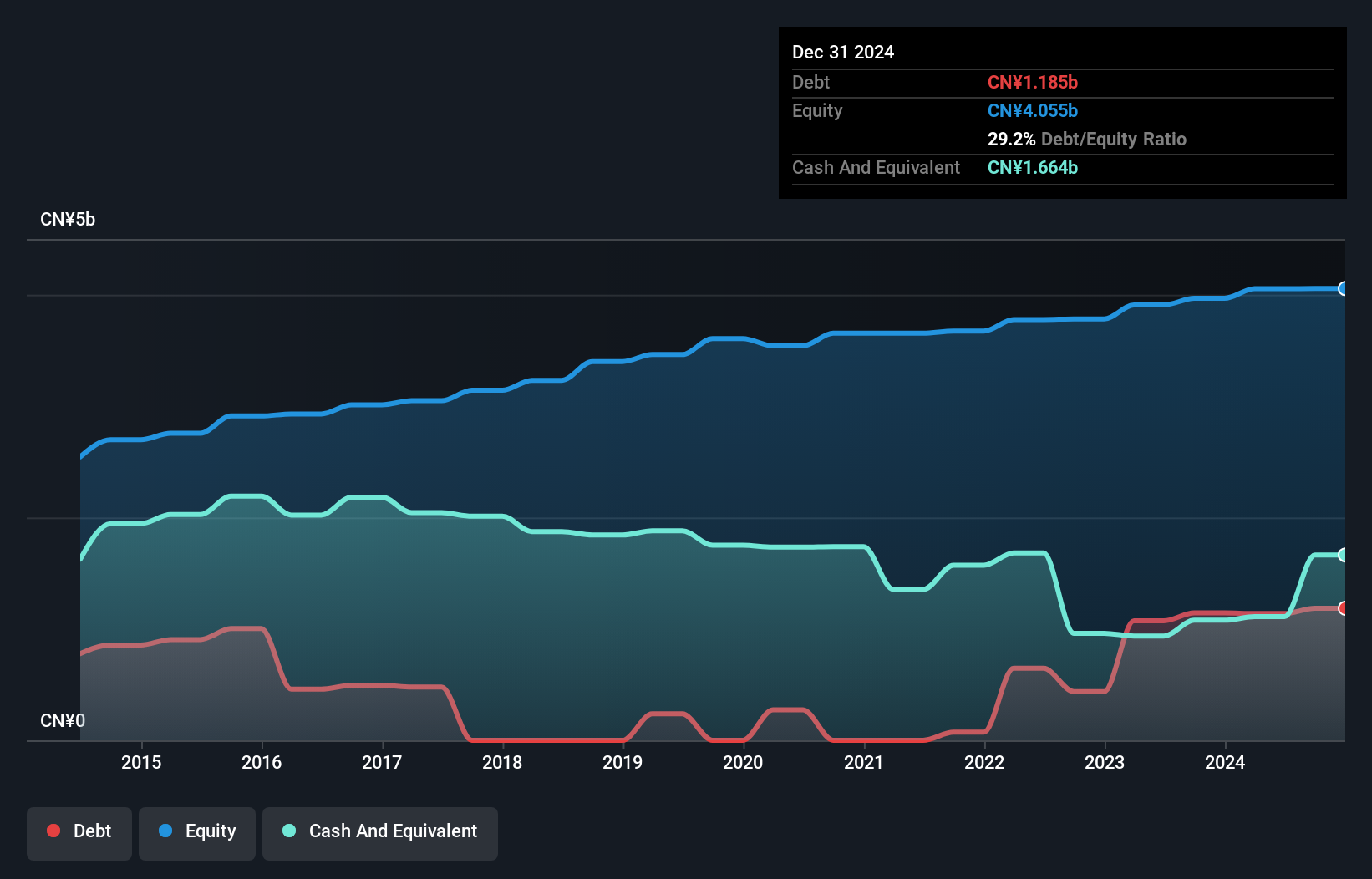

China Lilang Limited, with a market cap of HK$4.67 billion, demonstrates financial stability through its strong balance sheet, where short-term assets (CN¥3.0 billion) exceed both short and long-term liabilities. The company has high-quality past earnings and maintains satisfactory debt levels with well-covered interest payments. Despite a decline in earnings over the past five years, recent growth of 17% indicates potential recovery. Trading below estimated fair value by 38.7%, China Lilang's stock may attract investors seeking undervalued opportunities in the menswear sector, especially as retail sales showed mid-single-digit growth for 2024 compared to the previous year.

- Take a closer look at China Lilang's potential here in our financial health report.

- Examine China Lilang's earnings growth report to understand how analysts expect it to perform.

HK Asia Holdings (SEHK:1723)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HK Asia Holdings Limited is an investment holding company involved in the wholesale and retail sale of pre-paid products in Hong Kong, with a market cap of HK$190 million.

Operations: The company generates revenue from the sale of pre-paid products amounting to HK$221.92 million.

Market Cap: HK$190M

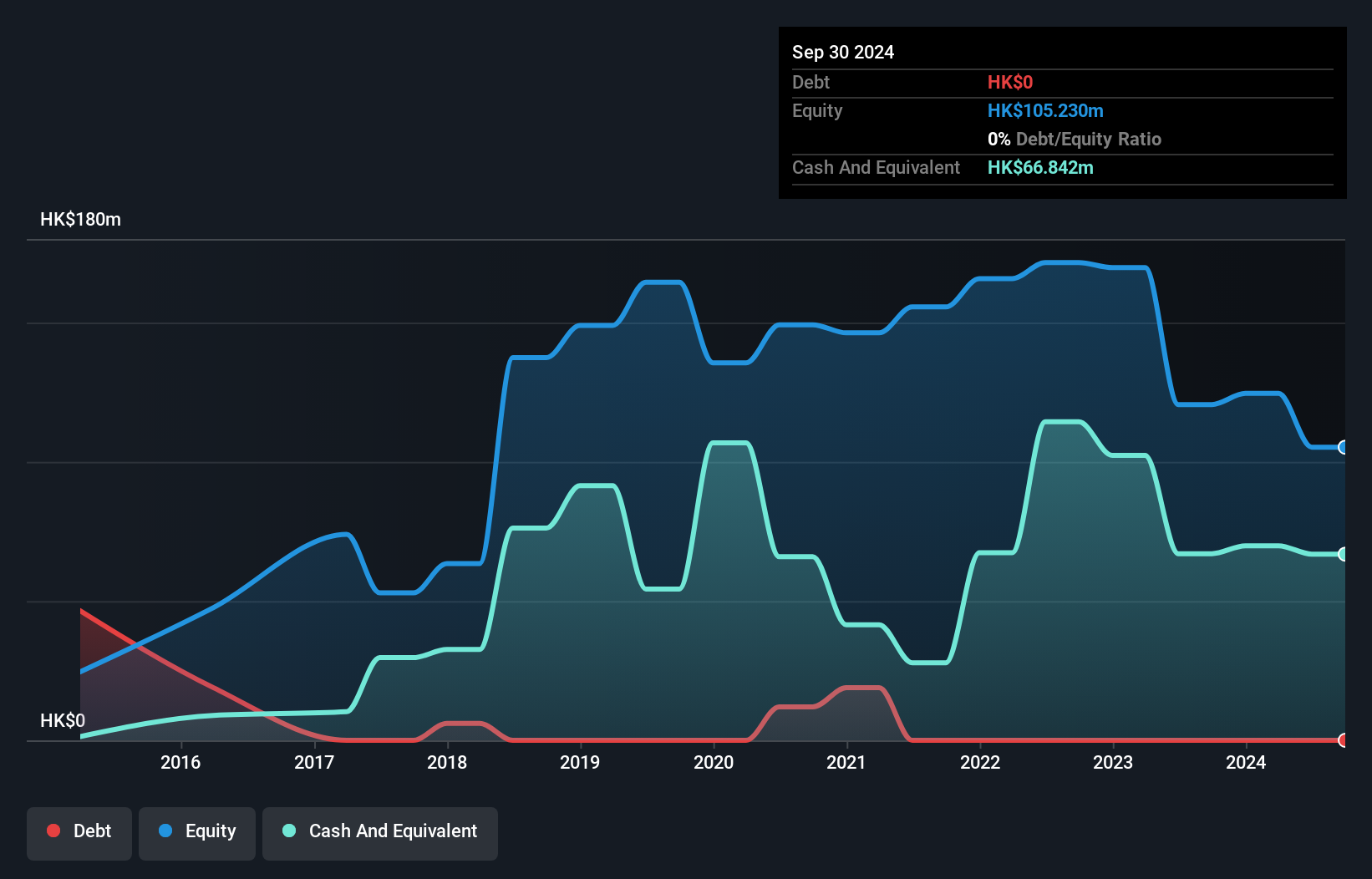

HK Asia Holdings Limited, with a market cap of HK$190 million, faces challenges as recent earnings show a significant decline. Sales dropped to HK$98.54 million for the half year ending September 2024 compared to HK$129 million the previous year, and net income fell sharply. Despite being debt-free and having short-term assets exceeding liabilities, profit margins have decreased from 3.7% to 2.1%. The company recently underwent board changes with Ms. Cheung Yuet Ngo Flora joining as a non-executive director amid competitive pressures impacting profitability in Hong Kong's retail sector.

- Click here to discover the nuances of HK Asia Holdings with our detailed analytical financial health report.

- Review our historical performance report to gain insights into HK Asia Holdings' track record.

Next Steps

- Jump into our full catalog of 5,710 Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English