Market Still Lacking Some Conviction On Beijing Enterprises Holdings Limited (HKG:392)

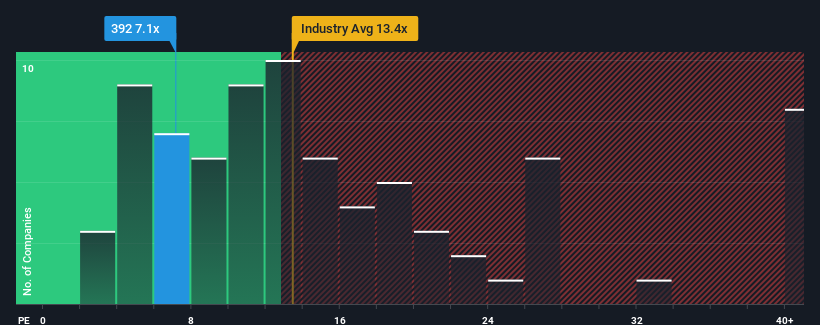

Beijing Enterprises Holdings Limited's (HKG:392) price-to-earnings (or "P/E") ratio of 7.1x might make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 20x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Beijing Enterprises Holdings' earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Beijing Enterprises Holdings

Is There Any Growth For Beijing Enterprises Holdings?

The only time you'd be truly comfortable seeing a P/E as low as Beijing Enterprises Holdings' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 32% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the five analysts watching the company. With the market only predicted to deliver 13% per year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Beijing Enterprises Holdings is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Beijing Enterprises Holdings' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Beijing Enterprises Holdings currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Beijing Enterprises Holdings (of which 1 can't be ignored!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English