Exploring None And 2 Other High Growth Tech Stocks For Your Portfolio

As global markets navigate a choppy start to the year, with small-cap stocks underperforming and inflation concerns persisting, investors are closely monitoring economic indicators and policy updates. In this environment, identifying high-growth technology stocks that can weather volatility and offer potential for long-term expansion becomes crucial for portfolio diversification.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.19% | 25.44% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

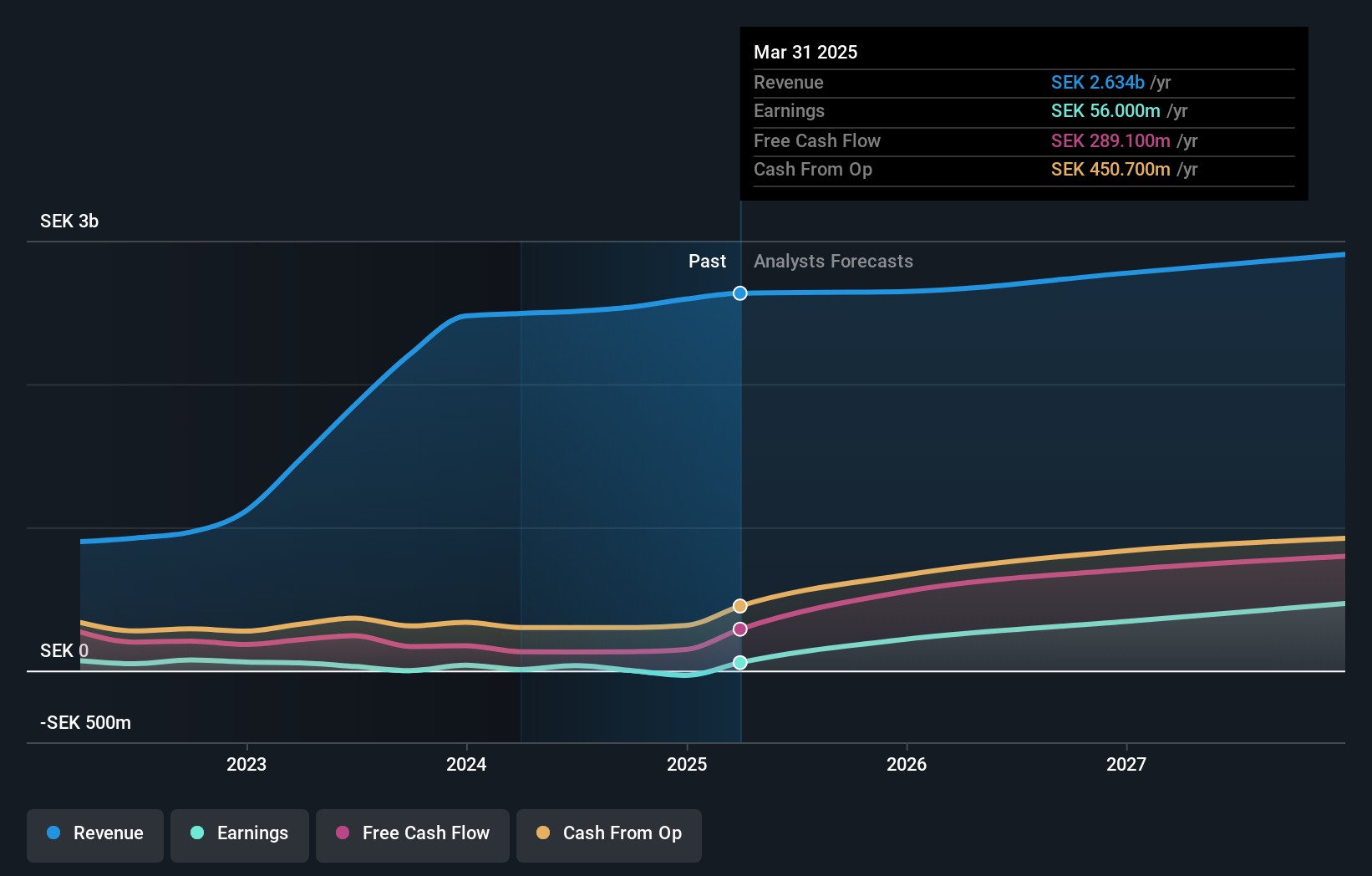

Karnov Group (OM:KAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Karnov Group AB (publ) offers information products and services for legal, tax and accounting, environmental, and health and safety professionals across Denmark, Norway, France, Sweden, Portugal, and Spain with a market capitalization of approximately SEK9.87 billion.

Operations: Karnov Group AB (publ) generates revenue through its information products and services, with SEK1.16 billion from Region North and SEK1.38 billion from Region South. The company serves professionals in multiple sectors across several European countries.

Karnov Group, navigating through a challenging fiscal period, reported a shift from a net income of SEK 21 million to a net loss of SEK 12.3 million in Q3 2024, reflecting volatility in its financial performance. Despite this setback, the company's revenue growth remains resilient at 4.4% annually, outpacing the Swedish market's growth rate of 1.1%. Impressively, Karnov’s earnings have surged by 466.7% over the past year, significantly exceeding the industry average of 30.4%. This robust growth trajectory is underpinned by forecasts predicting an annual earnings increase of approximately 121.8%, showcasing potential for substantial financial recovery and expansion within the interactive media and services sector.

- Delve into the full analysis health report here for a deeper understanding of Karnov Group.

Understand Karnov Group's track record by examining our Past report.

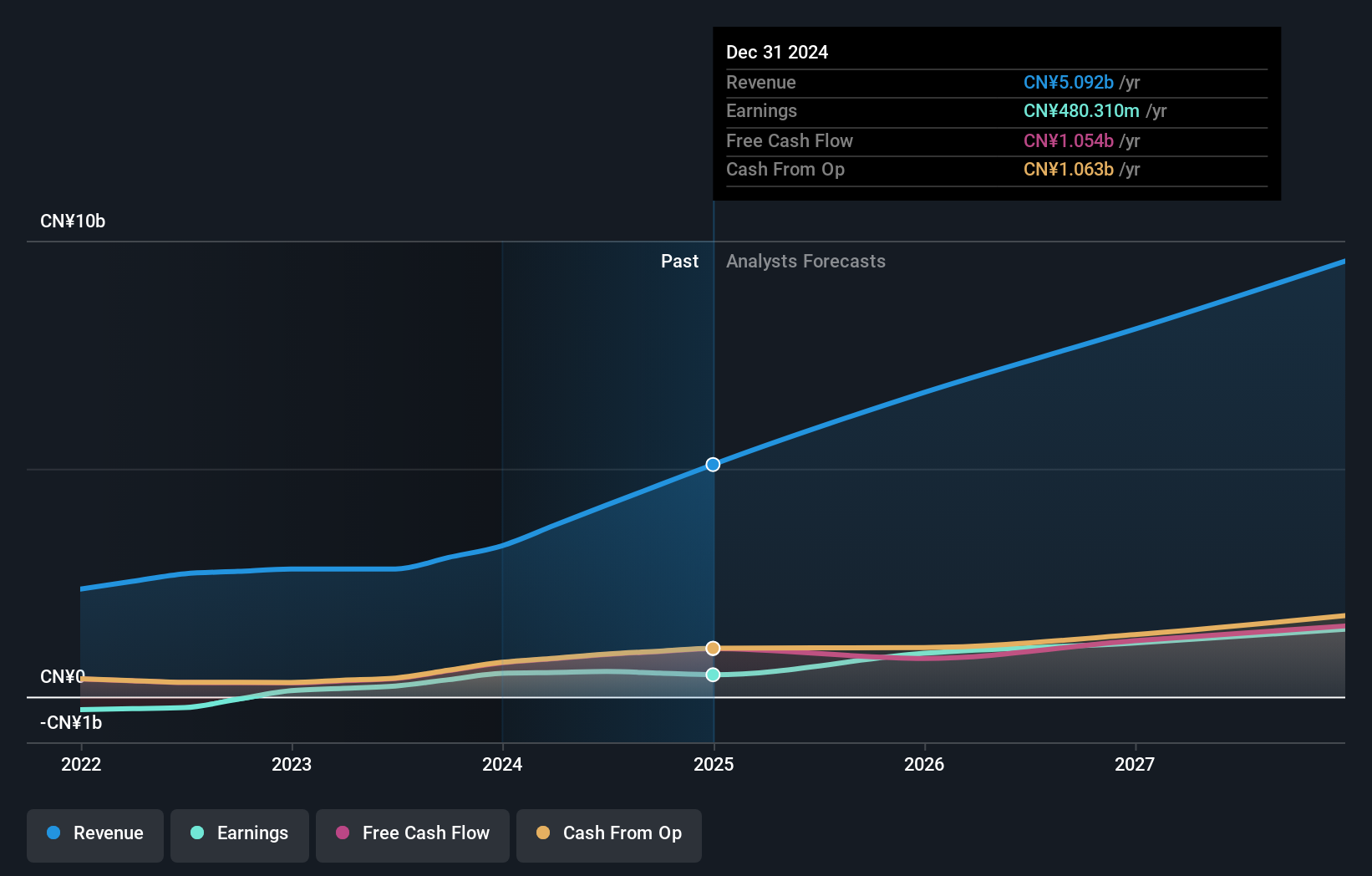

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Newborn Town Inc. is an investment holding company that operates in the global social networking sector with a market capitalization of approximately HK$5.39 billion.

Operations: The company focuses on the social networking sector globally, generating revenue primarily from its Social Networking Business segment, which accounts for CN¥3.80 billion. The Innovative Business segment contributes CN¥406.28 million to the overall revenue stream.

Newborn Town, with a notable annual revenue growth of 15.6%, outstrips Hong Kong's market average of 7.5%. This growth is complemented by an impressive earnings increase of 137.3% over the past year, far surpassing the industry's 6.5%. Despite recent board changes and a significant private placement raising HKD 988.86 million, the company's strategic focus on innovative technologies and leadership adjustments signal robust adaptability and potential for sustained advancement in interactive media services.

- Unlock comprehensive insights into our analysis of Newborn Town stock in this health report.

Explore historical data to track Newborn Town's performance over time in our Past section.

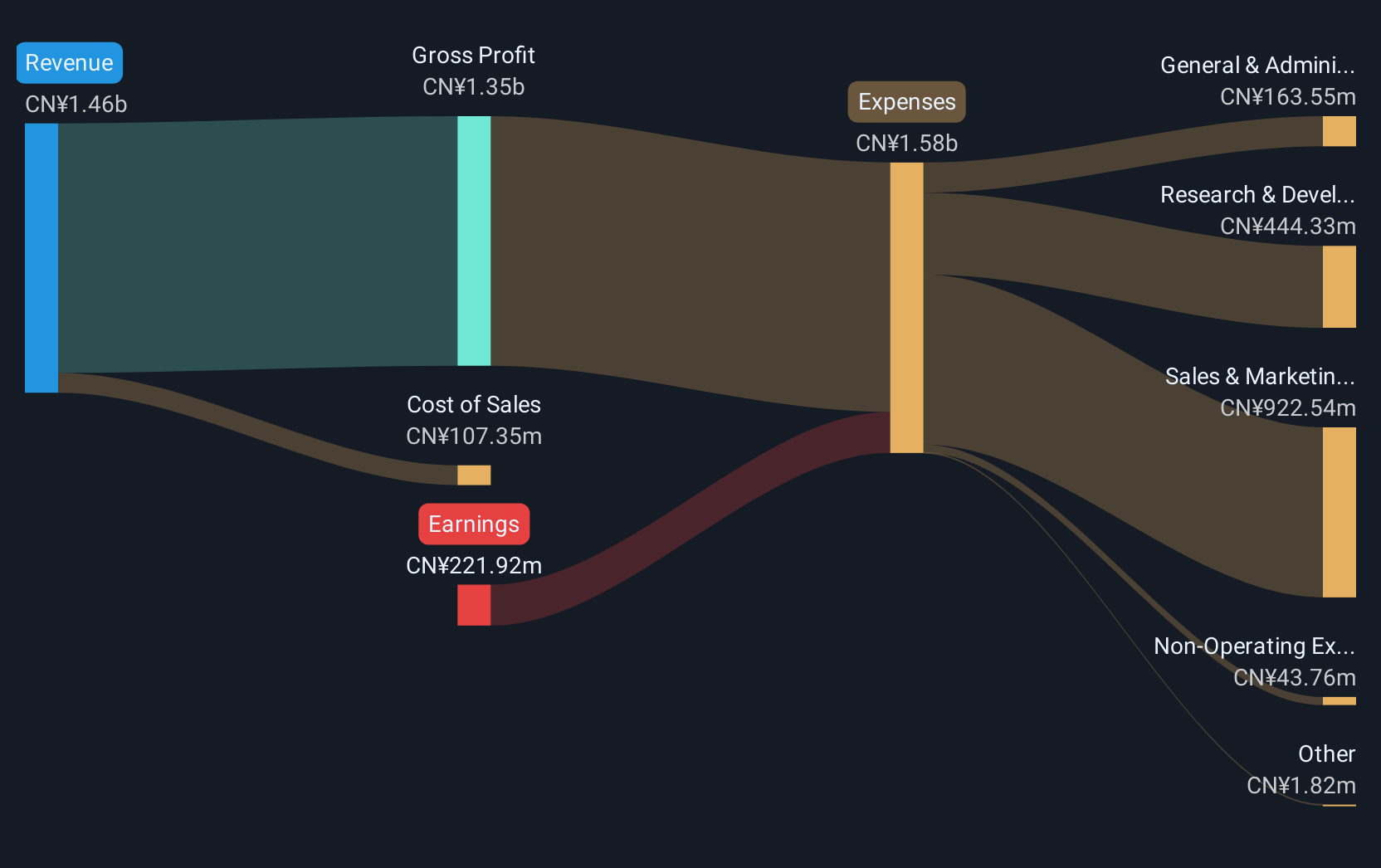

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wondershare Technology Group Co., Ltd. develops application software products in China and internationally, with a market cap of CN¥11.77 billion.

Operations: Wondershare Technology Group Co., Ltd. focuses on developing application software products, serving both domestic and international markets. The company's revenue model is driven by its diverse range of software solutions catering to various consumer needs.

Wondershare Technology Group has demonstrated a robust commitment to innovation, particularly with its latest product launches like Recoverit 13.5 and HiPDF enhancements, which focus on advanced data recovery and PDF editing capabilities, respectively. These developments underscore the company's dedication to refining user experience and expanding technological boundaries in software solutions. Financially, Wondershare reported a significant annual revenue growth of 16.2% and an even more impressive earnings increase of 74.5% year-over-year, positioning it well within the high-growth tech sector despite recent challenges reflected in a net loss this fiscal period. Additionally, its R&D expenditure remains substantial, aligning with ongoing product advancements and market competitiveness.

- Click to explore a detailed breakdown of our findings in Wondershare Technology Group's health report.

Gain insights into Wondershare Technology Group's past trends and performance with our Past report.

Summing It All Up

- Explore the 1227 names from our High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English