Agape ATP Leads The Charge With 2 Other Prominent US Penny Stocks

As the U.S. stock market navigates mixed signals with tech stocks under pressure and bond yields climbing, investors are keenly watching for opportunities that align with current economic conditions. Penny stocks, though a term from earlier trading days, continue to represent potential value in smaller or newer companies. By focusing on those with strong financials and growth potential, investors can uncover promising opportunities in this segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.33 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $100.69M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.87 | $6.14M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.41 | $10.57M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3175 | $12.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.37 | $44.07M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.23 | $24.12M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9234 | $86.33M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.55 | $377.99M | ★★★★☆☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Agape ATP (NasdaqCM:ATPC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Agape ATP Corporation is an investment holding company that provides health and wellness products and health solution advisory services in Malaysia, with a market cap of $5.03 million.

Operations: The company generates revenue from its wholesale drug segment, amounting to $1.35 million.

Market Cap: $5.03M

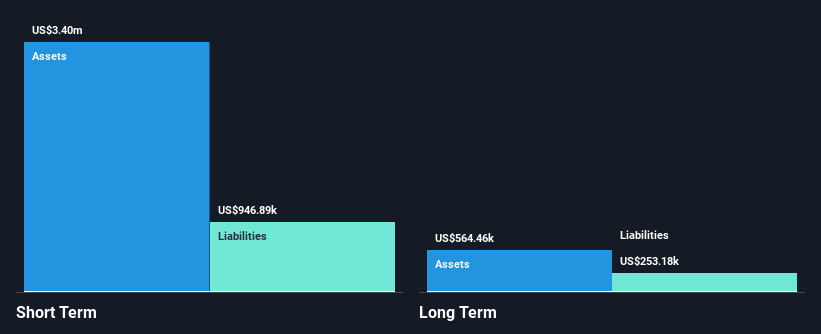

Agape ATP Corporation, with a market cap of US$5.03 million, faces challenges typical of penny stocks. The company reported third-quarter sales of US$0.33 million and a net loss of US$0.51 million, indicating it is pre-revenue with no significant revenue streams beyond its wholesale drug segment. Financially, Agape ATP has less than a year of cash runway and has experienced shareholder dilution over the past year. Despite being debt-free and having short-term assets exceeding liabilities, its high share price volatility and unprofitable status highlight the risks associated with investing in such speculative ventures.

- Get an in-depth perspective on Agape ATP's performance by reading our balance sheet health report here.

- Assess Agape ATP's previous results with our detailed historical performance reports.

Vasta Platform (NasdaqGS:VSTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vasta Platform Limited offers educational printed and digital solutions to private schools in Brazil's K-12 sector, with a market cap of $182.79 million.

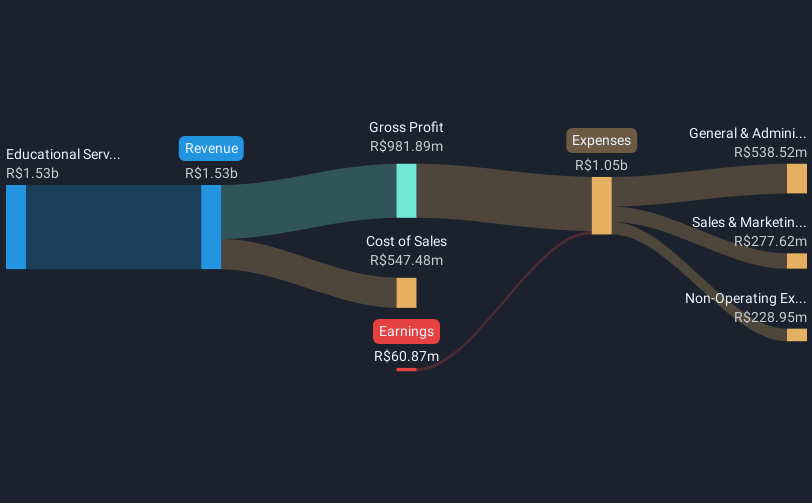

Operations: The company's revenue is primarily generated from its Educational Services segment, specifically in Education & Training Services, amounting to R$1.53 billion.

Market Cap: $182.79M

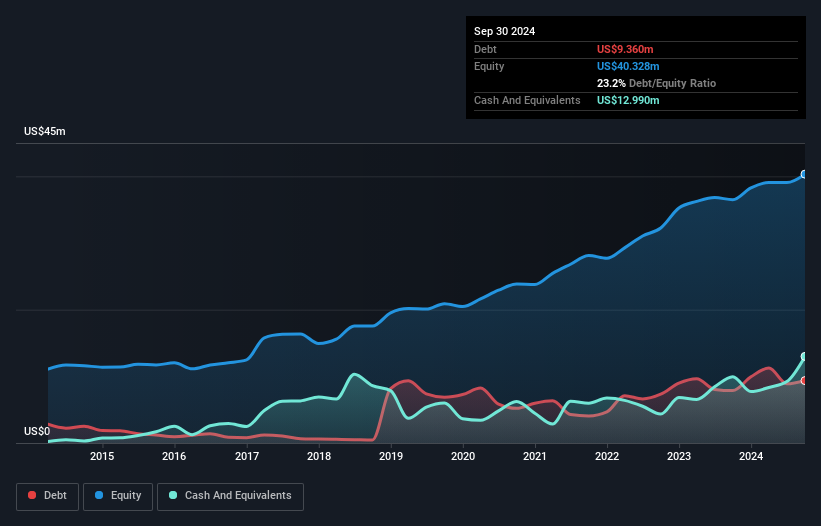

Vasta Platform Limited, with a market cap of $182.79 million, is navigating the challenges of being unprofitable while maintaining a solid cash runway for over three years. The company reported third-quarter revenue of R$220.19 million, down from R$257.93 million the previous year, and a net loss of R$77.14 million compared to R$62.39 million last year. Despite trading at 46% below its estimated fair value and having satisfactory debt levels with a net debt to equity ratio of 15.6%, Vasta's short-term assets exceed liabilities but fall short in covering long-term obligations, highlighting financial vulnerabilities amidst its unprofitability.

- Click here to discover the nuances of Vasta Platform with our detailed analytical financial health report.

- Examine Vasta Platform's earnings growth report to understand how analysts expect it to perform.

Flexible Solutions International (NYSEAM:FSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Flexible Solutions International, Inc. develops, manufactures, and markets specialty chemicals to reduce water evaporation across Canada, the United States, and internationally with a market cap of $47.33 million.

Operations: The company generates revenue from two main segments: Biodegradable Polymers (TPA), which contributes $37.87 million, and Energy and Water Conservation Products (EWCP), accounting for $0.63 million.

Market Cap: $47.33M

Flexible Solutions International, Inc., with a market cap of US$47.33 million, demonstrates a stable financial position among penny stocks. The company reported third-quarter sales of US$9.31 million and net income of US$0.61 million, marking an improvement from the previous year's net loss. Its earnings growth rate of 12.6% surpasses industry averages, supported by strong cash flow covering debt obligations effectively and short-term assets exceeding liabilities comfortably. Although its price-to-earnings ratio is attractive at 12.2x compared to the broader market, challenges remain with an unstable dividend history and low return on equity at 13.2%.

- Click here and access our complete financial health analysis report to understand the dynamics of Flexible Solutions International.

- Understand Flexible Solutions International's earnings outlook by examining our growth report.

Summing It All Up

- Embark on your investment journey to our 720 US Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English