January 2025's Promising Penny Stocks To Watch

As global markets navigate a mixed start to the new year, with U.S. stocks closing another strong year despite recent volatility, investors are exploring diverse opportunities. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those seeking potential growth at a lower entry cost. While the term may seem outdated, these investments can still offer significant value when backed by robust financials and strategic growth plans.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.54 | MYR2.69B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £434.2M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.66 | HK$40.3B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.97 | £153.01M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,807 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Global Bioenergies (ENXTPA:ALGBE)

Simply Wall St Financial Health Rating: ★★★★☆☆

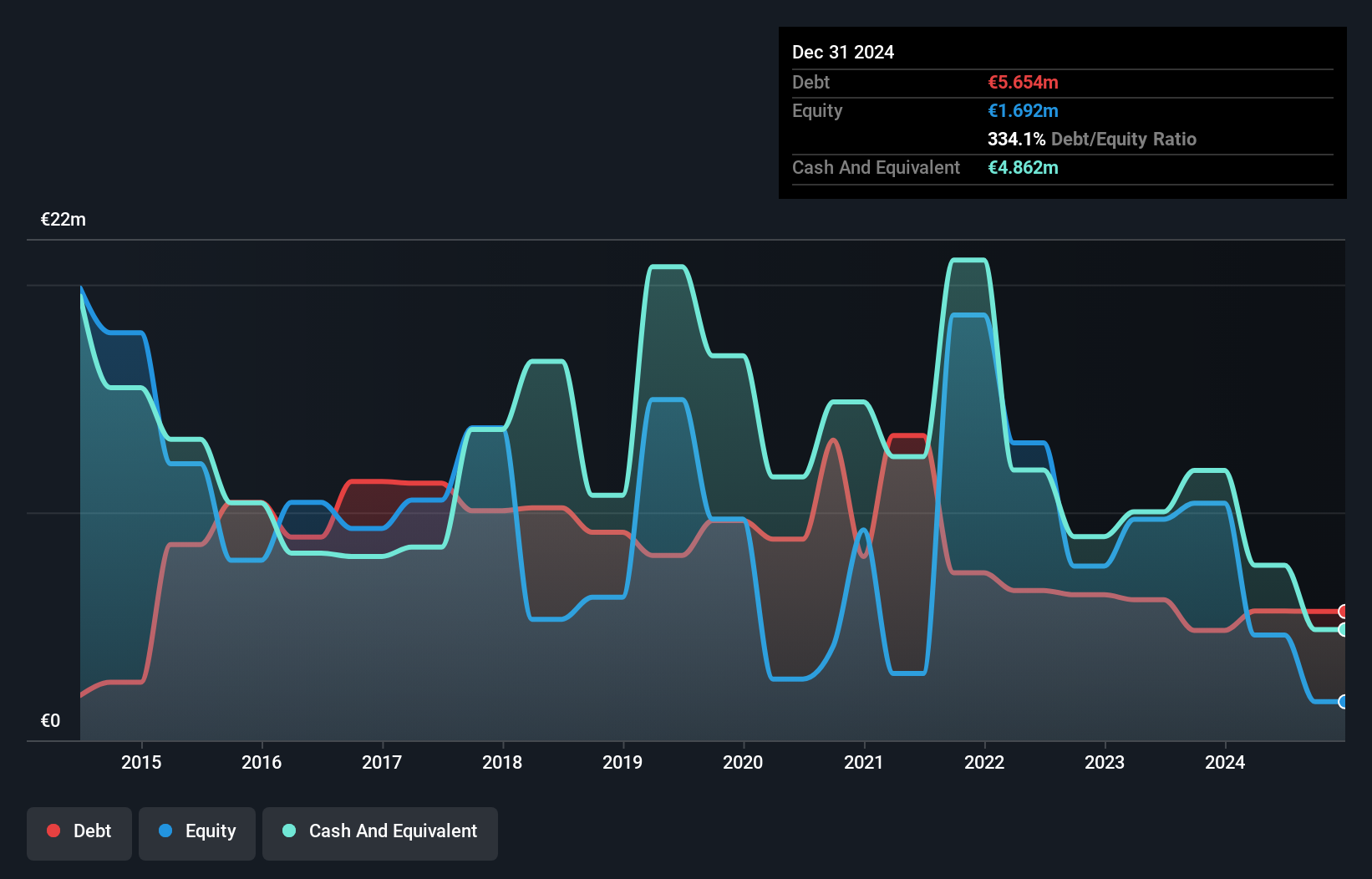

Overview: Global Bioenergies SA develops a process to convert plant-based feedstocks into isobutene for use in the cosmetic and aviation fuel industries, with a market cap of €18.31 million.

Operations: The company reported revenue of -€1.43 million from its specialty chemicals segment.

Market Cap: €18.31M

Global Bioenergies SA, with a market cap of €18.31 million, is navigating the challenges typical of penny stocks. The company is pre-revenue, generating less than US$1 million annually (€486K), and remains unprofitable. Its debt-to-equity ratio has risen significantly over the past five years, yet it holds more cash than total debt and covers both short-term and long-term liabilities with its assets. Despite a volatile share price and increasing weekly volatility, management's seasoned experience offers some stability. However, earnings are forecast to decline by 4% annually over the next three years while revenue is expected to grow 27.62% per year.

- Jump into the full analysis health report here for a deeper understanding of Global Bioenergies.

- Learn about Global Bioenergies' future growth trajectory here.

Grandshores Technology Group (SEHK:1647)

Simply Wall St Financial Health Rating: ★★★★★★

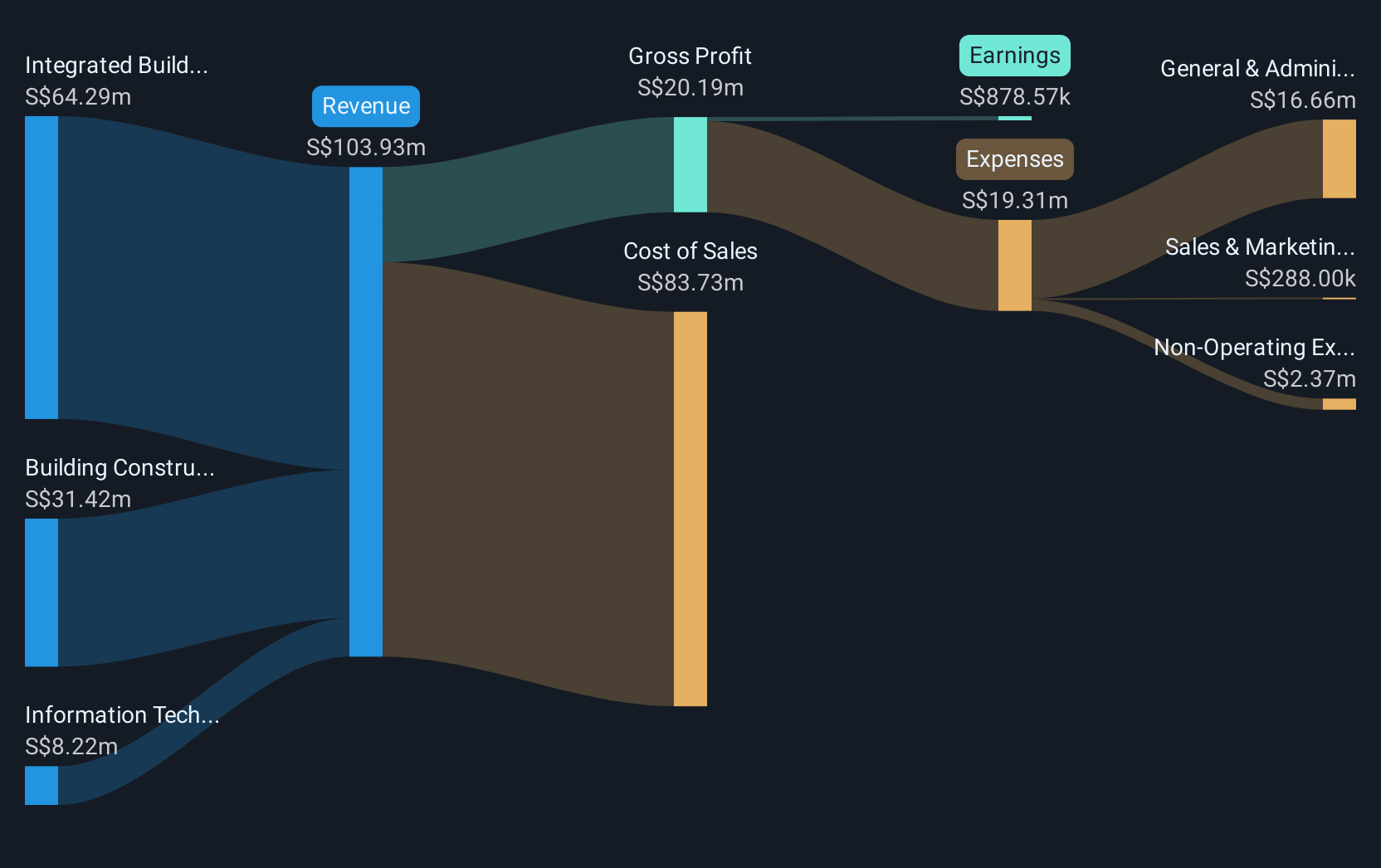

Overview: Grandshores Technology Group Limited is an investment holding company that offers integrated building services in Singapore, Hong Kong, and the People's Republic of China, with a market cap of HK$111.14 million.

Operations: The company's revenue is derived from three main segments: Building Construction Works (SGD 31.42 million), Integrated Building Services (SGD 64.29 million), and Information Technology Development and Application (SGD 8.22 million).

Market Cap: HK$111.14M

Grandshores Technology Group, with a market cap of HK$111.14 million, has shown mixed financial performance typical of penny stocks. It became profitable last year but reported a net loss of SGD 2.87 million for the half-year ending September 2024, up from SGD 1.54 million the previous year, largely due to reduced government grants and foreign exchange losses. Despite this, its short-term assets significantly exceed liabilities, and it remains debt-free after reducing its debt-to-equity ratio over five years ago. However, earnings have declined by an average of 29.1% annually over the past five years amidst high share price volatility.

- Get an in-depth perspective on Grandshores Technology Group's performance by reading our balance sheet health report here.

- Examine Grandshores Technology Group's past performance report to understand how it has performed in prior years.

Jutal Offshore Oil Services (SEHK:3303)

Simply Wall St Financial Health Rating: ★★★★★★

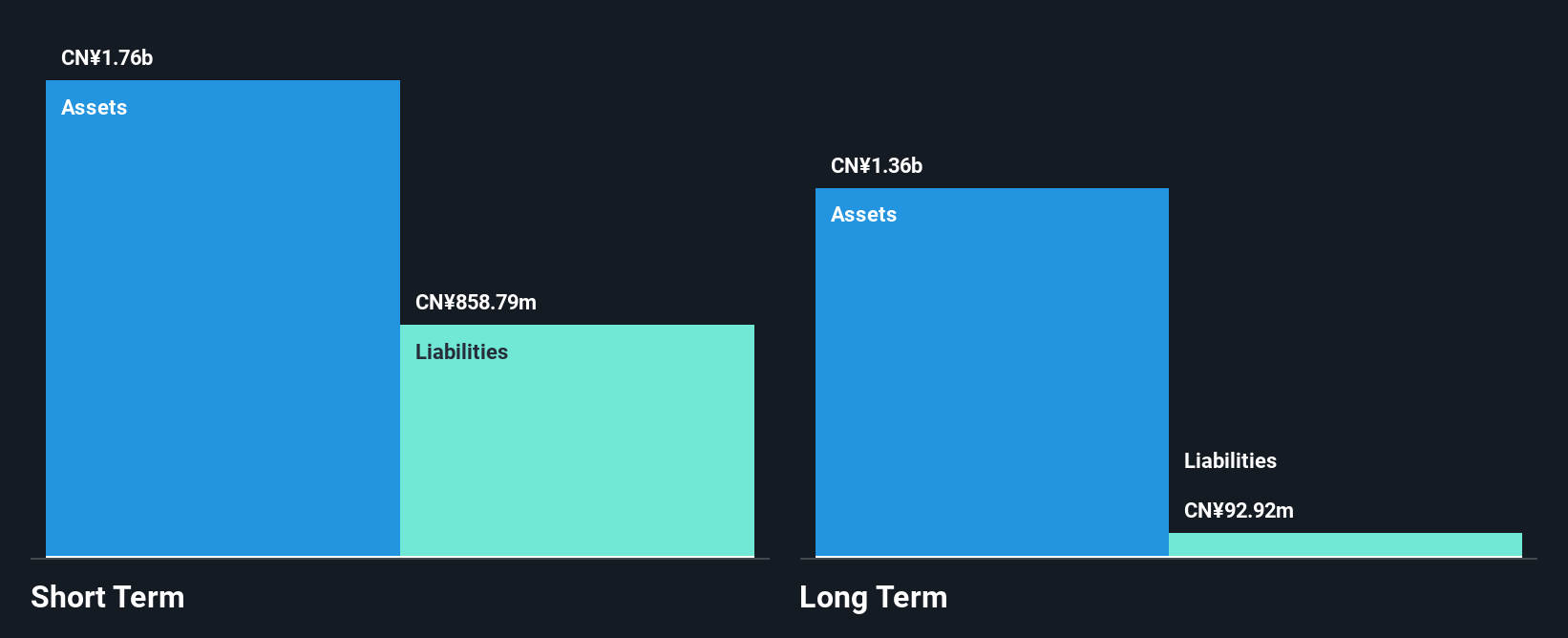

Overview: Jutal Offshore Oil Services Limited is an investment holding company that specializes in the fabrication of facilities and provides integrated services for the oil and gas, new energy, and refining and chemical industries, with a market cap of HK$1.53 billion.

Operations: The company generates revenue primarily from the oil and gas segment, amounting to CN¥2.98 billion, with additional income from the new energy and refinery and chemical segment totaling CN¥64.13 million.

Market Cap: HK$1.53B

Jutal Offshore Oil Services, with a market cap of HK$1.53 billion, has demonstrated significant earnings growth, with profits surging by a very large amount over the past year and surpassing industry averages. Its net profit margin improved to 11.9%, while short-term assets of CN¥2.2 billion comfortably cover both short-term and long-term liabilities. The company's debt is well-covered by operating cash flow, and it holds more cash than total debt, indicating strong financial health despite shareholder dilution of 7.6% over the past year. However, its dividend track record remains unstable amidst recent board changes.

- Dive into the specifics of Jutal Offshore Oil Services here with our thorough balance sheet health report.

- Evaluate Jutal Offshore Oil Services' historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 5,807 Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English