Top Growth Companies With Significant Insider Ownership

In a week marked by mixed performances across global markets, the Nasdaq Composite stood out by reaching a record high, driven in part by strong gains in growth stocks. As inflation concerns persist and rate cuts loom on the horizon, investors are increasingly focused on companies with robust insider ownership, which can signal confidence from those closest to the business. In this context, identifying growth companies where insiders maintain significant stakes becomes particularly compelling for investors seeking stability and potential upside amidst market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Let's take a closer look at a couple of our picks from the screened companies.

International Container Terminal Services (PSE:ICT)

Simply Wall St Growth Rating: ★★★★☆☆

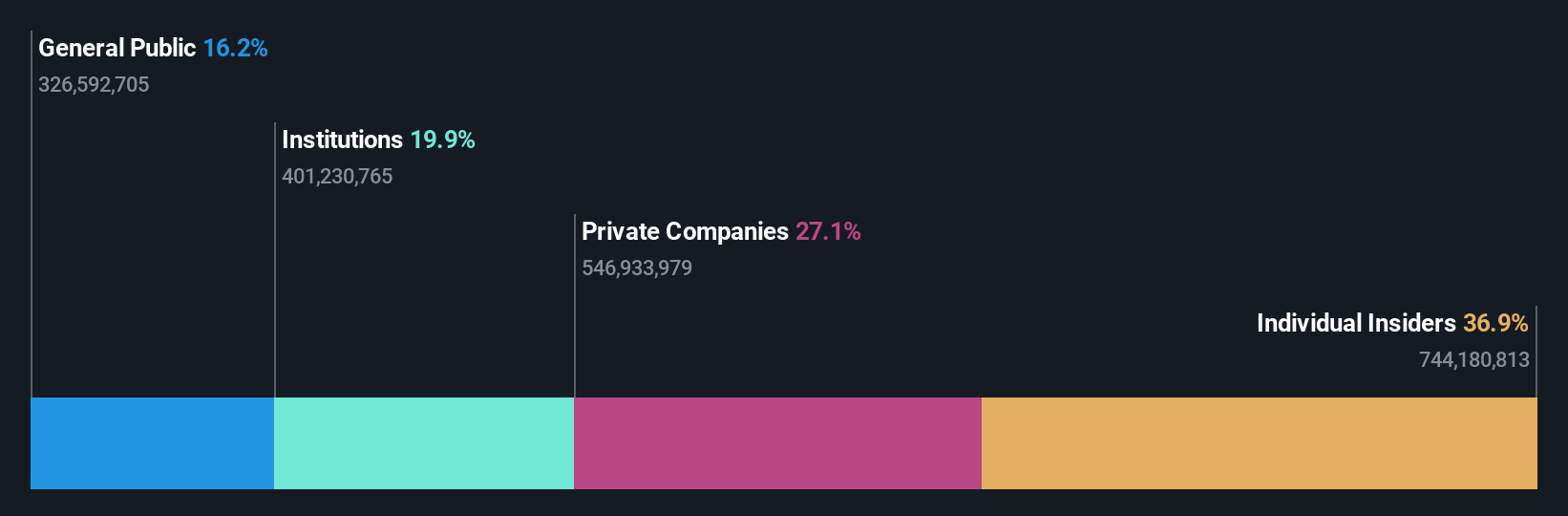

Overview: International Container Terminal Services, Inc. and its subsidiaries develop, manage, and operate container ports and terminals across Asia, Europe, the Middle East, Africa, and the Americas with a market cap of ₱781.79 billion.

Operations: The company's revenue is primarily derived from Cargo Handling and Related Services, totaling $2.64 billion.

Insider Ownership: 36.7%

Earnings Growth Forecast: 16.3% p.a.

International Container Terminal Services exhibits characteristics of a growth company with high insider ownership. The company's recent earnings report shows robust financial performance, with third-quarter revenue reaching US$715.36 million and net income at US$212.03 million, both up from the previous year. ICTSI's strategic expansion in Batangas aligns with its growth trajectory, supported by forecasts of substantial earnings growth at 16.3% annually, outpacing the Philippine market average of 11.8%.

- Dive into the specifics of International Container Terminal Services here with our thorough growth forecast report.

- According our valuation report, there's an indication that International Container Terminal Services' share price might be on the expensive side.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

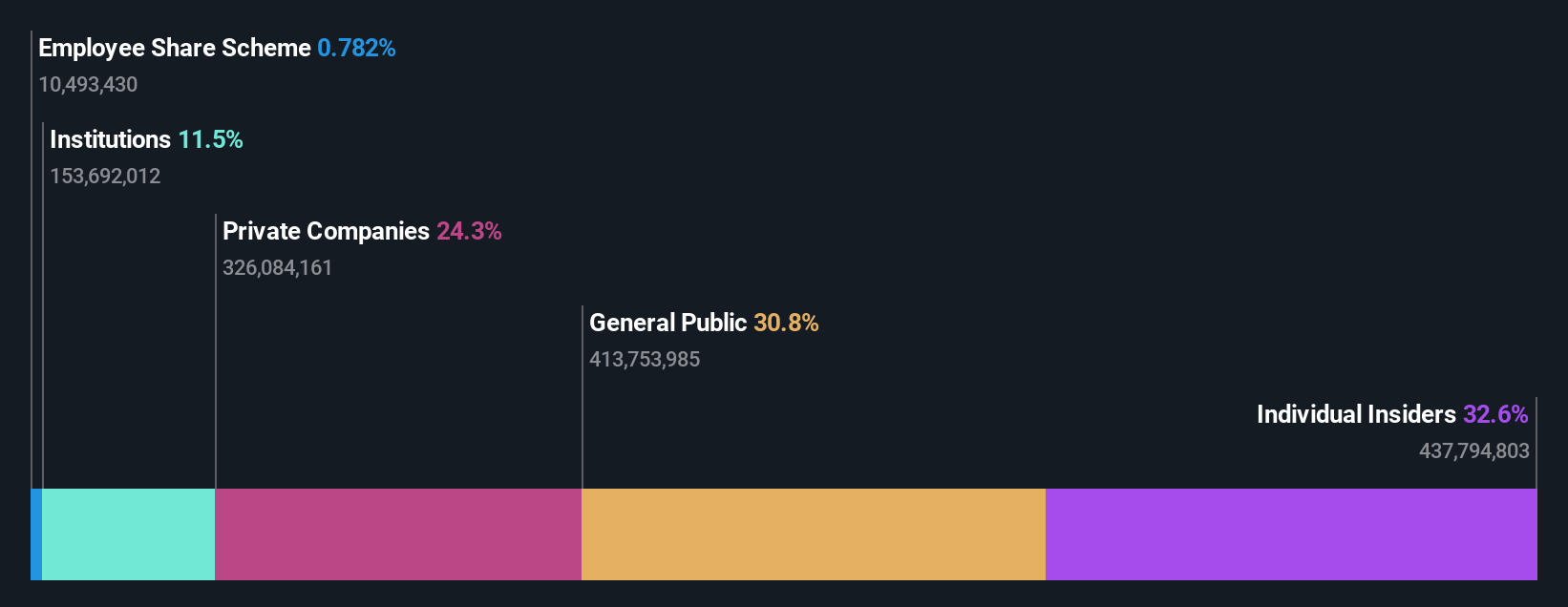

Overview: Xiaomi Corporation is an investment holding company that offers hardware and software services both in Mainland China and internationally, with a market cap of approximately HK$746.54 billion.

Operations: Xiaomi's revenue is derived from its diverse segments, including smartphones (CN¥167.25 billion), IoT and lifestyle products (CN¥67.93 billion), and internet services (CN¥28.22 billion).

Insider Ownership: 34.2%

Earnings Growth Forecast: 21.3% p.a.

Xiaomi's recent earnings report highlights its strong financial performance, with third-quarter sales reaching CNY 92.51 billion and net income at CNY 5.35 billion, both showing substantial year-over-year growth. The company's earnings are forecast to grow significantly at 21.3% annually over the next three years, outpacing the Hong Kong market average of 11.6%. Despite no recent insider trading activity, Xiaomi trades below its estimated fair value by 15.7%, offering potential investment appeal amidst expected revenue growth of 15.1% annually.

- Unlock comprehensive insights into our analysis of Xiaomi stock in this growth report.

- Our valuation report unveils the possibility Xiaomi's shares may be trading at a premium.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Newborn Town Inc. is an investment holding company that operates in the global social networking sector, with a market cap of HK$4.67 billion.

Operations: The company generates revenue from its innovative business segment amounting to CN¥406.28 million and its social networking business segment totaling CN¥3.80 billion.

Insider Ownership: 35.4%

Earnings Growth Forecast: 21% p.a.

Newborn Town's earnings have grown significantly by 137.3% over the past year and are expected to continue growing at 21% annually, surpassing the Hong Kong market average of 11.6%. The company trades at a substantial discount, 55.8% below its estimated fair value, suggesting potential upside. Despite large one-off items affecting quality earnings and no recent insider trading data, Newborn Town is positioned for growth with an upcoming shareholder meeting to approve strategic acquisitions.

- Click here and access our complete growth analysis report to understand the dynamics of Newborn Town.

- Insights from our recent valuation report point to the potential undervaluation of Newborn Town shares in the market.

Make It Happen

- Click here to access our complete index of 1528 Fast Growing Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English