3 Promising Penny Stocks With Market Caps Over US$100M

Global markets have been on an upward trajectory, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, driven by domestic policy developments and geopolitical factors. Amidst this backdrop, penny stocks remain a compelling area of interest for investors seeking opportunities in smaller or newer companies that might offer value beyond their price point. Despite being an older term, penny stocks represent a segment where strong financials and growth potential can lead to significant returns without the typical risks associated with these investments.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.725 | £177.65M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.96 | HK$43.61B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.415 | £439.1M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,701 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Meilleure Health International Industry Group (SEHK:2327)

Simply Wall St Financial Health Rating: ★★★★★☆

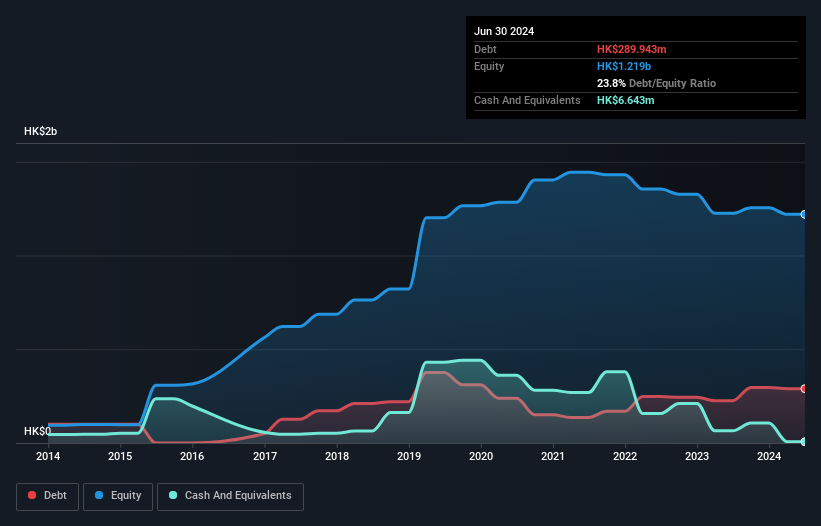

Overview: Meilleure Health International Industry Group Limited is an investment holding company involved in trading construction and photovoltaic components and materials across Hong Kong, China, Europe, and internationally, with a market cap of HK$1.08 billion.

Operations: The company's revenue is primarily derived from its Trading Business, which generated HK$29.57 million, and its Property Related Business, contributing HK$15.05 million.

Market Cap: HK$1.08B

Meilleure Health International Industry Group has shown notable earnings growth of 22.5% over the past year, outpacing its industry average. The company benefits from a stable financial position, with short-term assets significantly exceeding liabilities and satisfactory net debt levels. However, its operating cash flow does not adequately cover its debt, indicating potential liquidity challenges. The firm's high-quality earnings are impacted by substantial one-off gains, and while profit margins have improved to 36.8%, Return on Equity remains low at 2.4%. Both the board and management team are experienced, contributing to stable governance.

- Navigate through the intricacies of Meilleure Health International Industry Group with our comprehensive balance sheet health report here.

- Understand Meilleure Health International Industry Group's track record by examining our performance history report.

Fortune Ng Fung Food (Hebei)Ltd (SHSE:600965)

Simply Wall St Financial Health Rating: ★★★★★★

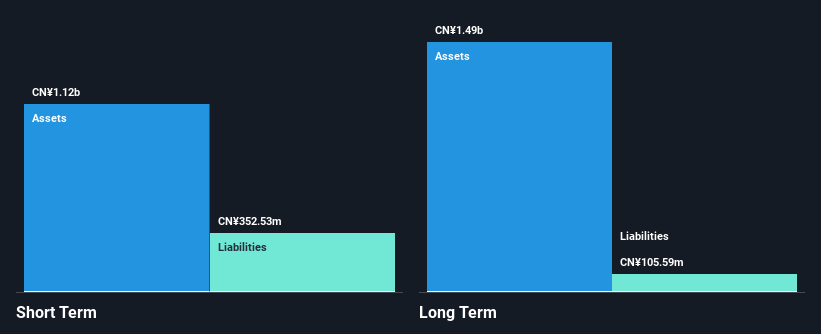

Overview: Fortune Ng Fung Food (Hebei) Co., Ltd operates in beef cattle breeding, slaughtering, and food processing both within China and internationally, with a market cap of CN¥3.64 billion.

Operations: No specific revenue segments have been reported.

Market Cap: CN¥3.64B

Fortune Ng Fung Food (Hebei) Co., Ltd, with a market cap of CN¥3.64 billion, faces profitability challenges as losses have grown by 21.5% annually over the past five years. Despite this, the company maintains a strong financial structure with short-term assets of CN¥1.1 billion exceeding both short and long-term liabilities and more cash than total debt. The debt to equity ratio has improved significantly from 9.2% to 3.7%. Recent earnings for the nine months ending September 2024 show sales of CN¥708.1 million, down from CN¥837.67 million in the previous year, reflecting ongoing revenue pressures amidst operational difficulties.

- Dive into the specifics of Fortune Ng Fung Food (Hebei)Ltd here with our thorough balance sheet health report.

- Assess Fortune Ng Fung Food (Hebei)Ltd's previous results with our detailed historical performance reports.

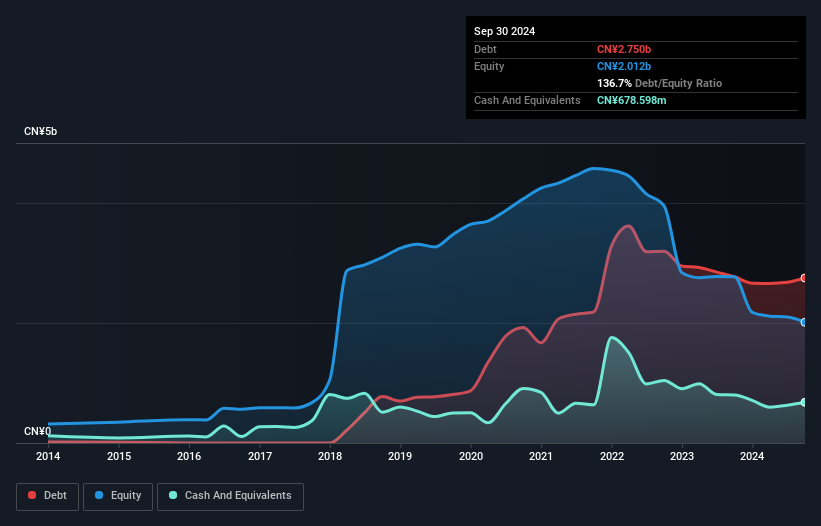

D&O Home Collection GroupLTD (SZSE:002798)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: D&O Home Collection Group Co., LTD is a company that produces and sells sanitary ware and architectural ceramic products in China, with a market capitalization of approximately CN¥1.64 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for D&O Home Collection Group Co., LTD.

Market Cap: CN¥1.64B

D&O Home Collection Group Co., LTD, with a market cap of CN¥1.64 billion, is experiencing financial difficulties as evidenced by its net loss of CN¥140.72 million for the nine months ending September 2024, up from a loss of CN¥65.18 million the previous year. Despite being unprofitable, the company has a positive cash flow and sufficient cash runway for over three years. Its short-term assets exceed both short and long-term liabilities, indicating some financial resilience; however, its high net debt to equity ratio at 103% raises concerns about leverage levels amidst declining revenues and increased losses.

- Click here and access our complete financial health analysis report to understand the dynamics of D&O Home Collection GroupLTD.

- Gain insights into D&O Home Collection GroupLTD's historical outcomes by reviewing our past performance report.

Make It Happen

- Jump into our full catalog of 5,701 Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English