China Gas Holdings (HKG:384) Will Pay A Dividend Of HK$0.15

China Gas Holdings Limited (HKG:384) will pay a dividend of HK$0.15 on the 18th of February. The dividend yield will be 8.0% based on this payment which is still above the industry average.

See our latest analysis for China Gas Holdings

China Gas Holdings' Projected Earnings Seem Likely To Cover Future Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The last payment made up 86% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

Over the next year, EPS is forecast to expand by 54.9%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 63% which brings it into quite a comfortable range.

China Gas Holdings Has A Solid Track Record

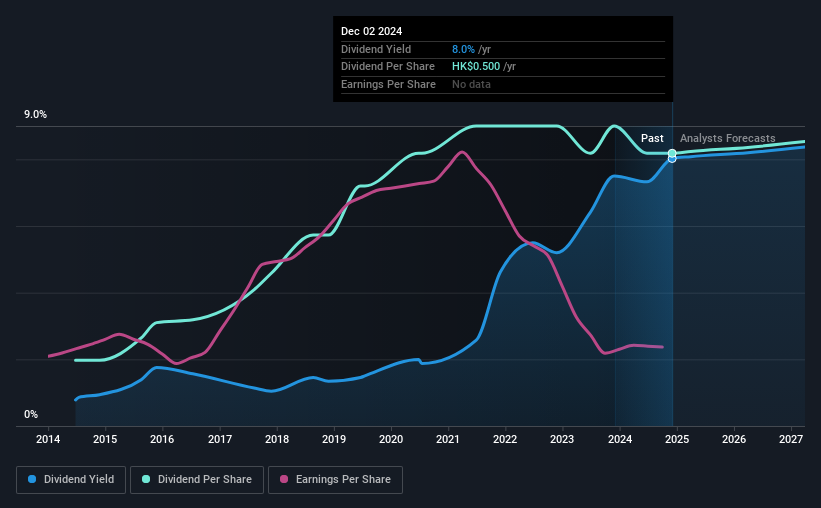

The company has an extended history of paying stable dividends. Since 2014, the annual payment back then was HK$0.121, compared to the most recent full-year payment of HK$0.50. This works out to be a compound annual growth rate (CAGR) of approximately 15% a year over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. Over the past five years, it looks as though China Gas Holdings' EPS has declined at around 20% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about China Gas Holdings' payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We don't think China Gas Holdings is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 2 warning signs for China Gas Holdings you should be aware of, and 1 of them shouldn't be ignored. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English