Discover High Growth Tech Stocks with Potential

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across key indices such as the S&P 500 and Nasdaq Composite, with notable fluctuations driven by sector-specific expectations. In this environment of shifting economic indicators and market sentiment, identifying high growth tech stocks with potential requires a focus on companies that demonstrate robust innovation, adaptability to regulatory changes, and resilience in volatile conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.66% | 31.69% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1301 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Norbit (OB:NORBT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Norbit ASA is a technology company that offers a range of products and solutions, with a market capitalization of NOK5.72 billion.

Operations: The company operates through distinct segments, each focusing on specialized technology products and solutions. Revenue streams are diversified across these segments, contributing to its overall financial performance.

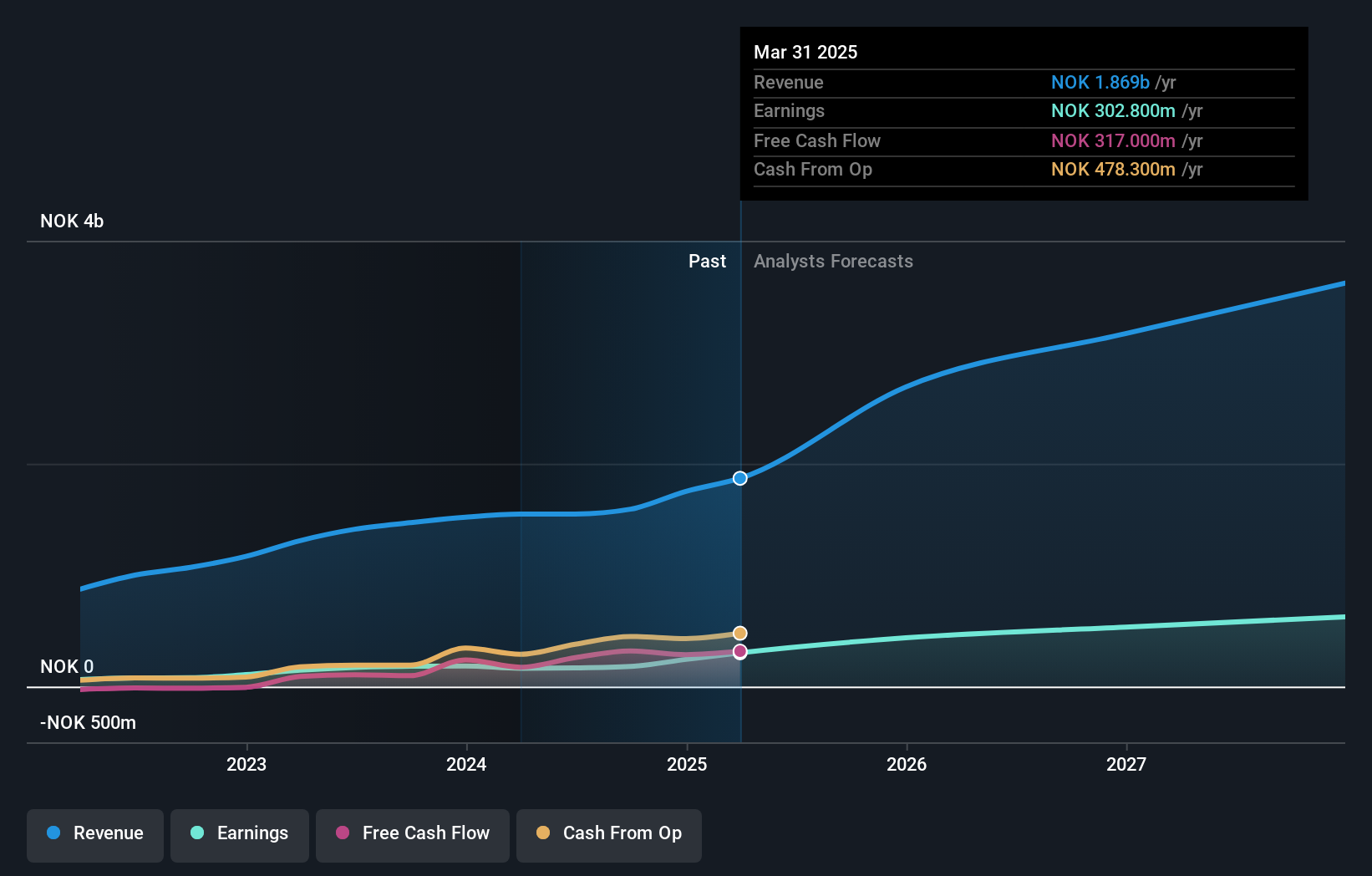

Norbit's recent performance underscores its potential in the tech sector, with third-quarter sales up by 13.2% year-over-year to NOK 371.9 million and net income increasing by 58.8% to NOK 35.1 million. This growth is supported by strategic client engagements, such as the anticipated NOK 50 million contract in its PIR segment and a NOK 75 million order for GuardPoint sonar systems, highlighting its robust product demand and expansion into new markets. Moreover, Norbit's commitment to innovation is evident from its R&D investments which are pivotal in sustaining long-term growth in the highly competitive tech landscape. With expected annual revenue and profit growth rates of 17.8% and 26.2% respectively—outpacing the Norwegian market averages—it’s clear that Norbit is not only growing but also enhancing its market position through strategic initiatives and strong operational execution.

- Get an in-depth perspective on Norbit's performance by reading our health report here.

Gain insights into Norbit's past trends and performance with our Past report.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RaySearch Laboratories AB (publ) is a medical technology company that offers software solutions for cancer care across various regions including the Americas, Europe, Africa, the Asia-Pacific, and the Middle East, with a market cap of SEK6.41 billion.

Operations: The company generates revenue primarily from its healthcare software segment, amounting to SEK1.13 billion.

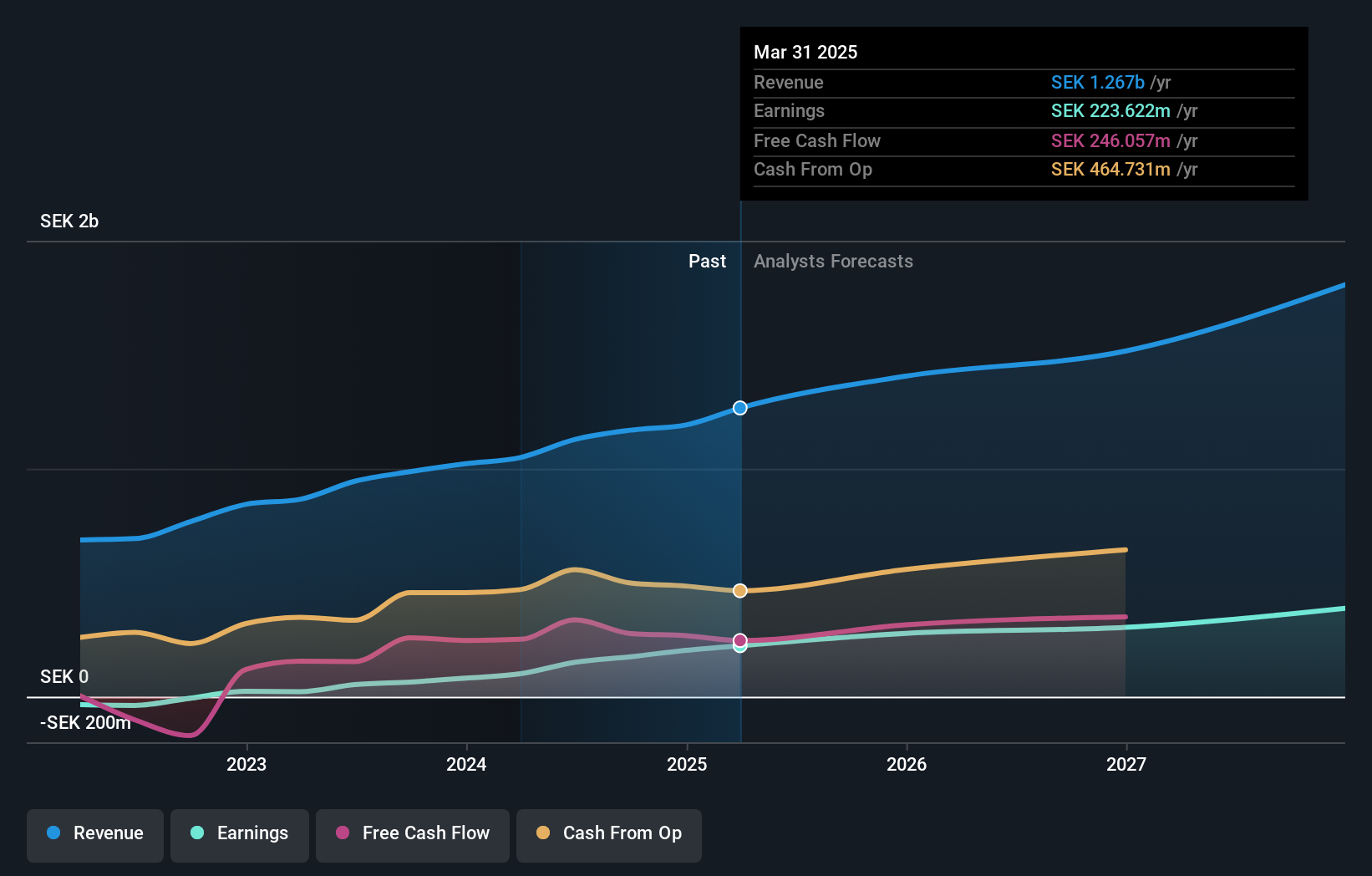

RaySearch Laboratories is carving a niche in the high-tech oncology sector, evidenced by recent strategic client acquisitions like Institut Curie for its RayStation® system. This EUR 1.7 million deal underscores its penetration into advanced cancer treatment technologies, leveraging AI and adaptive planning capabilities. Financially, RaySearch's commitment to innovation is marked by an 11.6% annual revenue growth forecast, outpacing the Swedish market significantly. Moreover, with an impressive earnings surge of 187% over the past year and projected annual growth of 26.2%, the company is not just expanding its technological footprint but also enhancing its financial robustness through strategic R&D investments and key market expansions.

- Unlock comprehensive insights into our analysis of RaySearch Laboratories stock in this health report.

Assess RaySearch Laboratories' past performance with our detailed historical performance reports.

Weimob (SEHK:2013)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Weimob Inc. is an investment holding company that offers digital commerce and media services in the People’s Republic of China, with a market cap of HK$5.23 billion.

Operations: Weimob focuses on providing digital commerce and media services in China, leveraging a diverse revenue model. The company generates income primarily through SaaS products and targeted marketing solutions. Notably, its gross profit margin has shown significant fluctuations over recent periods, reflecting the dynamic nature of its operational costs and pricing strategies.

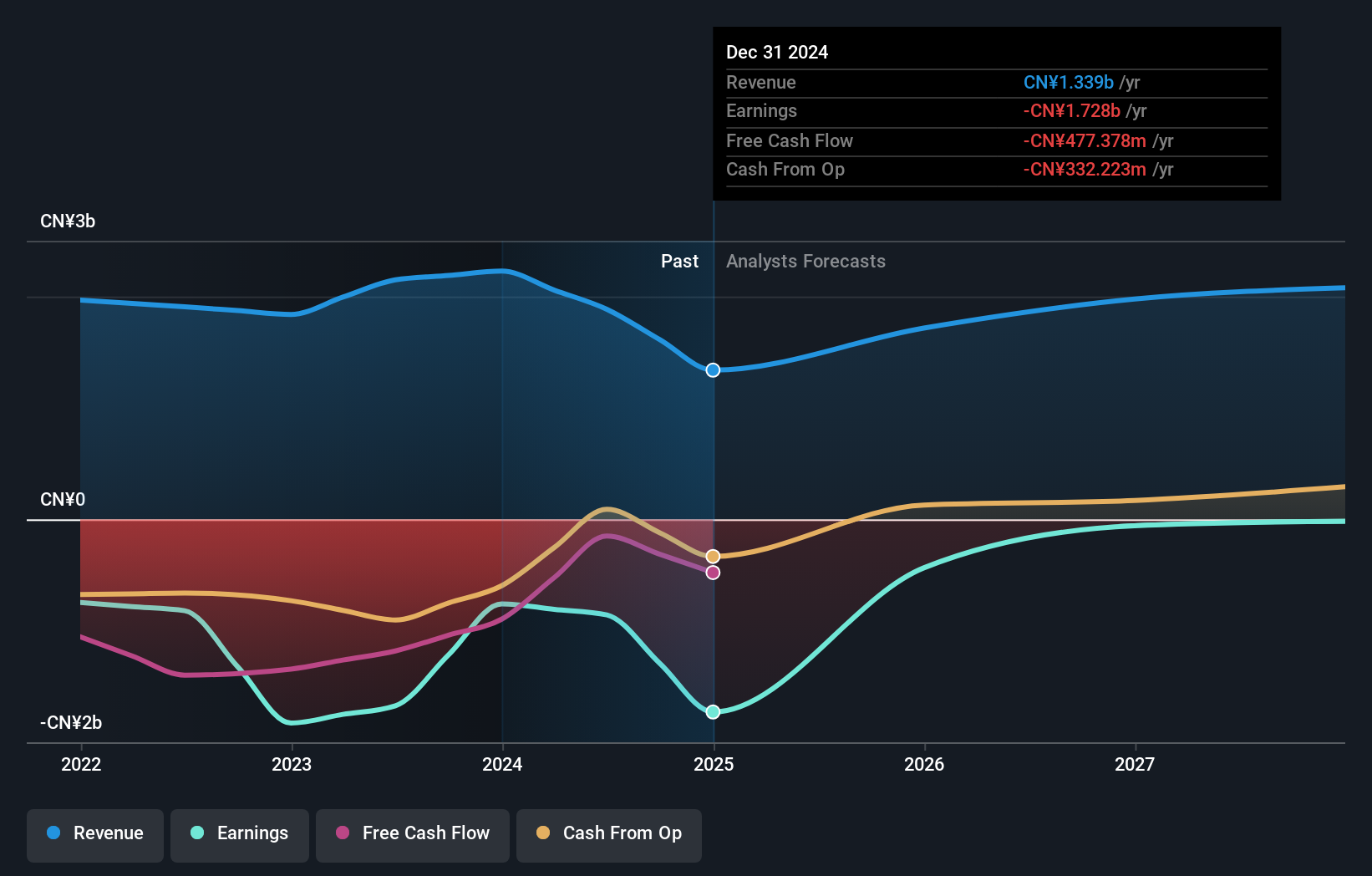

Weimob, navigating a challenging landscape, reported a revenue dip to CNY 867.43 million from CNY 1.21 billion year-over-year and an increased net loss of CNY 550.78 million. Despite these hurdles, the firm is poised for recovery with projected earnings growth of 99.2% annually, outpacing the Hong Kong market's average. The recent executive reshuffle could further invigorate its strategic direction, enhancing operational efficiency in its quest to pivot back to profitability within three years—a testament to its resilience and adaptive strategies in the fast-evolving tech sector.

- Delve into the full analysis health report here for a deeper understanding of Weimob.

Examine Weimob's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Click here to access our complete index of 1301 High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English