3 Reliable Dividend Stocks Yielding Up To 5.2%

As global markets react to the recent U.S. election and economic policy shifts, investors have seen major indices like the S&P 500 reach record highs, driven by optimism around potential tax cuts and deregulation. Amidst this backdrop of economic uncertainty and fluctuating interest rates, dividend stocks offer a reliable income stream for investors seeking stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.77% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.98% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1934 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

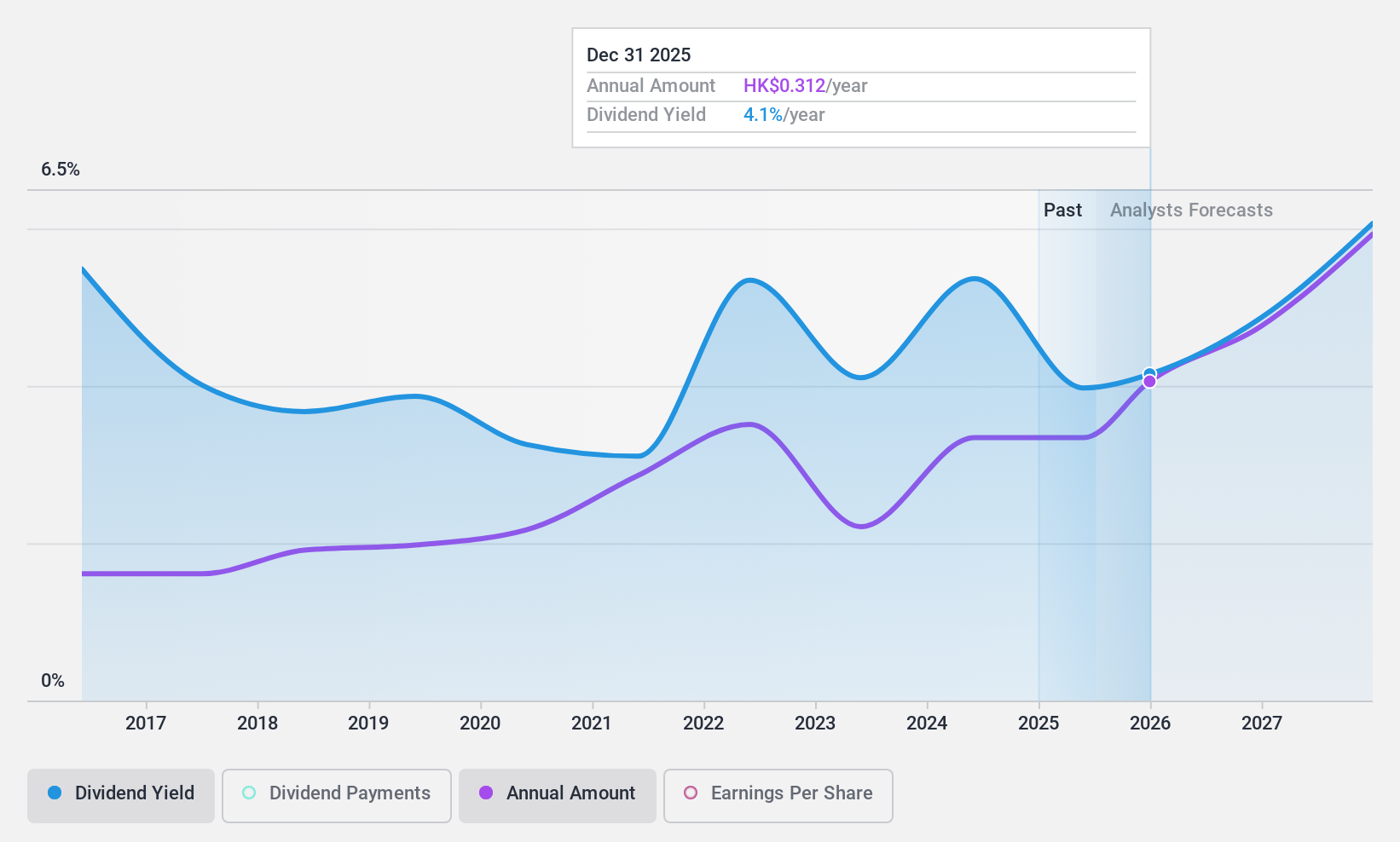

VSTECS Holdings (SEHK:856)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VSTECS Holdings Limited is an investment holding company that develops IT product channels and provides technical solution integration services in North Asia and South East Asia, with a market cap of HK$6.68 billion.

Operations: VSTECS Holdings Limited's revenue segments consist of Cloud Computing (HK$3.44 billion), Enterprise Systems (HK$44.82 billion), and Consumer Electronics (HK$31.69 billion).

Dividend Yield: 5.2%

VSTECS Holdings offers a dividend yield of 5.23%, which is below the top 25% in Hong Kong. Its dividends are well-covered by earnings and cash flow, with payout ratios of 41.1% and 49%, respectively. However, its dividend history has been volatile over the past decade despite recent increases. The company's price-to-earnings ratio is attractively lower than the market average, but recent earnings show a decline in net income despite increased sales to HK$40 billion for H1 2024.

- Take a closer look at VSTECS Holdings' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that VSTECS Holdings is trading beyond its estimated value.

Nihon DenkeiLtd (TSE:9908)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Nihon Denkei Co., Ltd. engages in the trading of electronic measuring instruments both in Japan and internationally, with a market cap of ¥19.45 billion.

Operations: Nihon Denkei Ltd.'s revenue segments include ¥15.75 billion from China and ¥89.39 billion from Japan.

Dividend Yield: 4.7%

Nihon Denkei Ltd. offers a reliable dividend yield of 4.79%, ranking in the top 25% of Japanese market payers, with stable growth over the past decade. The dividends are well-supported by earnings and cash flows, with payout ratios of 33.1% and 29.7%, respectively, ensuring sustainability. Recently, the company announced a share buyback program worth ¥460 million to enhance shareholder returns and capital efficiency amid its removal from the S&P Global BMI Index.

- Click to explore a detailed breakdown of our findings in Nihon DenkeiLtd's dividend report.

- The analysis detailed in our Nihon DenkeiLtd valuation report hints at an deflated share price compared to its estimated value.

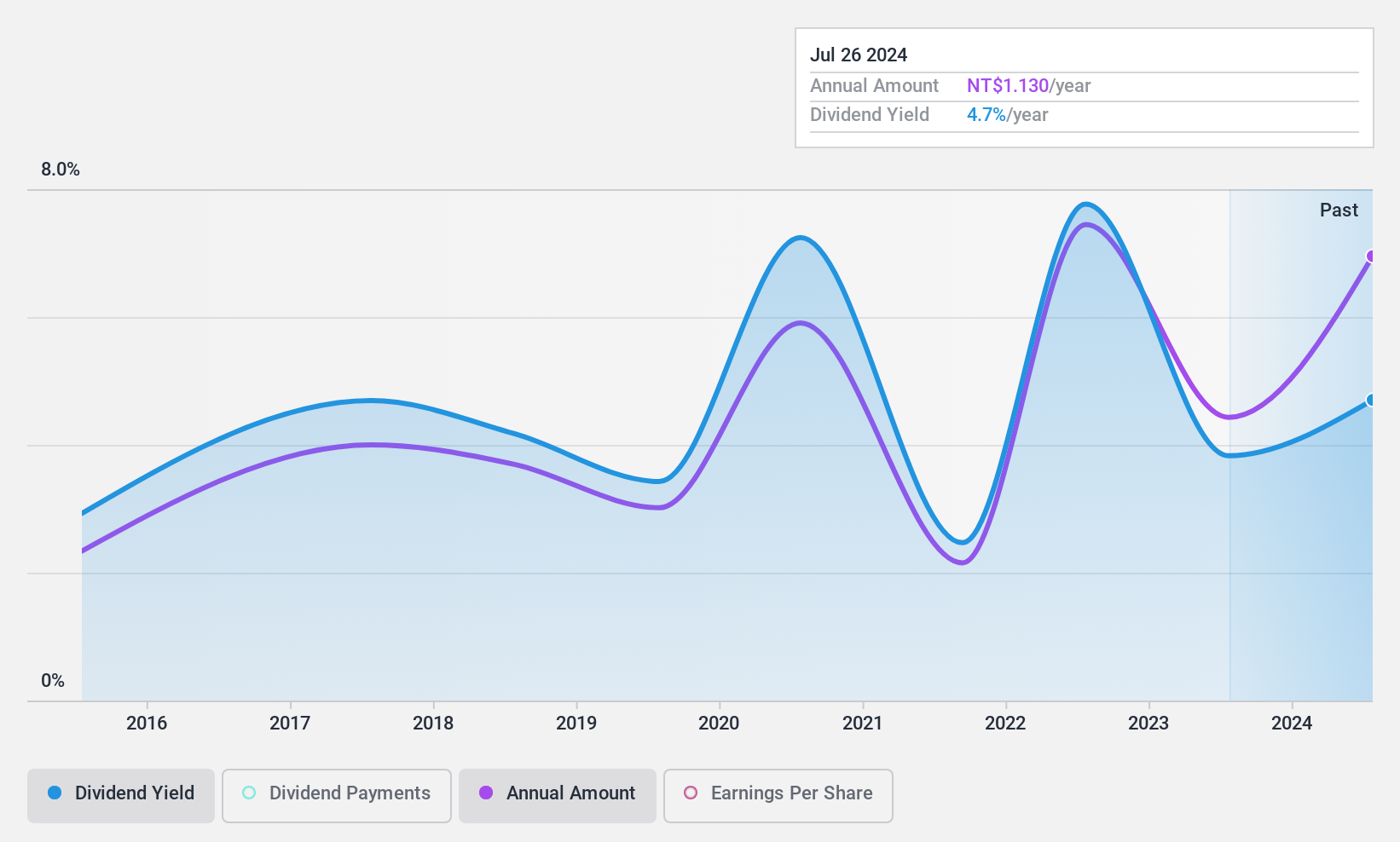

First Insurance (TWSE:2852)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The First Insurance Co., Ltd. provides a variety of insurance products and related services to both commercial and personal line customers in Taiwan, with a market cap of NT$7.26 billion.

Operations: The First Insurance Co., Ltd. generates its revenue primarily from Property and Casualty Insurance, amounting to NT$7.69 billion.

Dividend Yield: 4.7%

First Insurance's dividend yield of 4.66% is among the top 25% in Taiwan, but its reliability is questionable due to historical volatility. Although dividends are well-covered by earnings with a payout ratio of 38.6%, they aren't supported by free cash flow, raising sustainability concerns. Recent earnings growth, with net income reaching TWD 529.79 million for the first half of 2024, signals improved profitability despite past shareholder dilution issues.

- Click here and access our complete dividend analysis report to understand the dynamics of First Insurance.

- According our valuation report, there's an indication that First Insurance's share price might be on the cheaper side.

Seize The Opportunity

- Investigate our full lineup of 1934 Top Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English