BankFinancial's (NASDAQ:BFIN) Dividend Will Be $0.10

The board of BankFinancial Corporation (NASDAQ:BFIN) has announced that it will pay a dividend on the 29th of November, with investors receiving $0.10 per share. Based on this payment, the dividend yield will be 3.3%, which is fairly typical for the industry.

Check out our latest analysis for BankFinancial

BankFinancial's Dividend Forecasted To Be Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time.

BankFinancial has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Using data from its latest earnings report, BankFinancial's payout ratio sits at 16%, an extremely comfortable number that shows that it can pay its dividend.

Looking forward, earnings per share is forecast to rise by 14.3% over the next year. Assuming the dividend continues along recent trends, we think the future payout ratio could be 61% by next year, which is in a pretty sustainable range.

BankFinancial Has A Solid Track Record

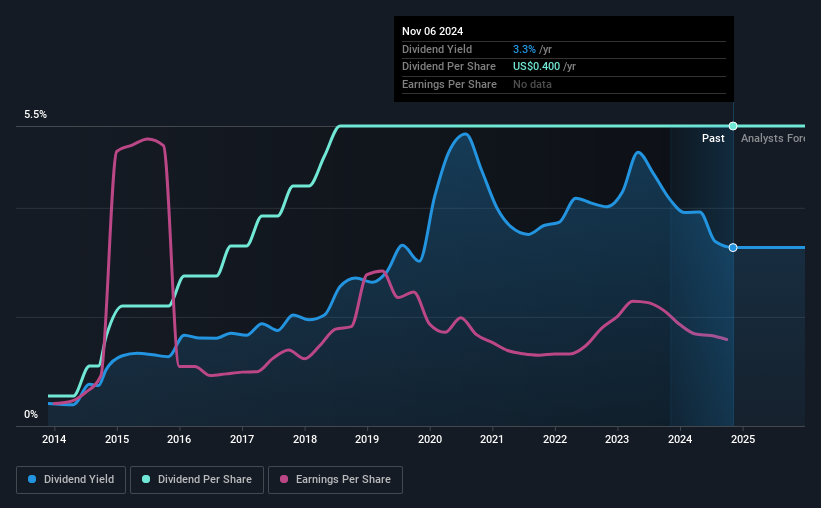

The company has an extended history of paying stable dividends. Since 2014, the dividend has gone from $0.04 total annually to $0.40. This means that it has been growing its distributions at 26% per annum over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

Dividend Growth Is Doubtful

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. In the last five years, BankFinancial's earnings per share has shrunk at approximately 8.4% per annum. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

In Summary

Overall, we think BankFinancial is a solid choice as a dividend stock, even though the dividend wasn't raised this year. The earnings coverage is acceptable for now, but with earnings on the decline we would definitely keep an eye on the payout ratio. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Now, if you want to look closer, it would be worth checking out our free research on BankFinancial management tenure, salary, and performance. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English