Here's What's Concerning About HK Asia Holdings' (HKG:1723) Returns On Capital

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This indicates the company is producing less profit from its investments and its total assets are decreasing. On that note, looking into HK Asia Holdings (HKG:1723), we weren't too upbeat about how things were going.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on HK Asia Holdings is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = HK$16m ÷ (HK$139m - HK$13m) (Based on the trailing twelve months to March 2024).

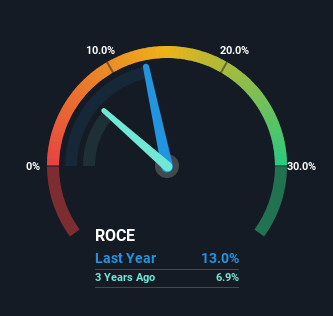

So, HK Asia Holdings has an ROCE of 13%. On its own, that's a standard return, however it's much better than the 7.4% generated by the Electronic industry.

View our latest analysis for HK Asia Holdings

Historical performance is a great place to start when researching a stock so above you can see the gauge for HK Asia Holdings' ROCE against it's prior returns. If you'd like to look at how HK Asia Holdings has performed in the past in other metrics, you can view this free graph of HK Asia Holdings' past earnings, revenue and cash flow.

What Does the ROCE Trend For HK Asia Holdings Tell Us?

There is reason to be cautious about HK Asia Holdings, given the returns are trending downwards. To be more specific, the ROCE was 23% five years ago, but since then it has dropped noticeably. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect HK Asia Holdings to turn into a multi-bagger.

The Bottom Line

In summary, it's unfortunate that HK Asia Holdings is generating lower returns from the same amount of capital. We expect this has contributed to the stock plummeting 84% during the last five years. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

HK Asia Holdings does have some risks, we noticed 2 warning signs (and 1 which is significant) we think you should know about.

While HK Asia Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English