Top SEHK Dividend Stocks To Watch In October 2024

As global markets face challenges from rising U.S. Treasury yields and economic uncertainties, the Hong Kong market has seen mixed performances, with the Hang Seng Index recently experiencing a decline. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking to navigate market volatility while benefiting from regular payouts.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Hongqiao Group (SEHK:1378) | 8.77% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.28% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.99% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.70% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.07% | ★★★★★☆ |

| Lenovo Group (SEHK:992) | 3.48% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.37% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 6.96% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.63% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.63% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top SEHK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

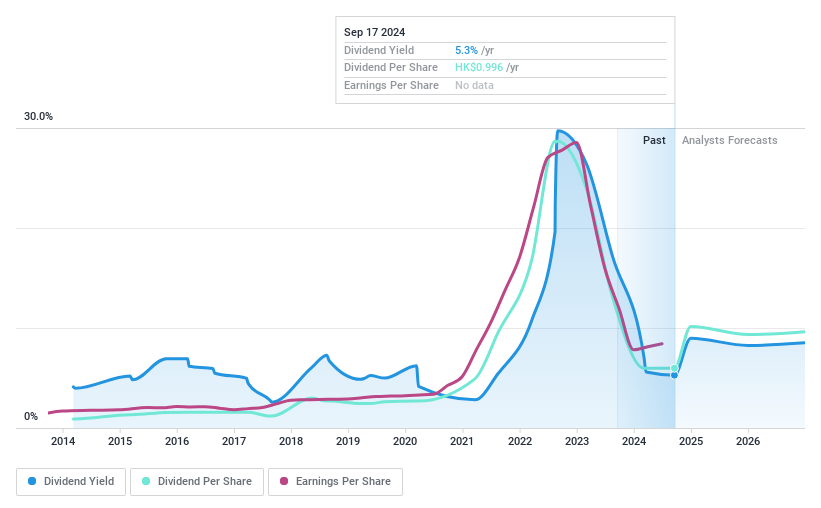

SITC International Holdings (SEHK:1308)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SITC International Holdings Company Limited is a shipping logistics company that provides integrated transportation and logistics solutions across Mainland China, Hong Kong, Taiwan, Japan, Southeast Asia, and internationally with a market cap of approximately HK$62.88 billion.

Operations: SITC International Holdings generates revenue primarily from its Container Shipping and Logistics segment, which amounted to approximately $2.48 billion.

Dividend Yield: 4.2%

SITC International Holdings offers a mixed dividend profile, trading at 51.3% below its estimated fair value with dividends covered by earnings and cash flows (payout ratios of 72.2% and 76.5%, respectively). Despite a history of volatile dividends, recent increases include an interim dividend of HK$0.72 per share and a special dividend of HK$0.4 per share announced for November 2024. However, its current yield (4.24%) is lower than Hong Kong's top-tier payers (7.93%).

- Click here and access our complete dividend analysis report to understand the dynamics of SITC International Holdings.

- According our valuation report, there's an indication that SITC International Holdings' share price might be on the expensive side.

Tsingtao Brewery (SEHK:168)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tsingtao Brewery Company Limited, along with its subsidiaries, is involved in the production, distribution, wholesale, and retail sale of beer products across Mainland China, Hong Kong, Macau, and international markets; it has a market cap of HK$91.06 billion.

Operations: Tsingtao Brewery's revenue is primarily derived from its operations in the Shandong Area (CN¥23.49 billion), North China (CN¥8.00 billion), South China (CN¥3.58 billion), East China (CN¥2.53 billion), South-East China Region (CN¥0.75 billion), and Hong Kong, Macau, and other overseas markets (CN¥0.82 billion).

Dividend Yield: 3.9%

Tsingtao Brewery's dividend profile shows mixed signals. While its dividends have been stable and reliable over the past decade, they are not well covered by cash flows due to a high cash payout ratio of 145.5%. The dividend yield of 3.92% is below Hong Kong's top-tier payers, although earnings growth of 4.7% indicates potential for future stability. Trading at a significant discount to estimated fair value, it presents good relative value compared to peers and industry standards.

- Dive into the specifics of Tsingtao Brewery here with our thorough dividend report.

- Our valuation report here indicates Tsingtao Brewery may be undervalued.

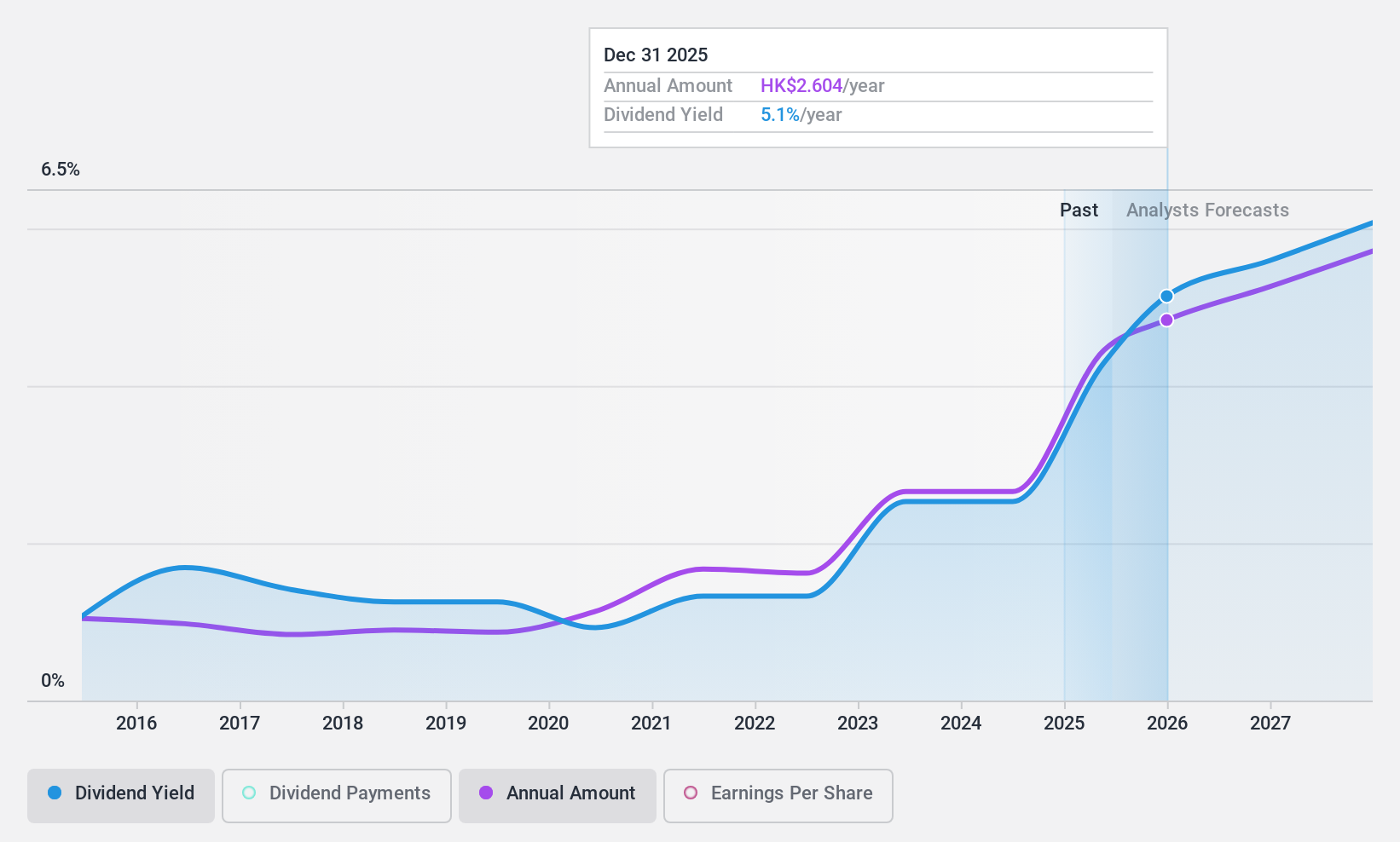

Cathay Pacific Airways (SEHK:293)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cathay Pacific Airways Limited, along with its subsidiaries, provides international passenger and air cargo transportation services and has a market cap of HK$52.86 billion.

Operations: Cathay Pacific Airways Limited generates revenue through its primary segments: Cathay Pacific at HK$90.85 billion, HK Express at HK$6.18 billion, Air Hong Kong at HK$3.48 billion, and Airline Services at HK$4.50 billion.

Dividend Yield: 4.9%

Cathay Pacific Airways' dividend profile is characterized by a reasonably low payout ratio of 47.8%, suggesting dividends are well covered by earnings and cash flows, with a cash payout ratio of 25%. Despite an unstable dividend track record over the past decade, recent interim dividends totaled HK$1.29 billion. The stock trades at a significant discount to fair value, offering good relative value in its industry. However, its dividend yield of 4.87% remains lower than Hong Kong's top-tier payers.

- Click to explore a detailed breakdown of our findings in Cathay Pacific Airways' dividend report.

- The analysis detailed in our Cathay Pacific Airways valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Get an in-depth perspective on all 89 Top SEHK Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English