Undiscovered Gems in Hong Kong to Explore This October 2024

As global markets react to rising U.S. Treasury yields and economic uncertainties, the Hong Kong market presents unique opportunities for investors seeking to explore lesser-known stocks. In this environment, identifying promising small-cap companies that demonstrate resilience and potential growth can be particularly rewarding, as they may offer untapped value amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Mobvista (SEHK:1860)

Simply Wall St Value Rating: ★★★★☆☆

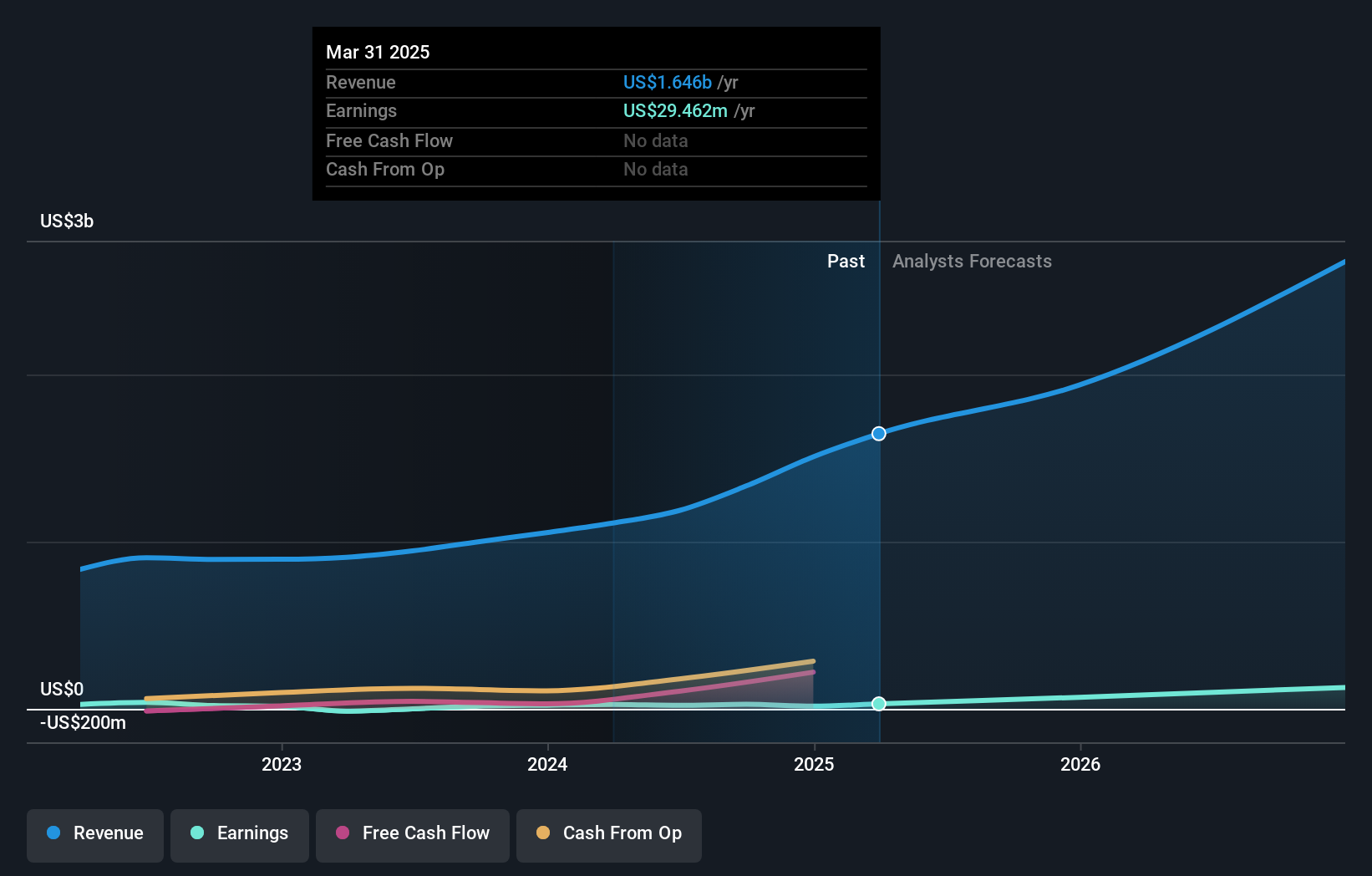

Overview: Mobvista Inc. is a company that provides advertising and marketing technology services to support the mobile internet ecosystem globally, with a market capitalization of HK$3.63 billion.

Operations: Mobvista generates revenue primarily from its Advertising Technology Services, amounting to $1.17 billion, and a smaller portion from its Marketing Technology Business at $16.98 million.

Mobvista, a promising player in the media industry, has shown remarkable earnings growth of 4320.9% over the past year, surpassing the sector's average of 6.4%. Despite this impressive performance, recent financials reveal net income at US$9.27 million for H1 2024, slightly down from US$10.16 million last year. The company's net debt to equity ratio stands at a satisfactory 4%, indicating prudent financial management amidst volatility in its share price over the past three months. Trading well below estimated fair value by 91.3%, Mobvista presents potential opportunities for discerning investors seeking value in Hong Kong's market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Mobvista.

Evaluate Mobvista's historical performance by accessing our past performance report.

Binjiang Service Group (SEHK:3316)

Simply Wall St Value Rating: ★★★★★★

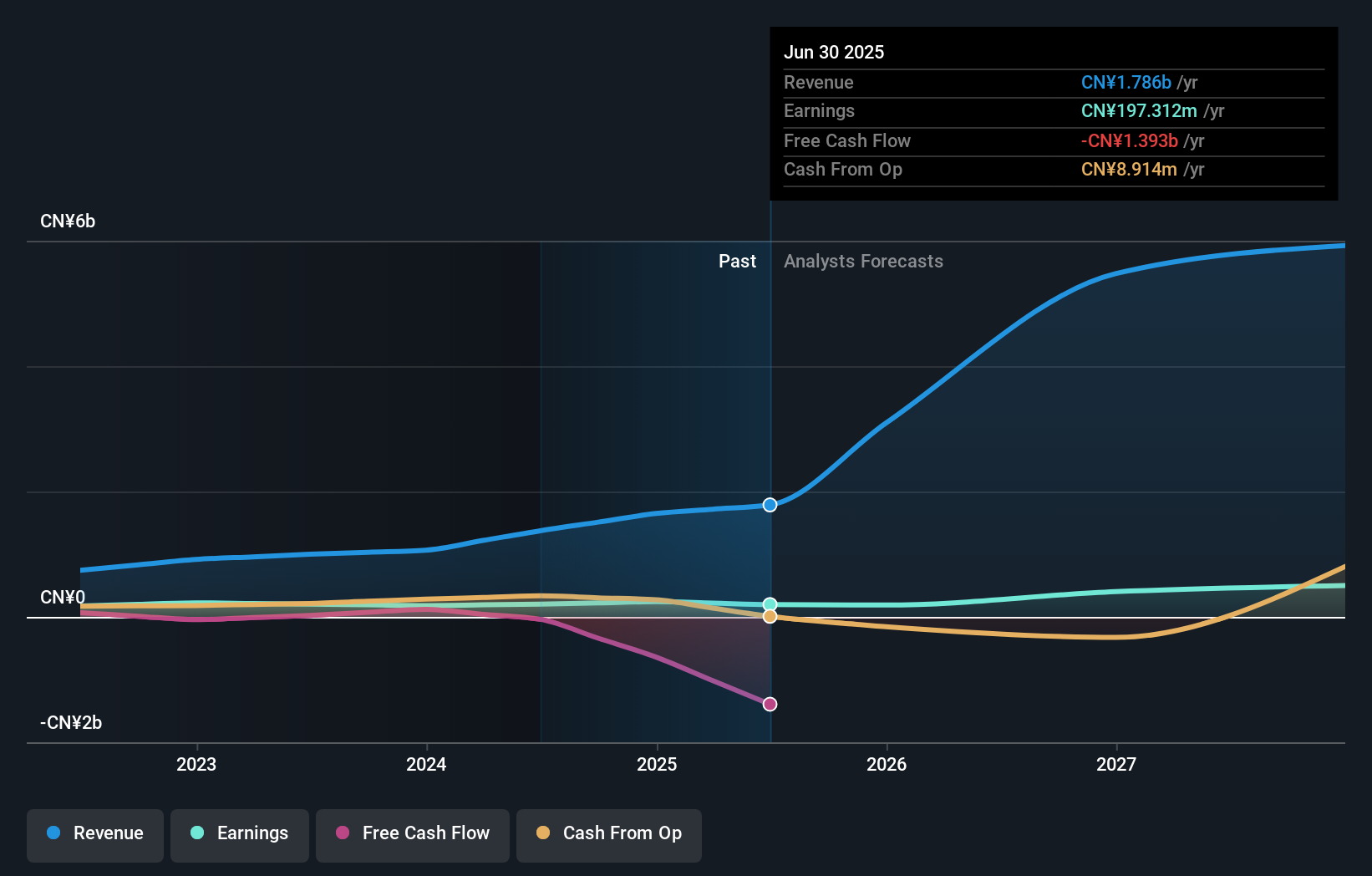

Overview: Binjiang Service Group Co. Ltd. offers property management and related services in the People’s Republic of China, with a market capitalization of HK$5.24 billion.

Operations: Binjiang Service Group generates revenue primarily through property management services in China. The company has a market capitalization of HK$5.24 billion.

Binjiang Service Group, a small player in the property management sector, is showing promising signs with earnings growth of 16.4% over the past year, outperforming the Commercial Services industry. The company trades at 31% below its estimated fair value and remains debt-free, ensuring no concerns over interest payments. Recent results for the first half of 2024 highlight sales reaching CNY 1.65 billion from CNY 1.19 billion last year, while net income rose to CNY 265 million from CNY 231 million. Additionally, an interim dividend of HKD 0.63 per share was announced for shareholders, reflecting robust financial health and shareholder returns.

- Delve into the full analysis health report here for a deeper understanding of Binjiang Service Group.

Explore historical data to track Binjiang Service Group's performance over time in our Past section.

Global New Material International Holdings (SEHK:6616)

Simply Wall St Value Rating: ★★★★★★

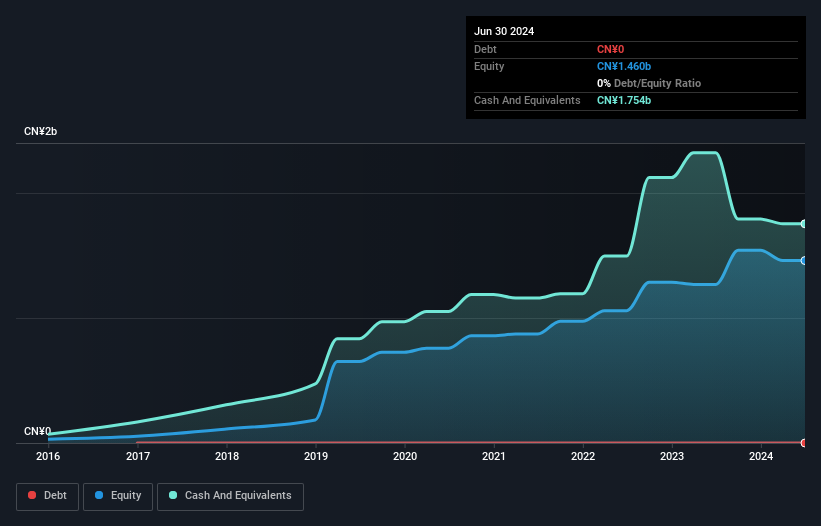

Overview: Global New Material International Holdings Limited is an investment holding company that manufactures and markets pearlescent pigments, functional mica fillers, and related products both in China and globally, with a market cap of HK$4.72 billion.

Operations: The company generates revenue primarily from its PRC business operations, which contribute CN¥1.11 billion. The segment adjustment amounts to CN¥266.09 million.

With its earnings growth of 0.9% surpassing the chemicals industry's -29.6%, Global New Material International Holdings shows resilience in a challenging sector. The company reported a net income of CNY 107 million for the half-year ending June 2024, up from CNY 85 million the previous year, with basic earnings per share rising to CNY 0.09 from CNY 0.07. Recent leadership changes include Mr. Lim Kwang Su and Professor Chen Fadong joining as directors, potentially strengthening governance and innovation capabilities in pearl effect pigments and data science management respectively, setting an optimistic tone for future growth prospects within this niche market space.

- Take a closer look at Global New Material International Holdings' potential here in our health report.

Learn about Global New Material International Holdings' historical performance.

Key Takeaways

- Unlock our comprehensive list of 168 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English