Consun Pharmaceutical Group And 2 Other Hidden Small Cap Gems In Hong Kong

In recent weeks, the Hong Kong market has experienced fluctuations, with the Hang Seng Index seeing a decline amidst broader global market movements and economic pressures. As investors navigate these dynamic conditions, small-cap stocks often present unique opportunities due to their potential for growth and innovation in less saturated segments of the market. Identifying promising small-cap companies involves looking for strong fundamentals, innovative business models, and resilience in challenging economic environments—all traits that can be found in hidden gems like Consun Pharmaceutical Group.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Lvji Technology Holdings | 3.06% | 4.56% | -1.87% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Value Rating: ★★★★★★

Overview: Consun Pharmaceutical Group Limited is engaged in the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in the People’s Republic of China with a market cap of HK$6.62 billion.

Operations: Consun Pharmaceutical Group generates revenue primarily from its Consun Pharmaceutical Segment, contributing CN¥2.33 billion, and the Yulin Pharmaceutical Segment, which adds CN¥410 million. The company's gross profit margin shows an interesting trend at 73.5%.

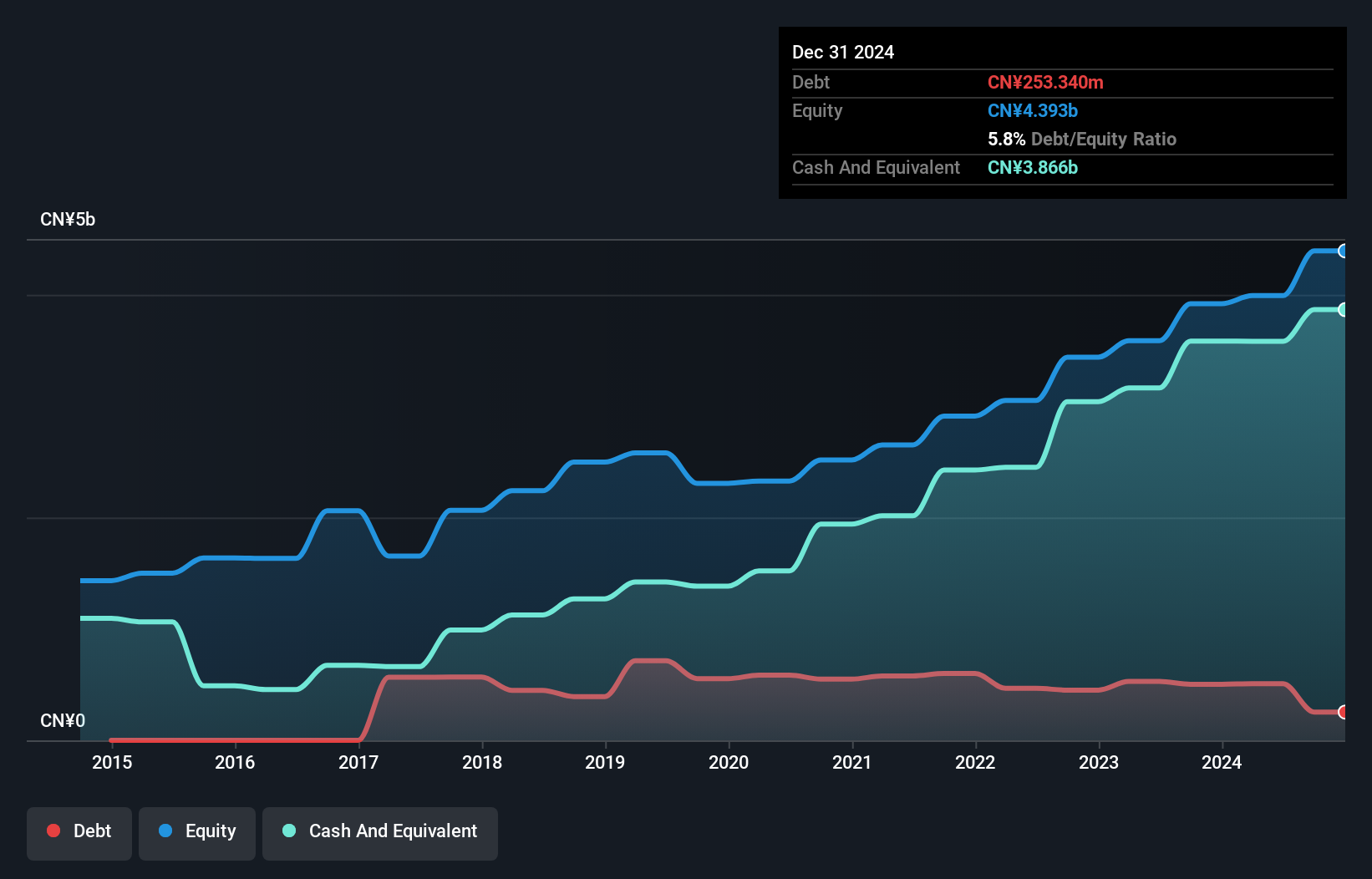

Consun Pharmaceutical Group, a nimble player in the pharmaceutical industry, has demonstrated robust financial health with earnings growth of 13.9% over the past year, outpacing the industry's 6.4%. The company is trading at a significant discount, valued at 71.7% below its estimated fair value. Recent financial results show sales hitting CNY 1.27 billion and net income reaching CNY 399.77 million for the first half of 2024, reflecting solid performance compared to last year's figures. Additionally, Consun's debt-to-equity ratio improved from 27.7% to 12.7% over five years, underscoring prudent financial management amidst executive changes and dividend announcements this year.

LEPU ScienTech Medical Technology (Shanghai) (SEHK:2291)

Simply Wall St Value Rating: ★★★★★★

Overview: LEPU ScienTech Medical Technology (Shanghai) Co., Ltd. is an investment holding company involved in the research, development, manufacture, and commercialization of interventional medical devices globally, with a market cap of HK$5.65 billion.

Operations: LEPU ScienTech generates revenue primarily from its interventional medical devices. The company's financial performance is influenced by its cost structure, which impacts the net profit margin.

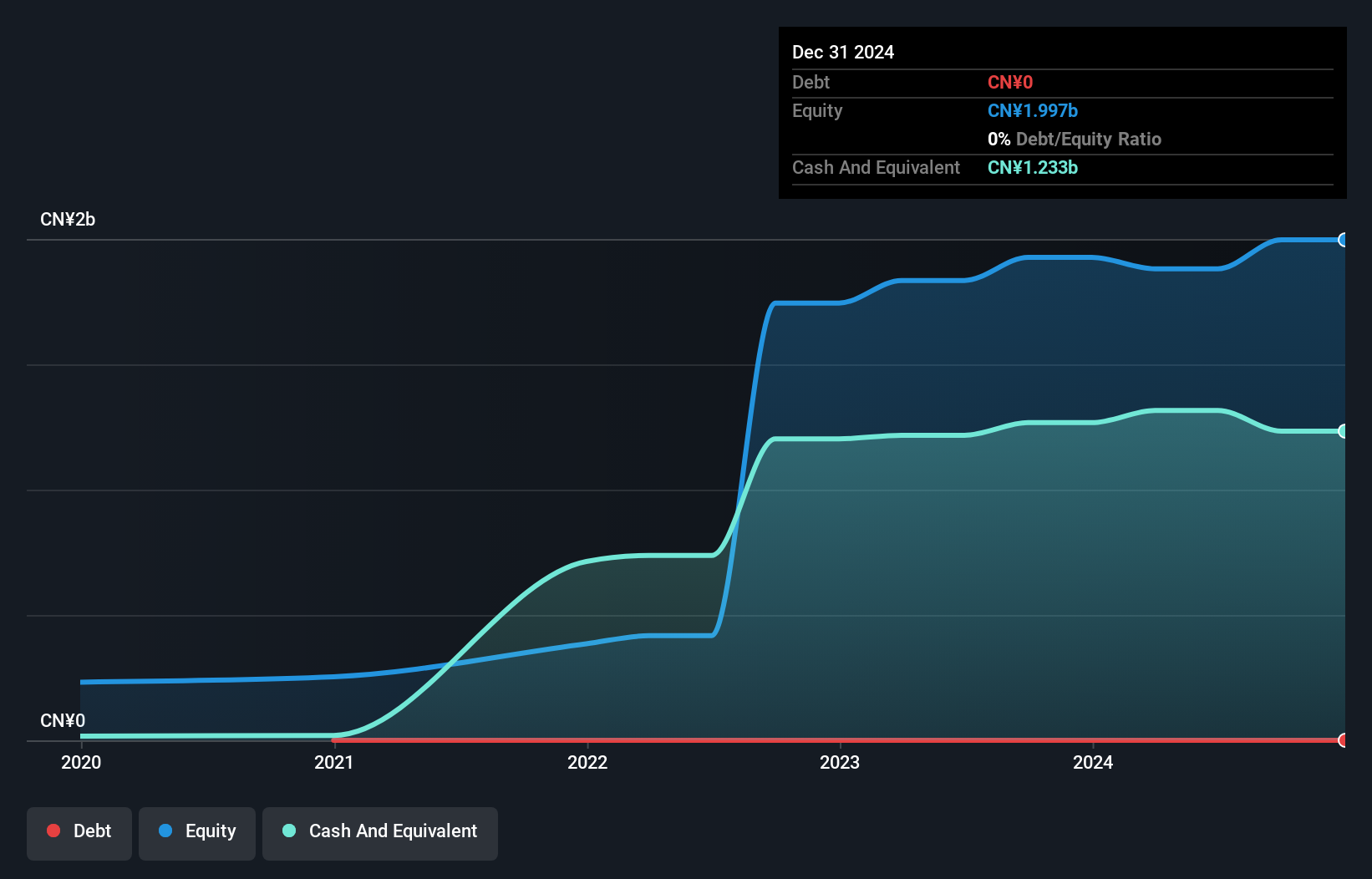

Lepu ScienTech Medical Technology, a nimble player in the medical tech scene, has shown impressive financial strides recently. Their earnings surged by 586% over the past year, outpacing the industry average of -4%. The company reported half-year sales of CNY 248.79 million, up from last year's CNY 165.93 million, with net income rising to CNY 140.23 million from CNY 75.57 million previously. Trading at a value that's about 29% below its estimated fair value and being debt-free for five years suggests solid footing for future endeavors despite recent leadership changes in their boardroom dynamics.

- Navigate through the intricacies of LEPU ScienTech Medical Technology (Shanghai) with our comprehensive health report here.

Learn about LEPU ScienTech Medical Technology (Shanghai)'s historical performance.

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Banking Group Limited is an investment holding company offering banking and financial services in Hong Kong, Macau, and the People's Republic of China, with a market cap of approximately HK$10.46 billion.

Operations: Dah Sing Banking Group generates revenue primarily from Personal Banking (HK$2.68 billion), Treasury and Global Markets (HK$1.34 billion), and Corporate Banking (HK$853.60 million).

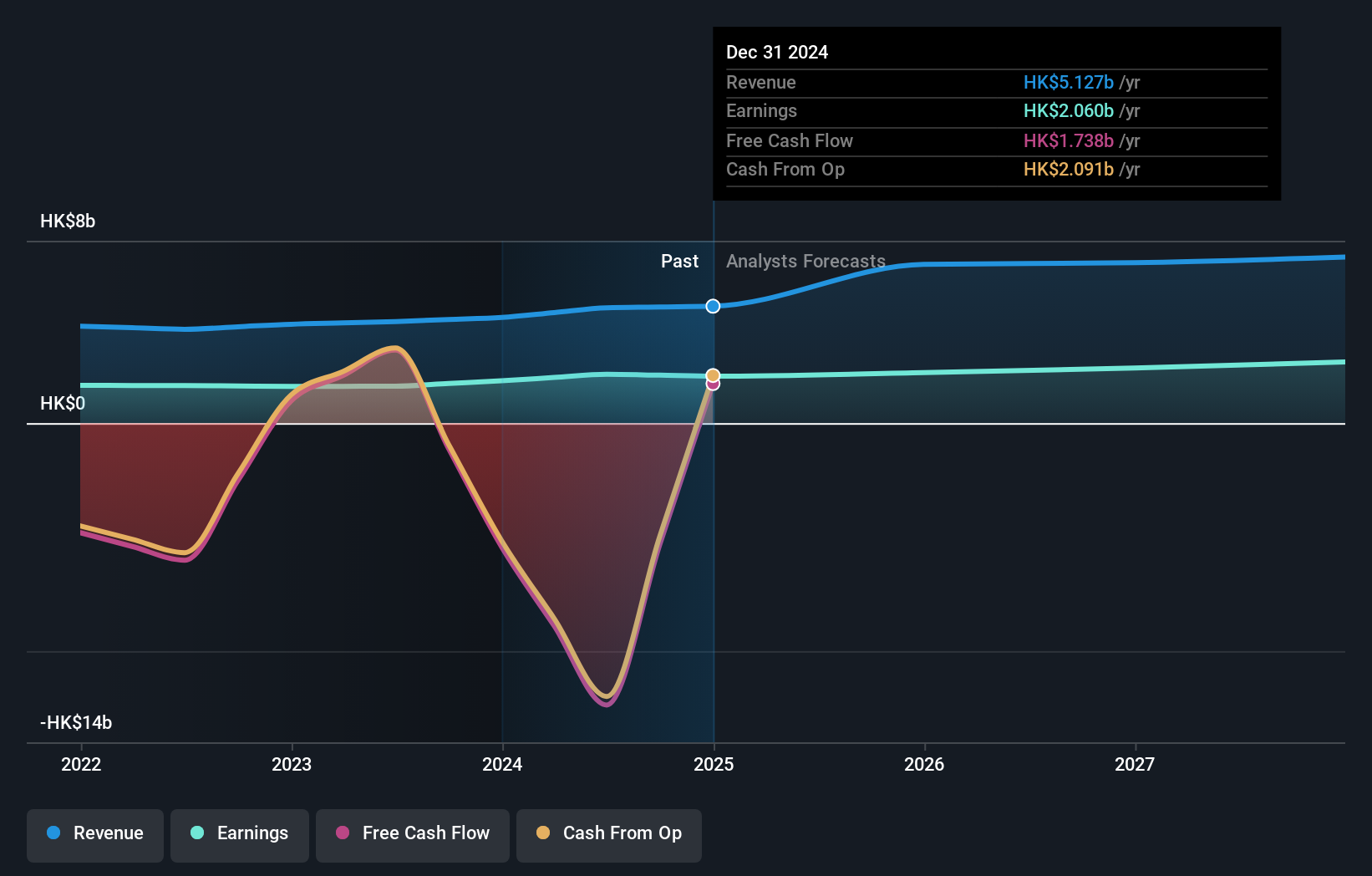

Dah Sing Banking Group, with assets totaling HK$262.4B and equity of HK$33.6B, stands out for its robust financial health in Hong Kong's banking sector. The bank's total deposits are HK$214.6B against loans of HK$141.9B, supported by a net interest margin of 2%. Despite a low allowance for bad loans at 43%, the bad loan ratio remains appropriate at 1.9%. Impressively, earnings surged by 32% last year, far surpassing the industry's average growth of 3%. Trading significantly below fair value estimates enhances its appeal as an undervalued opportunity amidst recent dividend increases and earnings announcements.

Taking Advantage

- Dive into all 167 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English