Hidden Opportunities in Hong Kong's Market October 2024

As global markets adjust to recent interest rate cuts in Europe and mixed economic signals from major economies, the Hong Kong market presents unique opportunities amid these shifting dynamics. In this environment, identifying stocks with strong fundamentals and potential for growth can uncover hidden gems that may benefit from broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Lvji Technology Holdings | 3.06% | 4.56% | -1.87% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company focused on the extraction and sale of coal products in the People’s Republic of China, with a market capitalization of HK$14.92 billion.

Operations: Kinetic Development Group generates revenue primarily through the extraction and sale of coal products in China. The company has a market capitalization of HK$14.92 billion, indicating its significant presence in the industry.

Kinetic Development Group, a dynamic player in Hong Kong's market, showcases impressive financial performance with earnings growth of 39.2% over the past year, significantly outpacing the Oil and Gas industry average of 4.6%. The company has reduced its debt to equity ratio from 28.4% to 12.5% over five years, demonstrating solid financial management. Trading at 53.7% below its estimated fair value suggests potential undervaluation opportunities for investors. Recent announcements include a net income increase to CNY 1 billion from CNY 570 million last year and dividends declared at HKD 0.04 per share, reflecting robust profitability and shareholder returns.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company that focuses on the research and development, design, manufacture, and sale of mobile phones across various international markets including China, India, Algeria, and Bangladesh; it has a market cap of HK$6.88 billion.

Operations: The company generates revenue primarily from the sale of wireless communications equipment, amounting to CN¥3.27 billion.

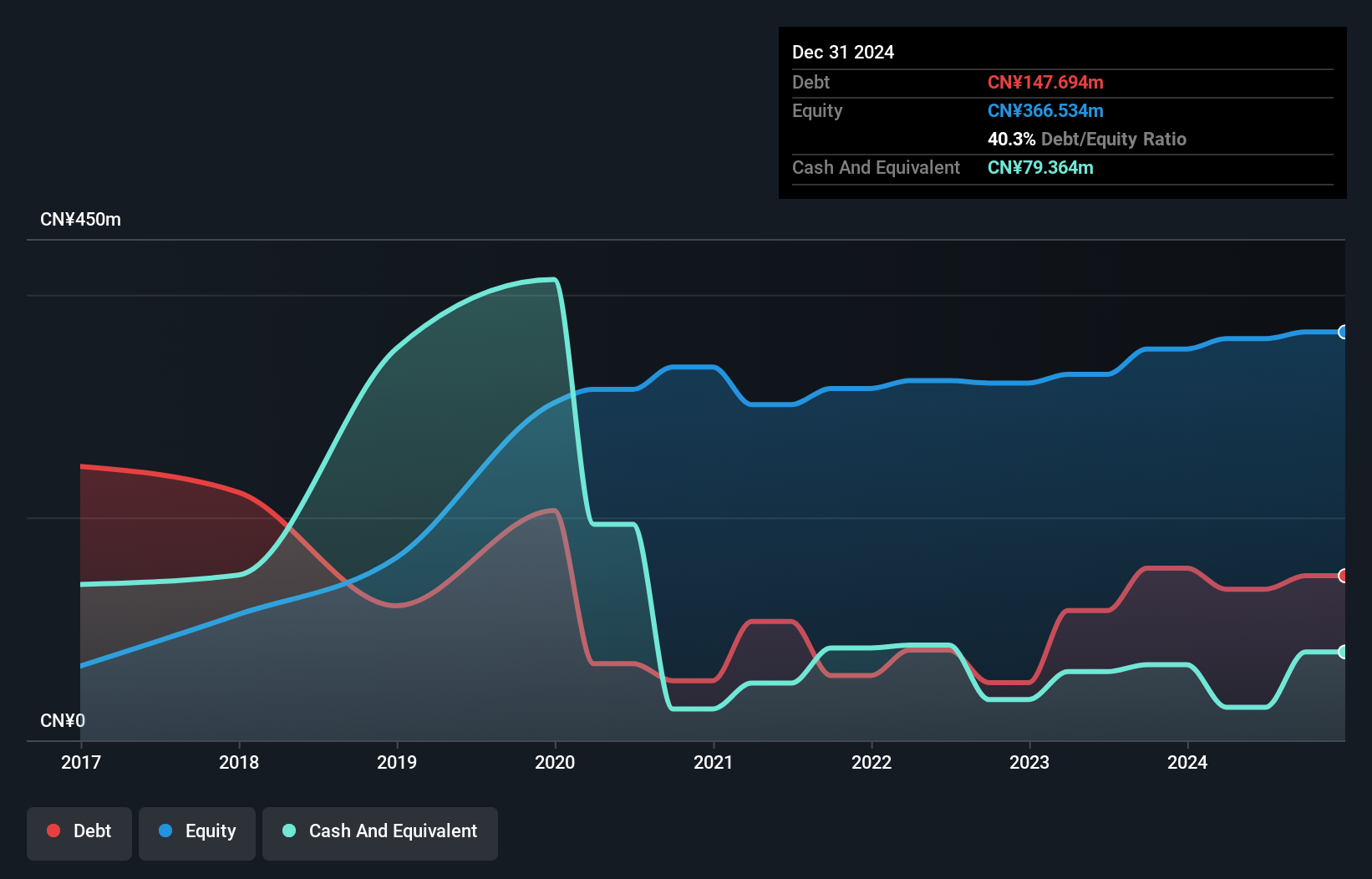

Sprocomm Intelligence, a tech player in Hong Kong, has shown impressive recent performance with earnings growth of 301% over the past year, outpacing the industry average. Despite a satisfactory net debt to equity ratio of 29%, their interest coverage remains low at 1.8 times EBIT. The company reported sales of CNY 1.26 billion for the half-year ending June 2024, up from CNY 806 million previously, while net income slightly increased to CNY 9.86 million from CNY 9.51 million last year. Recent strategic stakes were acquired by undisclosed buyers for HKD 200 million and HKD equivalent transactions in September, indicating potential investor confidence in its prospects.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$5.87 billion.

Operations: The company generates revenue primarily through the sale of SD-WAN routers, categorized into Fixed First Connectivity (HK$15.19 million) and Mobile First Connectivity (HK$59.87 million), along with income from software licenses and warranty and support services (HK$31.86 million).

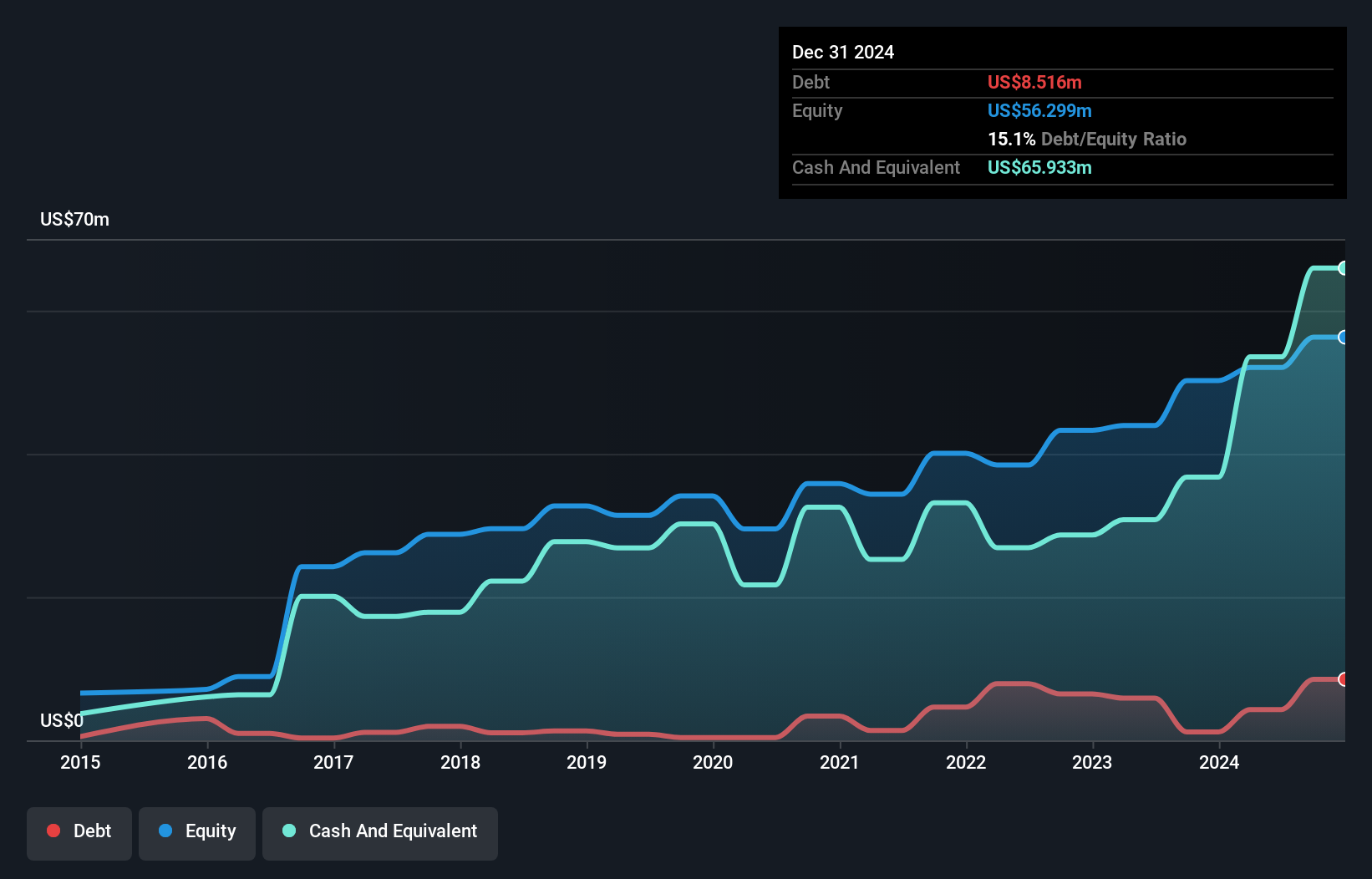

Plover Bay Technologies, a compact player in the tech landscape, has been making waves with its impressive earnings growth of 41% over the past year, outpacing the broader Communications industry. The company reported a net income of US$19.1 million for the first half of 2024, up from US$12.32 million in 2023, reflecting high-quality earnings and robust financial health as it holds more cash than its total debt. Despite an increase in its debt to equity ratio from 2.7 to 8.3 over five years, Plover Bay remains attractive by trading at nearly half its fair value estimate and continues to offer dividends like HKD0.1083 per share announced recently.

- Delve into the full analysis health report here for a deeper understanding of Plover Bay Technologies.

Evaluate Plover Bay Technologies' historical performance by accessing our past performance report.

Key Takeaways

- Embark on your investment journey to our 167 SEHK Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English