Undiscovered Gems in Hong Kong for October 2024

As global markets experience shifts with central banks in Europe cutting rates and the Hang Seng Index in Hong Kong recently declining, small-cap stocks have garnered attention for their potential resilience and growth opportunities. In this dynamic environment, identifying promising stocks involves looking for companies with strong fundamentals and innovative capabilities that can navigate economic fluctuations effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Lvji Technology Holdings | 3.06% | 4.56% | -1.87% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company involved in the extraction and sale of coal products in the People's Republic of China, with a market capitalization of HK$14.92 billion.

Operations: Kinetic Development Group generates revenue primarily from coal extraction and sales in China. The company's net profit margin has shown variability, reflecting fluctuations in operational efficiency and market conditions.

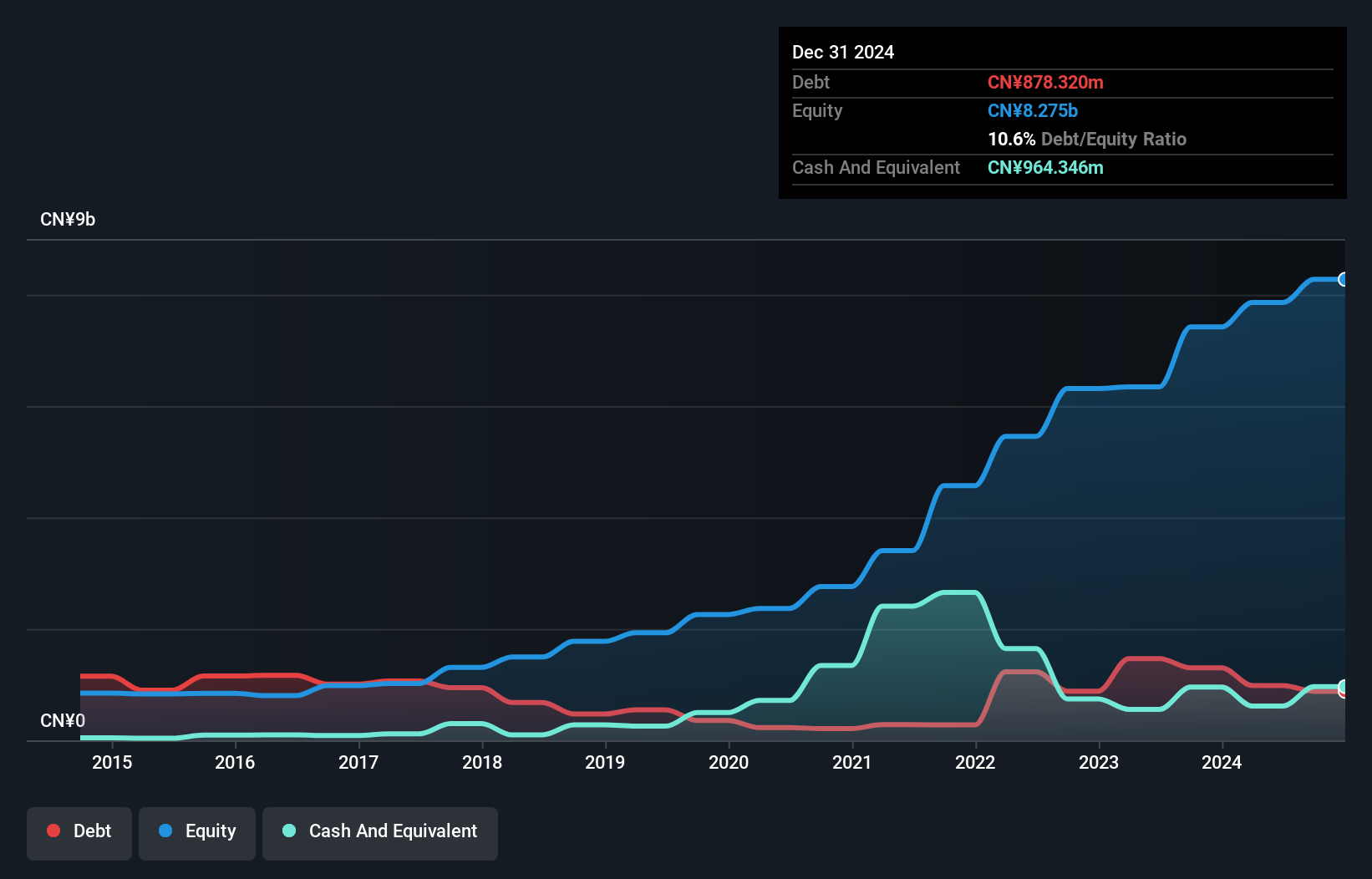

Kinetic Development Group, a small cap company, has demonstrated robust financial health with earnings growth of 39.2% over the past year, outpacing the Oil and Gas industry average of 4.6%. Its debt to equity ratio has improved significantly from 28.4% to 12.5% over five years, indicating prudent financial management. Trading at a substantial discount of 53.7% below its estimated fair value suggests potential undervaluation in the market. Recent reports highlight sales reaching CNY 2.53 billion for the first half of 2024, with net income rising to CNY 1.10 billion compared to CNY 570 million a year prior.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across various international markets including China, India, Algeria, and Bangladesh with a market capitalization of HK$6.88 billion.

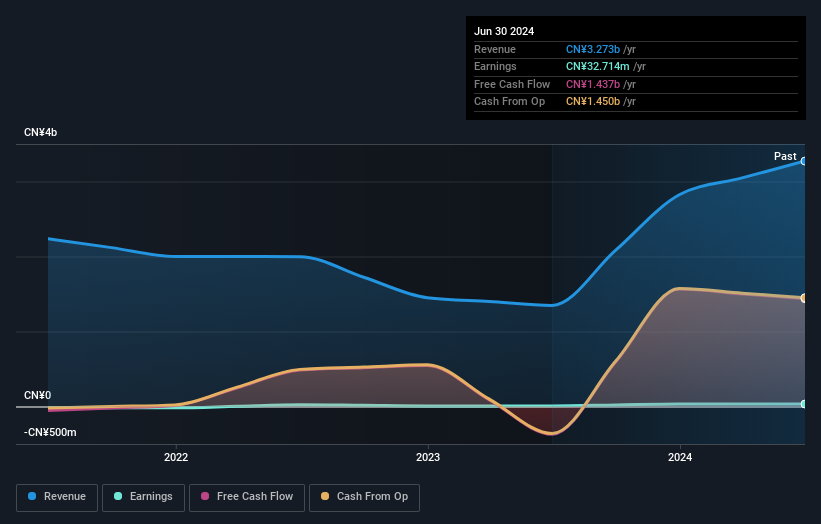

Operations: Sprocomm Intelligence generates revenue primarily from its wireless communications equipment segment, amounting to CN¥3.27 billion. The company's net profit margin reflects its ability to manage costs and profitability effectively.

Sprocomm Intelligence, a small player in the tech space, is making waves with its impressive earnings growth of 301.3% over the past year, outpacing the broader industry significantly. Despite this surge, it's trading at a substantial discount of 91.7% below its estimated fair value. The company's debt to equity ratio has improved from 73.8% to 37.6% over five years, reflecting better financial health; however, interest payments are not well covered by EBIT at just 1.8 times coverage. Recent transactions saw undisclosed buyers acquiring a combined stake of 33% for HK$200 million in September 2024, indicating potential investor confidence in Sprocomm's prospects amidst these mixed signals.

- Click here and access our complete health analysis report to understand the dynamics of Sprocomm Intelligence.

Understand Sprocomm Intelligence's track record by examining our Past report.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★☆

Overview: Plover Bay Technologies Limited, an investment holding company, designs, develops, and markets software-defined wide area network routers with a market capitalization of HK$5.87 billion.

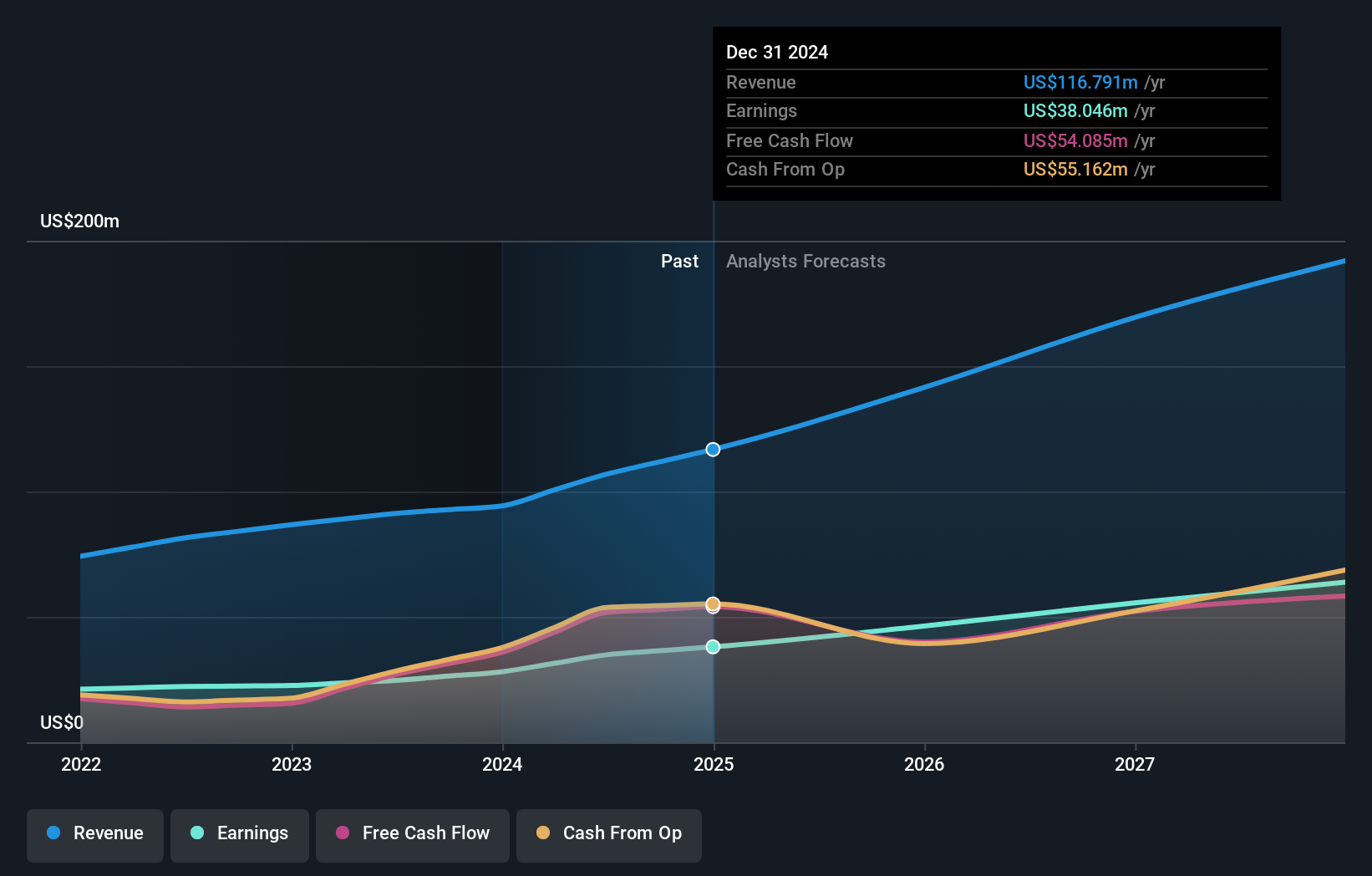

Operations: The company's revenue primarily comes from sales of SD-WAN routers, with mobile-first connectivity generating $59.87 million and fixed-first connectivity contributing $15.19 million. Additionally, software licenses and warranty and support services add $31.86 million to the revenue stream.

Plover Bay Technologies, a promising player in Hong Kong's tech scene, has shown impressive financial performance with earnings climbing 41% over the past year, outpacing the broader communications industry. The company reported half-year sales of US$57.3 million and net income of US$19.1 million, reflecting robust growth from last year's figures. Trading at 47% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Additionally, Plover Bay maintains a strong cash position exceeding its total debt, ensuring financial stability. Recent board changes with Ms. Chiu's appointment aim to bolster diversity and expertise within the company’s leadership team.

- Click here to discover the nuances of Plover Bay Technologies with our detailed analytical health report.

Learn about Plover Bay Technologies' historical performance.

Make It Happen

- Click this link to deep-dive into the 167 companies within our SEHK Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English