Mobvista (HKG:1860 investor three-year losses grow to 81% as the stock sheds HK$846m this past week

This month, we saw the Mobvista Inc. (HKG:1860) up an impressive 32%. But that is meagre solace in the face of the shocking decline over three years. In that time the share price has melted like a snowball in the desert, down 81%. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Mobvista

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Mobvista became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Revenue is actually up 19% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Mobvista further; while we may be missing something on this analysis, there might also be an opportunity.

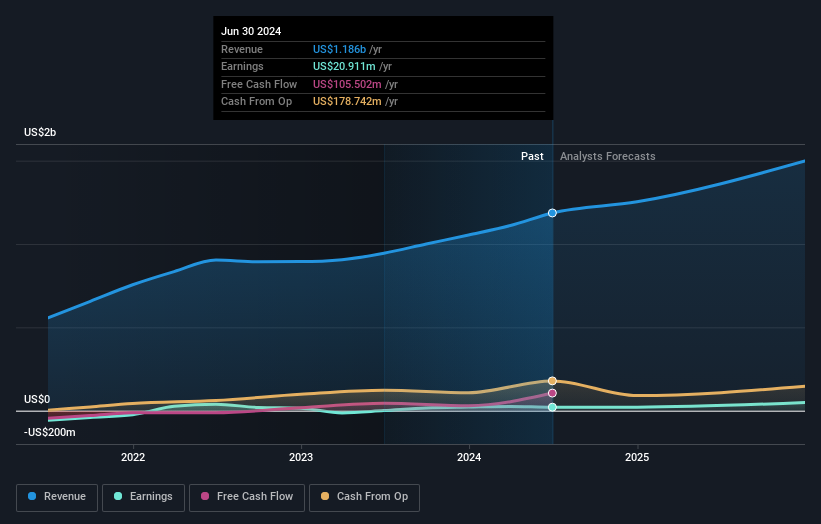

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Mobvista has grown profits over the years, but the future is more important for shareholders. This free interactive report on Mobvista's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Mobvista had a tough year, with a total loss of 51%, against a market gain of about 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Mobvista , and understanding them should be part of your investment process.

But note: Mobvista may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English