SEHK Stocks Estimated To Be Undervalued In September 2024

The Hong Kong market has shown resilience amid global economic uncertainties, with the Hang Seng Index gaining 2.14% despite weaker-than-expected corporate earnings reports in China. As investors navigate these volatile conditions, identifying undervalued stocks can offer significant opportunities for growth and stability. In this context, a good stock is typically characterized by strong fundamentals, a robust business model, and attractive valuation metrics that suggest it is trading below its intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.79 | HK$6.75 | 43.9% |

| CIMC Enric Holdings (SEHK:3899) | HK$6.18 | HK$10.45 | 40.9% |

| Zhaojin Mining Industry (SEHK:1818) | HK$12.24 | HK$21.27 | 42.4% |

| WuXi XDC Cayman (SEHK:2268) | HK$19.88 | HK$39.07 | 49.1% |

| Pacific Textiles Holdings (SEHK:1382) | HK$1.54 | HK$2.85 | 46% |

| XD (SEHK:2400) | HK$18.66 | HK$31.05 | 39.9% |

| China Renaissance Holdings (SEHK:1911) | HK$7.27 | HK$12.30 | 40.9% |

| United Company RUSAL International (SEHK:486) | HK$2.34 | HK$4.25 | 44.9% |

| Vobile Group (SEHK:3738) | HK$1.58 | HK$2.64 | 40.2% |

| DPC Dash (SEHK:1405) | HK$69.75 | HK$134.29 | 48.1% |

Let's dive into some prime choices out of the screener.

WuXi XDC Cayman (SEHK:2268)

Overview: WuXi XDC Cayman Inc. is an investment holding company that provides contract research, development, and manufacturing services globally, with a market cap of HK$23.82 billion.

Operations: WuXi XDC Cayman Inc. generates revenue primarily from its Pharmaceuticals segment, which accounts for CN¥2.80 billion.

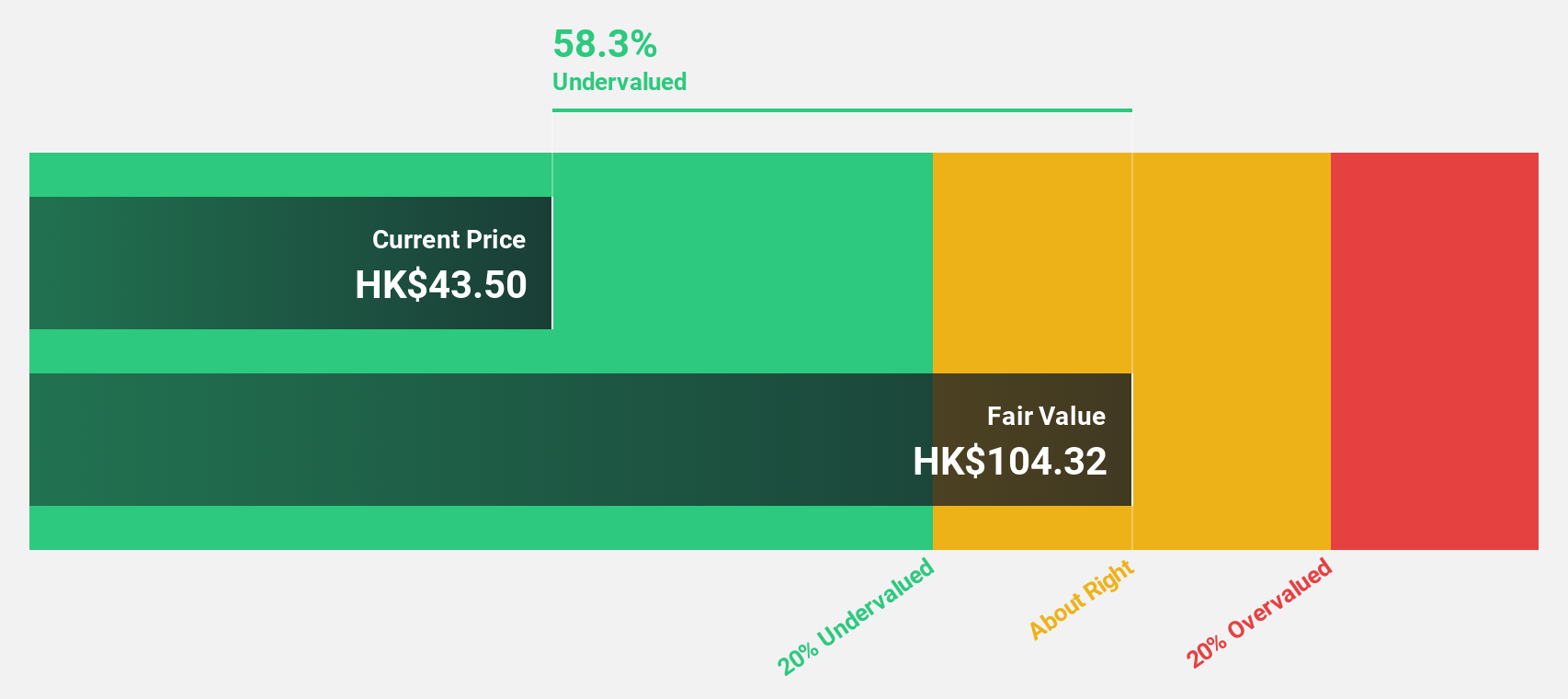

Estimated Discount To Fair Value: 49.1%

WuXi XDC Cayman Inc. appears undervalued based on cash flows, trading at HK$19.88, significantly below its estimated fair value of HK$39.07. Recent earnings show robust growth, with net income rising to CNY 488.23 million for the half-year ended June 30, 2024, from CNY 177.21 million a year ago. Forecasts indicate strong annual profit and revenue growth rates of 27.5% and 26.3%, respectively, outpacing the Hong Kong market averages.

- Our comprehensive growth report raises the possibility that WuXi XDC Cayman is poised for substantial financial growth.

- Take a closer look at WuXi XDC Cayman's balance sheet health here in our report.

NetDragon Websoft Holdings (SEHK:777)

Overview: NetDragon Websoft Holdings Limited, with a market cap of HK$5.46 billion, develops and provides online and mobile games in the People's Republic of China, the United States, the United Kingdom, and internationally.

Operations: The company's revenue segments include CN¥4.17 billion from Gaming and Application Services and CN¥2.55 billion from Mynd.ai.

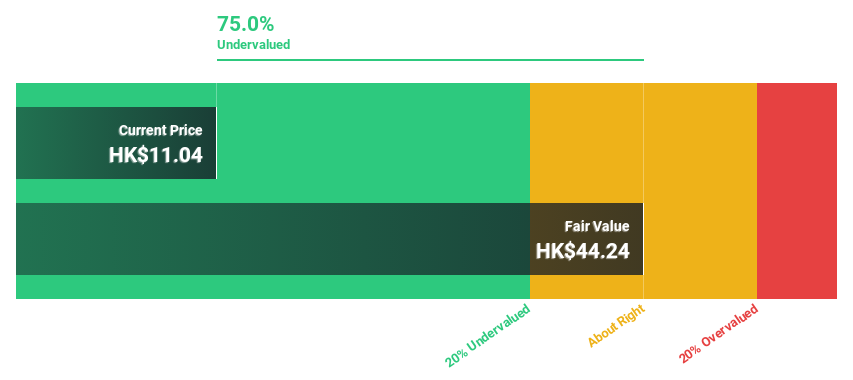

Estimated Discount To Fair Value: 11.8%

NetDragon Websoft Holdings is trading at HK$10.28, slightly below its fair value estimate of HK$11.66. Despite a decline in sales and net income for the first half of 2024, earnings are forecast to grow significantly at 32.8% annually over the next three years, outpacing the Hong Kong market average. However, profit margins have decreased from 10.5% to 6.7%, and its return on equity is expected to be modest at 16.2%.

- The analysis detailed in our NetDragon Websoft Holdings growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in NetDragon Websoft Holdings' balance sheet health report.

Yeahka (SEHK:9923)

Overview: Yeahka Limited, with a market cap of HK$4.50 billion, offers payment and business services to merchants and consumers in the People’s Republic of China.

Operations: Revenue from business services amounts to CN¥3.47 billion.

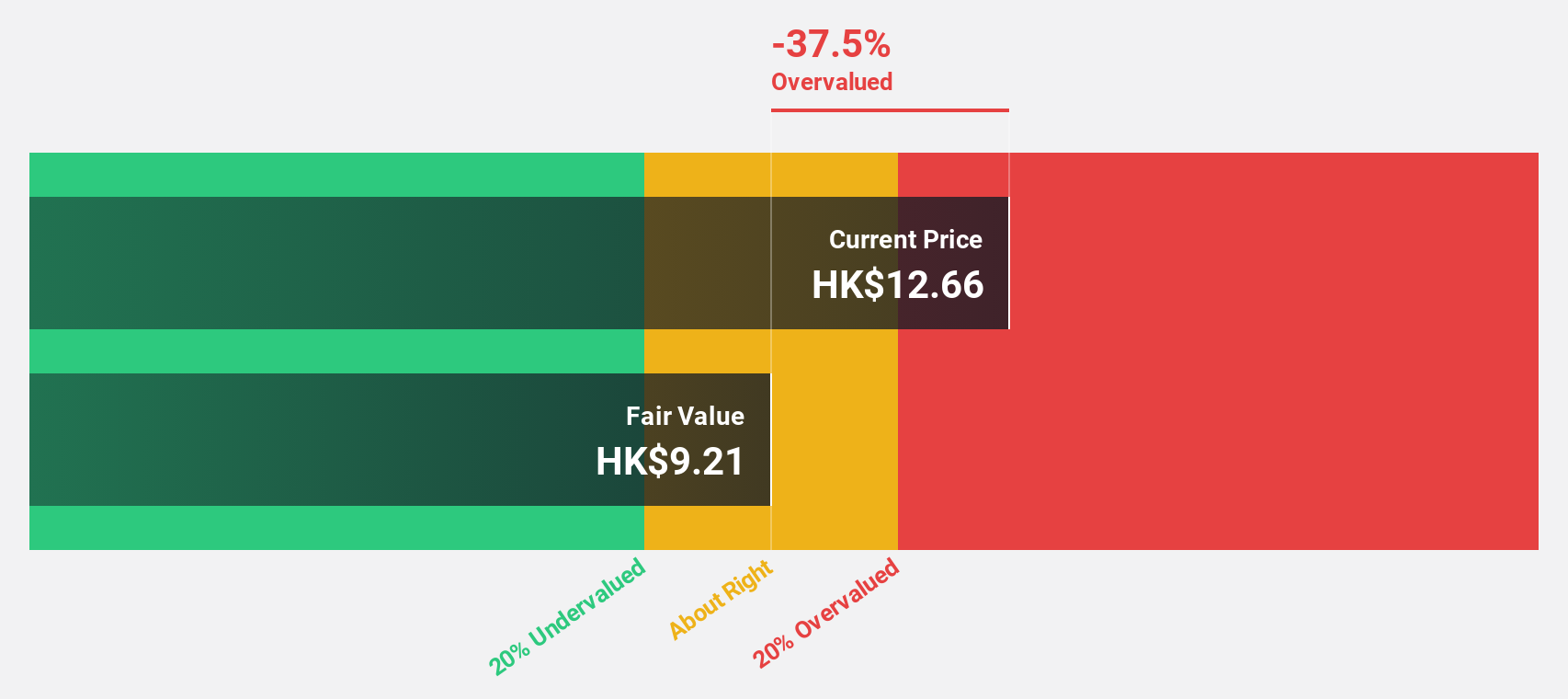

Estimated Discount To Fair Value: 22%

Yeahka Limited is trading at HK$10.5, 22% below its fair value estimate of HK$13.46, indicating it may be undervalued based on cash flows. Despite a drop in sales to CNY 1.58 billion from CNY 2.06 billion year-over-year, earnings are forecast to grow significantly at 39.23% annually over the next three years, outpacing the Hong Kong market average of 10.9%. However, profit margins have decreased from 2.9% to 0.3%.

- Upon reviewing our latest growth report, Yeahka's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Yeahka with our comprehensive financial health report here.

Make It Happen

- Dive into all 29 of the Undervalued SEHK Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period from July 1, 2023 to June 30, 2024 US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English