Undervalued Small Caps With Insider Buying In Hong Kong For August 2024

As the Hang Seng Index in Hong Kong sees a modest rise of 1.99% amid global market fluctuations, investors are increasingly looking towards small-cap stocks for potential opportunities. In this article, we will explore three undervalued small-cap stocks with insider buying activity in Hong Kong for August 2024, examining how these factors might position them favorably within the current economic landscape.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ever Sunshine Services Group | 5.4x | 0.4x | 28.31% | ★★★★★☆ |

| Ferretti | 11.3x | 0.8x | 45.25% | ★★★★★☆ |

| Wasion Holdings | 11.4x | 0.8x | 40.24% | ★★★★☆☆ |

| Lion Rock Group | 6.7x | 0.5x | 31.11% | ★★★★☆☆ |

| Shenzhen International Holdings | 8.1x | 0.7x | 22.93% | ★★★★☆☆ |

| Skyworth Group | 5.5x | 0.1x | -250.37% | ★★★☆☆☆ |

| China Leon Inspection Holding | 9.7x | 0.7x | 36.96% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 6.1x | 0.4x | -25.25% | ★★★☆☆☆ |

| FriendTimes | NA | 1.0x | -142.44% | ★★★☆☆☆ |

| Cathay Group Holdings | NA | 1.5x | 2.61% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, as well as operator telecommunication services, with a market cap of approximately HK$1.53 billion.

Operations: The company generates revenue primarily from Wireless Telecommunications Network System Equipment and Services (HK$5824.14 million) and Operator Telecommunication Services (HK$157.83 million). The gross profit margin has shown variation, with a recent value of 28.79%.

PE: 410.1x

Comba Telecom Systems Holdings, a small cap in Hong Kong, has recently seen insider confidence with Tung Ling Fok purchasing 1.83 million shares worth approximately HK$930,371. The company expects to report a loss of up to HK$160 million for the first half of 2024 due to delayed network projects and fair value losses on equity investments. Despite this, recent share repurchases authorized by shareholders aim to enhance net assets per share and earnings per share.

- Click here to discover the nuances of Comba Telecom Systems Holdings with our detailed analytical valuation report.

Learn about Comba Telecom Systems Holdings' historical performance.

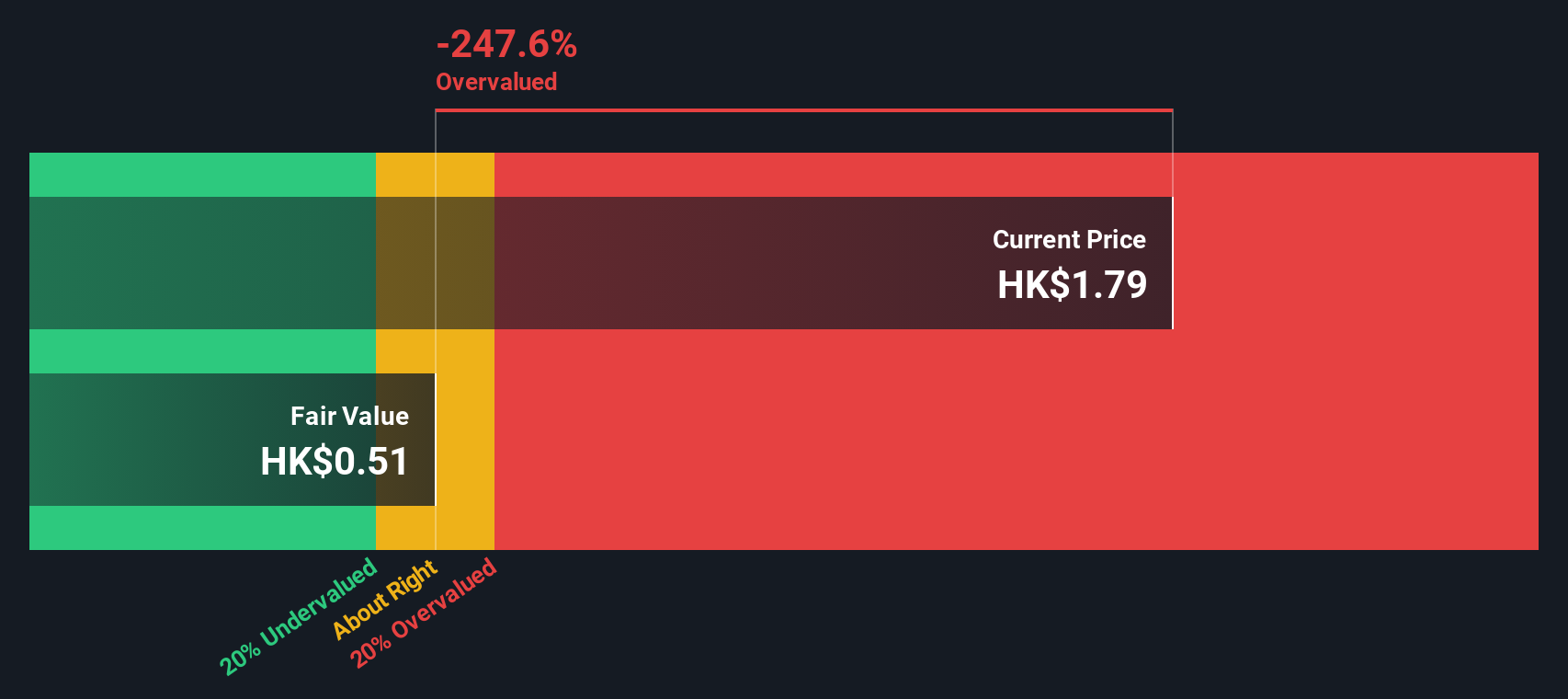

Skyworth Group (SEHK:751)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Skyworth Group operates in the smart household appliances, smart systems technology, modern services, and new energy sectors with a market cap of CN¥7.5 billion.

Operations: The company generates revenue primarily from Smart Household Appliances, New Energy Business, Smart Systems Technology Business, and Modern Services. For the period ending December 31, 2023, the gross profit margin was 13.80%, with operating expenses totaling CN¥7743 million against a gross profit of CN¥9506 million.

PE: 5.5x

Skyworth Group has recently expanded into the Russian market, showcasing its advanced technology and innovative products like the BM series developed with Designworks. This move aligns with their strategy to tap into new markets and enhance brand presence. Insider confidence is evident as Chi Shi purchased 2,188,000 shares worth approximately HK$6.3 million, reflecting a significant 16.5% increase in their holdings. Additionally, Skyworth's share repurchase program authorized up to 236 million shares buyback to potentially boost earnings per share and net asset value.

- Click to explore a detailed breakdown of our findings in Skyworth Group's valuation report.

Explore historical data to track Skyworth Group's performance over time in our Past section.

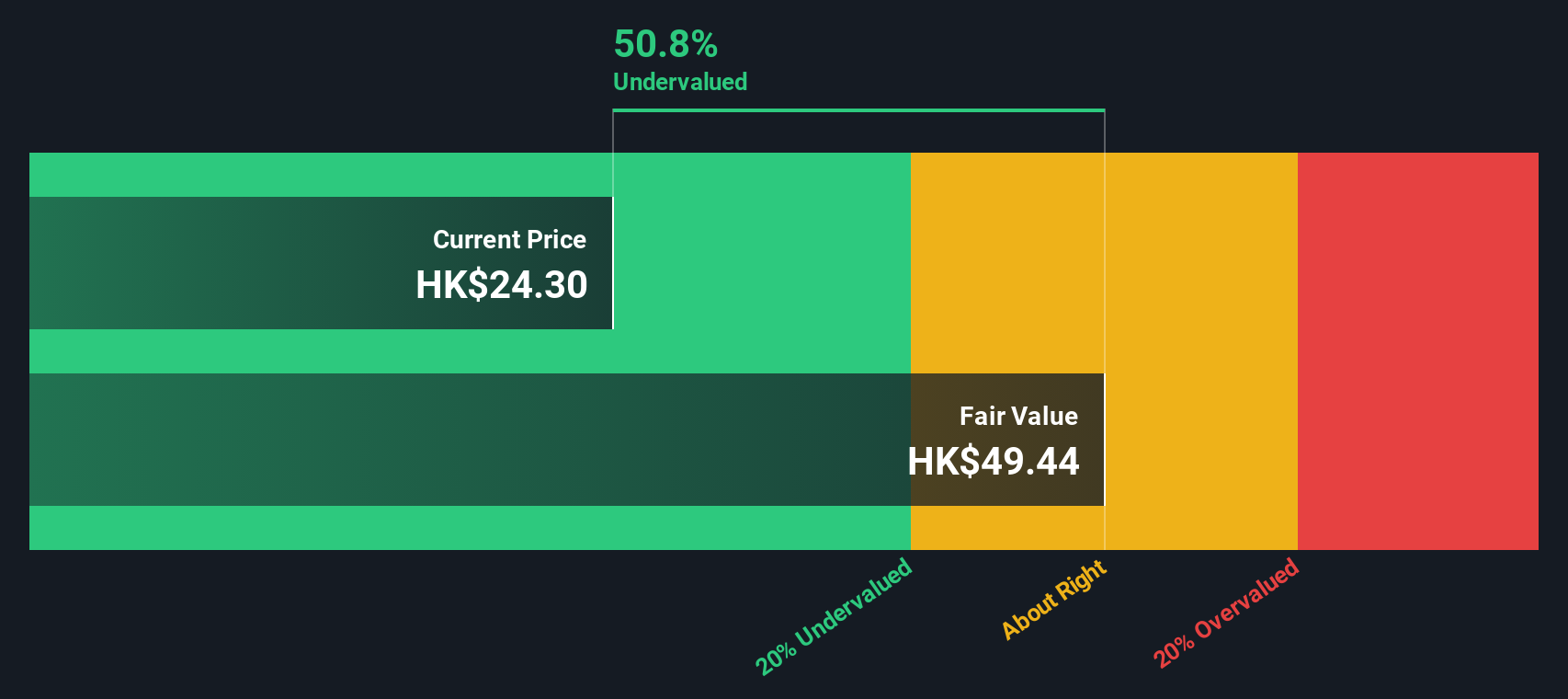

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti is engaged in the design, construction, and marketing of yachts and recreational boats with a market cap of €2.56 billion.

Operations: The company generated €1.23 billion in revenue from the design, construction, and marketing of yachts and recreational boats. The cost of goods sold (COGS) was €773.32 million, resulting in a gross profit of €455.82 million with a gross profit margin of 37.08%. Operating expenses amounted to €358.24 million, while net income reached €83.05 million, yielding a net income margin of 6.76%.

PE: 11.3x

Ferretti, a small cap in Hong Kong, has shown insider confidence with significant share purchases by executives over the past six months. The company’s earnings are projected to grow 12.35% annually, highlighting its potential for future growth. Recently, Ferretti appointed Mr. Qinggui Hao as joint company secretary and alternate authorized representative, bringing extensive experience from Weichai Power and Shandong Heavy Industry Group. This leadership change could bolster strategic initiatives and operational efficiency moving forward.

- Unlock comprehensive insights into our analysis of Ferretti stock in this valuation report.

Evaluate Ferretti's historical performance by accessing our past performance report.

Next Steps

- Click through to start exploring the rest of the 14 Undervalued SEHK Small Caps With Insider Buying now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English