Exploring Three High Growth Tech Stocks In Hong Kong

As global markets continue to show resilience, with key indices like the Nasdaq Composite leading gains and bolstering investor sentiment, Hong Kong's tech sector is also capturing attention. In this article, we explore three high-growth tech stocks in Hong Kong that stand out for their innovative potential and alignment with current market trends.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

| Be Friends Holding | 33.82% | 32.27% | ★★★★★★ |

| Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| Cowell e Holdings | 30.92% | 35.35% | ★★★★★★ |

| Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.35% | 100.10% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 31.84% | 21.23% | ★★★★★☆ |

| Beijing Fourth Paradigm Technology | 20.08% | 104.16% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plover Bay Technologies Limited, with a market cap of HK$4.35 billion, is an investment holding company that designs, develops, and markets software-defined wide area network routers.

Operations: The company generates revenue primarily from the sales of SD-WAN routers, with HK$15.19 million from Fixed First Connectivity and HK$59.87 million from Mobile First Connectivity, alongside HK$31.86 million from software licenses and warranty support services.

Plover Bay Technologies has shown robust earnings growth of 41.4% over the past year, significantly outpacing the Communications industry average of 10.6%. The company's revenue is forecasted to grow at 16.7% per year, which is faster than the Hong Kong market's projected growth of 7.4%. Notably, Plover Bay's R&D expenses have been a focal point, with substantial investments driving innovation and product development; this strategic focus on R&D has contributed to their impressive net income increase from $12.32 million to $19.1 million for H1 2024. In addition to strong financial performance, Plover Bay announced an interim dividend of HKD 0.1083 per share for the period ending June 30, 2024, reflecting confidence in sustained profitability and cash flow generation capabilities. With earnings expected to grow at an annual rate of approximately 16.3%, higher than the Hong Kong market's forecasted growth rate of around 11%, Plover Bay continues to leverage its technological advancements and expanding client base effectively within a competitive landscape.

- Click to explore a detailed breakdown of our findings in Plover Bay Technologies' health report.

Assess Plover Bay Technologies' past performance with our detailed historical performance reports.

Weimob (SEHK:2013)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Weimob Inc. is an investment holding company that offers digital commerce and media services in the People’s Republic of China, with a market cap of HK$4.03 billion.

Operations: Weimob generates revenue primarily from two segments: Merchant Solutions (CN¥878.28 million) and Subscription Solutions (CN¥1.35 billion). The company focuses on providing digital commerce and media services within China.

Weimob's revenue is forecasted to grow at 12.2% per year, outpacing the Hong Kong market's average of 7.4%. Despite being unprofitable currently, earnings are expected to surge by 109.68% annually over the next three years. Significant R&D investments, accounting for HKD 1.5 billion in H1 2024, underscore their commitment to innovation and long-term growth potential. The company repurchased shares in the past year, indicating confidence in its future prospects amidst a competitive landscape focused on SaaS models and digital transformation solutions for clients like TSMC and Apple.

- Navigate through the intricacies of Weimob with our comprehensive health report here.

Review our historical performance report to gain insights into Weimob's's past performance.

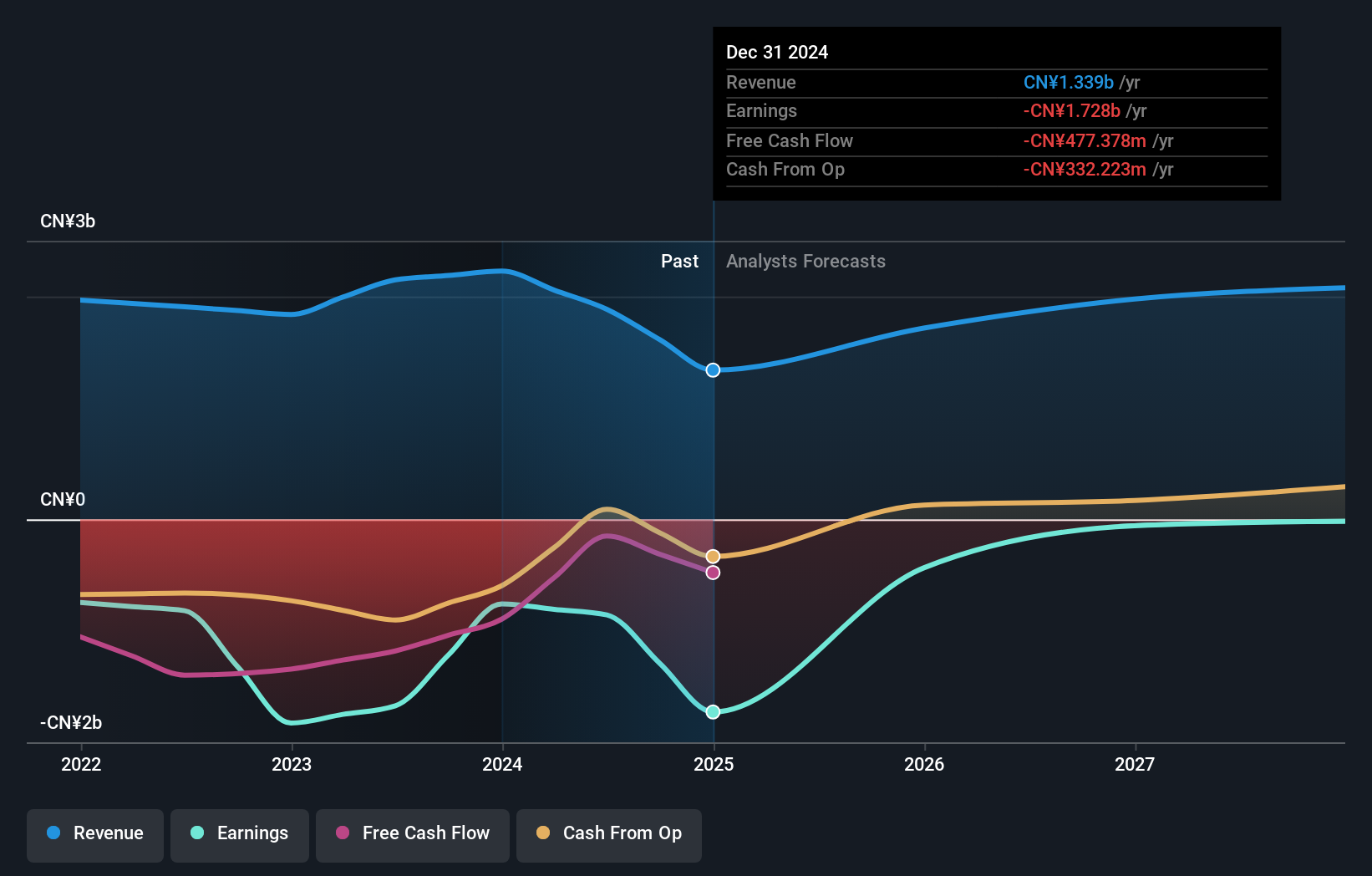

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ming Yuan Cloud Group Holdings Limited, an investment holding company with a market cap of HK$3.26 billion, provides software solutions for property developers in China.

Operations: Ming Yuan Cloud Group Holdings generates revenue primarily from its Cloud Services (CN¥1.32 billion) and On-premise Software and Services (CN¥281.71 million). The company focuses on providing software solutions tailored to property developers in China.

Ming Yuan Cloud Group Holdings reported sales of CNY 720.11 million for H1 2024, a slight decrease from CNY 762.34 million the previous year, yet significantly reduced its net loss to CNY 115.37 million from CNY 323.32 million. The company is investing heavily in R&D, with expenditures contributing to their innovative SaaS solutions, which could drive future growth despite current unprofitability. Revenue is forecasted to grow at 9.3% annually, outpacing the Hong Kong market's average of 7.4%.

Key Takeaways

- Click here to access our complete index of 46 SEHK High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English