Top Dividend Stocks On SEHK For August 2024

The Hong Kong market has shown resilience, with the Hang Seng Index up 1.99% amidst mixed economic signals from China. As investors navigate these conditions, dividend stocks remain a compelling option for those seeking steady income and potential growth. In this article, we will explore three top dividend stocks on the SEHK for August 2024 that stand out due to their robust yield and stability in an uncertain market environment.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Luk Fook Holdings (International) (SEHK:590) | 9.13% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.70% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 9.70% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.55% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.96% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 6.95% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 8.61% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.28% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.87% | ★★★★★☆ |

Click here to see the full list of 85 stocks from our Top SEHK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

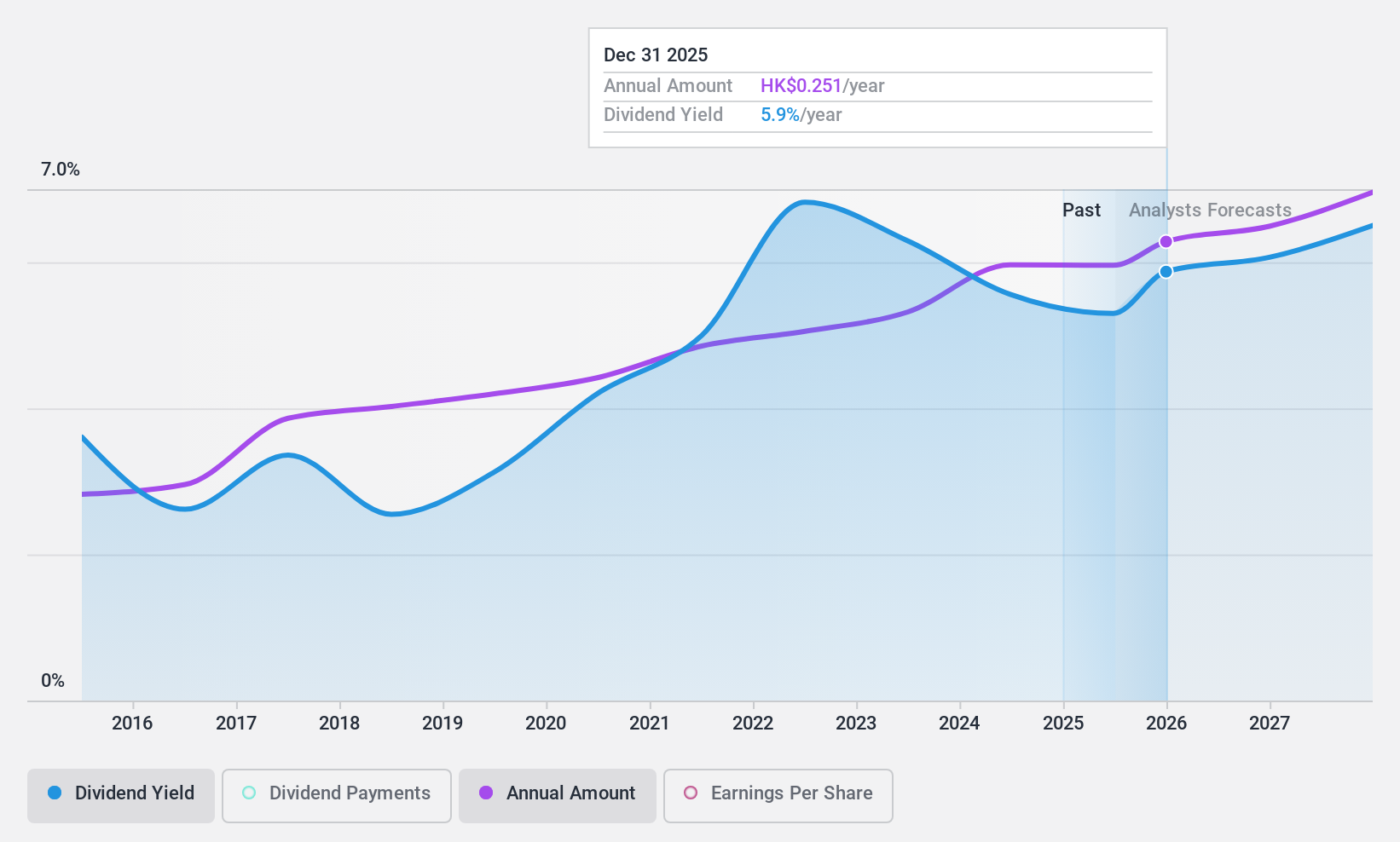

China Communications Services (SEHK:552)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Communications Services Corporation Limited provides telecommunications support services worldwide and has a market cap of HK$28.54 billion.

Operations: China Communications Services Corporation Limited generates CN¥148.61 billion from its Provision of Integrated Comprehensive Solutions segment.

Dividend Yield: 5.8%

China Communications Services' dividend payments have been volatile over the past decade, with recent news highlighting a final dividend of HK$0.23864 per share for 2023. Despite this volatility, the company maintains a low payout ratio (42%) and cash payout ratio (36.4%), indicating dividends are well covered by earnings and cash flows. Recent executive changes include Mr. Shen Aqiang's appointment as Executive Director and CFO, potentially impacting future financial strategies.

- Unlock comprehensive insights into our analysis of China Communications Services stock in this dividend report.

- In light of our recent valuation report, it seems possible that China Communications Services is trading behind its estimated value.

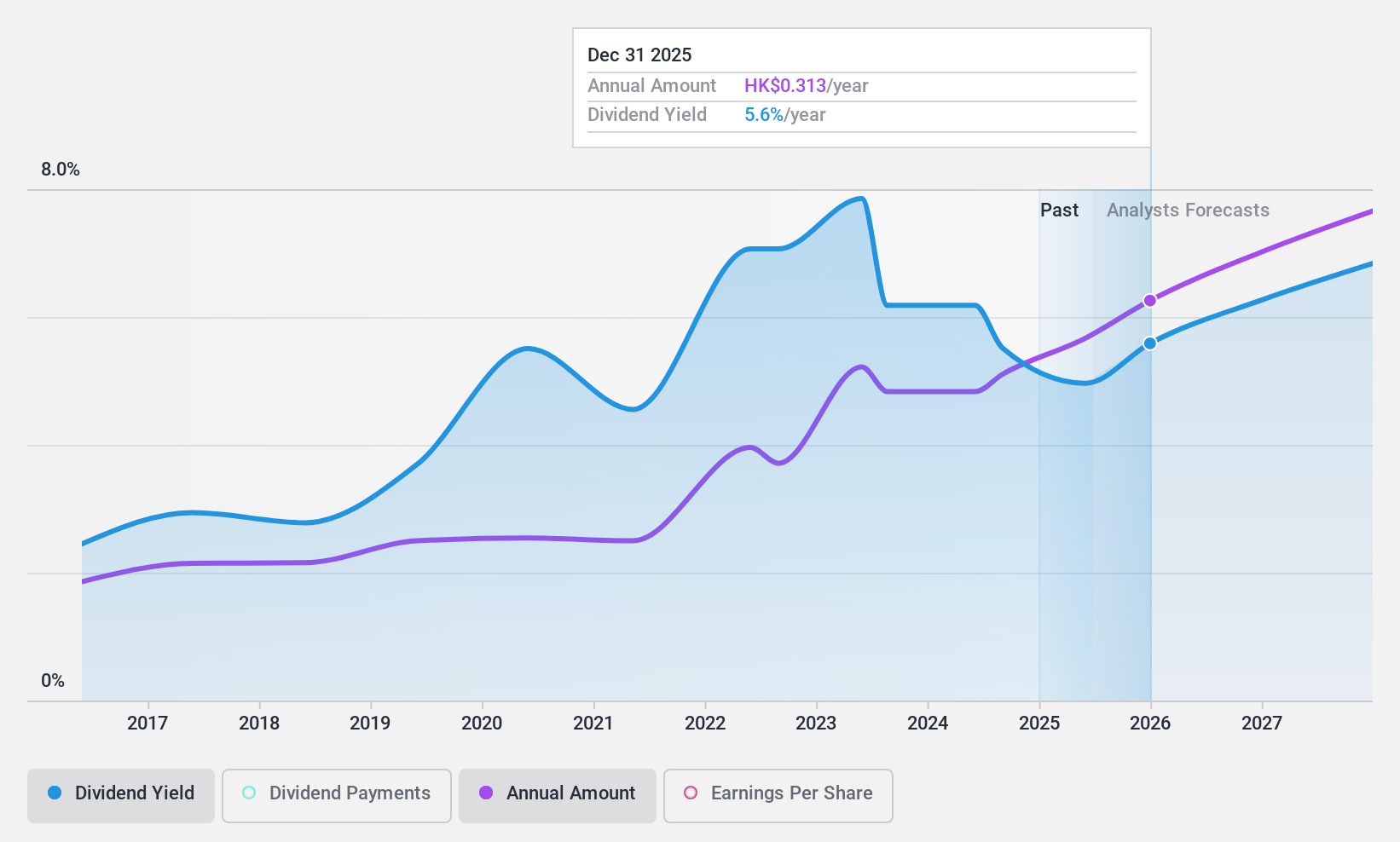

China Telecom (SEHK:728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Telecom Corporation Limited, along with its subsidiaries, offers wireline and mobile telecommunications services mainly in the People’s Republic of China and has a market cap of approximately HK$572.52 billion.

Operations: China Telecom Corporation Limited generates revenue of CN¥512.75 billion from its integrated telecommunications business.

Dividend Yield: 5.6%

China Telecom's dividend payments have been volatile over the past decade, with a current payout ratio of 68.7% and cash payout ratio of 52.9%, indicating dividends are covered by earnings and cash flows. Despite this, the dividend yield is relatively low compared to top-tier payers in Hong Kong. Recent executive changes include Liang Baojun's appointment as President and COO, which may influence future strategic direction but does not immediately impact dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of China Telecom.

- Insights from our recent valuation report point to the potential undervaluation of China Telecom shares in the market.

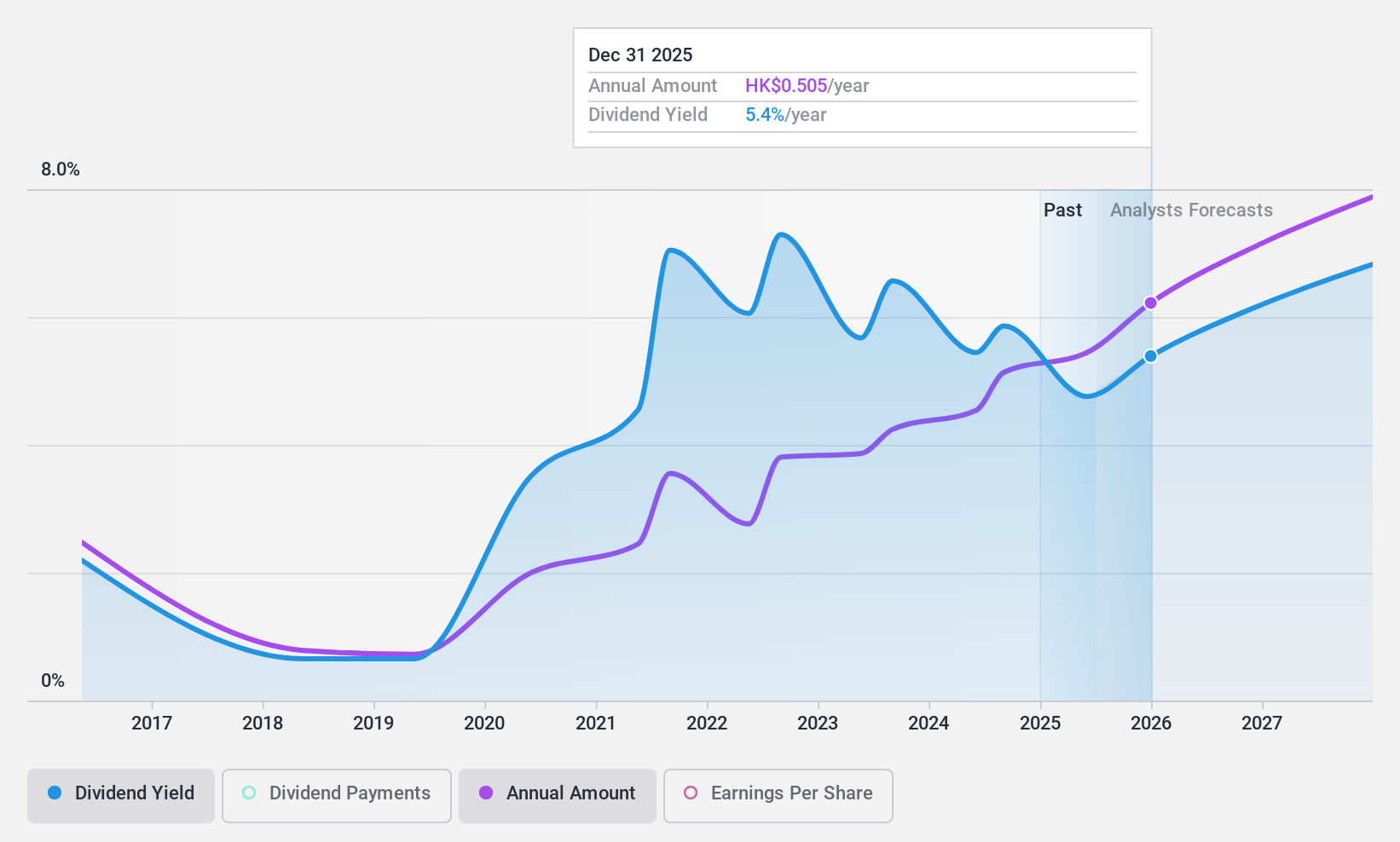

China Unicom (Hong Kong) (SEHK:762)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Unicom (Hong Kong) Limited is an investment holding company that offers telecommunications and related value-added services in the People’s Republic of China, with a market cap of HK$200.42 billion.

Operations: China Unicom (Hong Kong) Limited generates CN¥378.11 billion from Wireless Communications Services in the People’s Republic of China.

Dividend Yield: 5.6%

China Unicom (Hong Kong) Limited recently announced an interim dividend of HK$0.27043 per share, payable on 25 September 2024. The company reported half-year earnings of CNY 13.79 billion, up from CNY 12.39 billion a year ago, indicating improved profitability. With a payout ratio of 58% and cash payout ratio of 44.7%, dividends are well-covered by earnings and cash flows despite a historically volatile dividend track record over the past decade.

- Navigate through the intricacies of China Unicom (Hong Kong) with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that China Unicom (Hong Kong) is priced lower than what may be justified by its financials.

Key Takeaways

- Dive into all 85 of the Top SEHK Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English