Hidden Gems Undiscovered Companies with Strong Fundamentals For July 2024

Over the last 7 days, the market has dropped 1.7%, but it is up 17% over the past year with earnings expected to grow by 15% per annum. In this dynamic environment, identifying stocks with strong fundamentals can be crucial for investors looking to capitalize on hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| River Financial | 131.04% | 17.59% | 20.70% | ★★★★★★ |

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Ligand Pharmaceuticals (NasdaqGM:LGND)

Simply Wall St Value Rating: ★★★★★★

Overview: Ligand Pharmaceuticals Incorporated is a biopharmaceutical company focused on developing and licensing biopharmaceutical assets globally, with a market cap of $1.92 billion.

Operations: Ligand Pharmaceuticals generates revenue primarily from the development and licensing of biopharmaceutical assets, amounting to $118.31 million. The company has a market cap of approximately $1.92 billion.

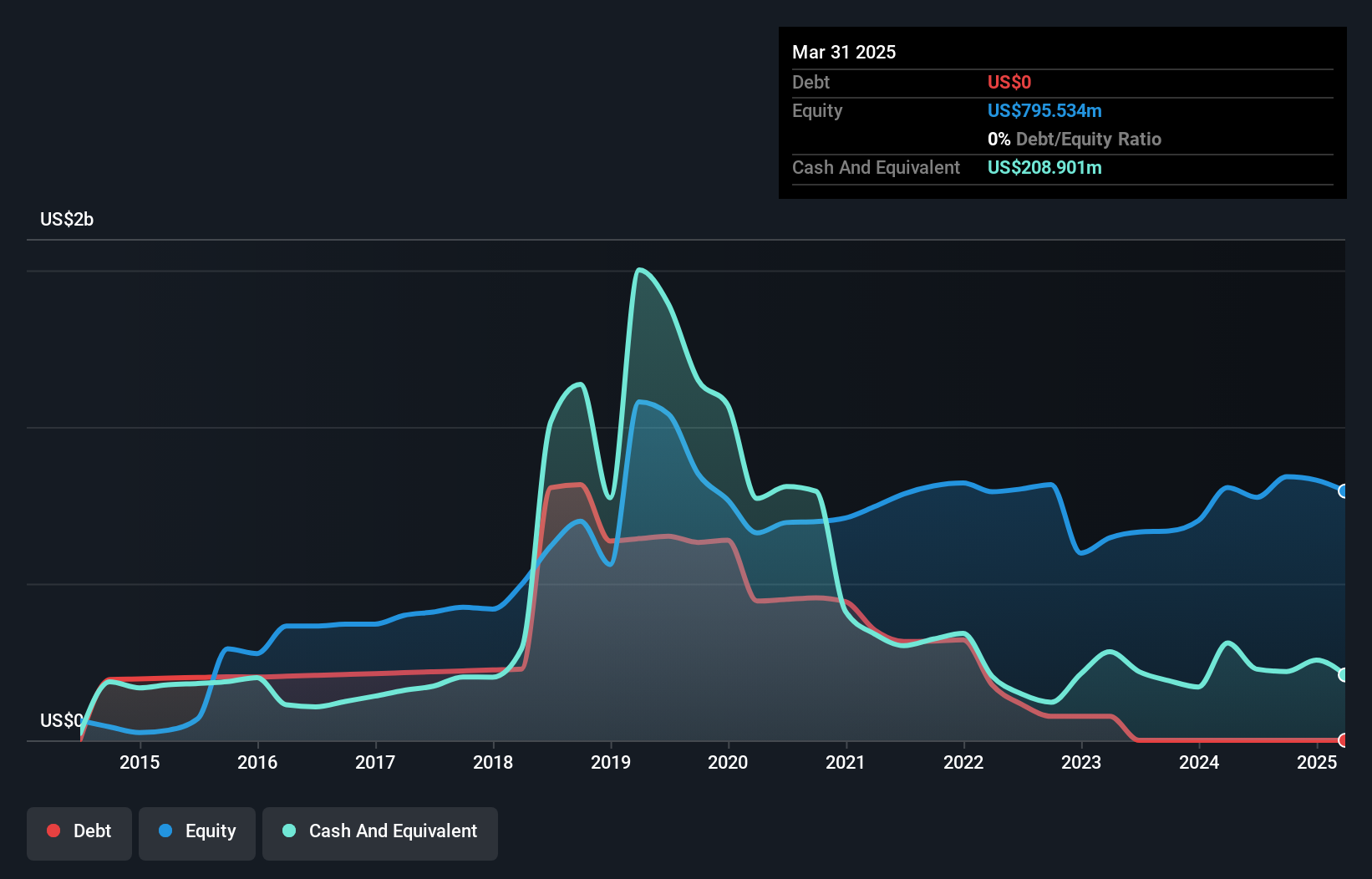

Ligand Pharmaceuticals, a small-cap biotech firm, has seen earnings grow by 87.7% in the past year, outpacing the industry’s 19.9%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 59.6%. Despite significant insider selling recently, Ligand trades at 50.6% below its estimated fair value and forecasts a revenue growth of 19.8% annually. However, earnings are expected to decline by an average of 23.5% per year over the next three years.

- Navigate through the intricacies of Ligand Pharmaceuticals with our comprehensive health report here.

Evaluate Ligand Pharmaceuticals' historical performance by accessing our past performance report.

Meta Data (NYSE:AIU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Meta Data Limited, with a market cap of $374.09 million, operates a K-12 after-school education platform specializing in young children's mathematics training and FasTrack English services in China and internationally.

Operations: Meta Data Limited generates revenue primarily from its educational services, specifically in education and training, amounting to $32.43 million. The company has a market cap of $374.09 million.

Meta Data, a small-cap company, recently executed a 1:5 stock split on July 29, 2024. Despite becoming profitable this year and having high-quality earnings, the company faces significant challenges. A winding-up petition was filed against it in April due to its inability to repay debts from a $139 million term facility drawn in March 2019. The debt-to-equity ratio surged from 41.1% to over 2151% in five years, indicating financial stress despite well-covered interest payments (4.4x EBIT).

- Get an in-depth perspective on Meta Data's performance by reading our health report here.

Gain insights into Meta Data's past trends and performance with our Past report.

Worthington Steel (NYSE:WS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Worthington Steel, Inc. operates as a steel processor in North America with a market cap of $1.96 billion.

Operations: Worthington Steel generates revenue primarily from its Metal Processors and Fabrication segment, amounting to $3.43 billion.

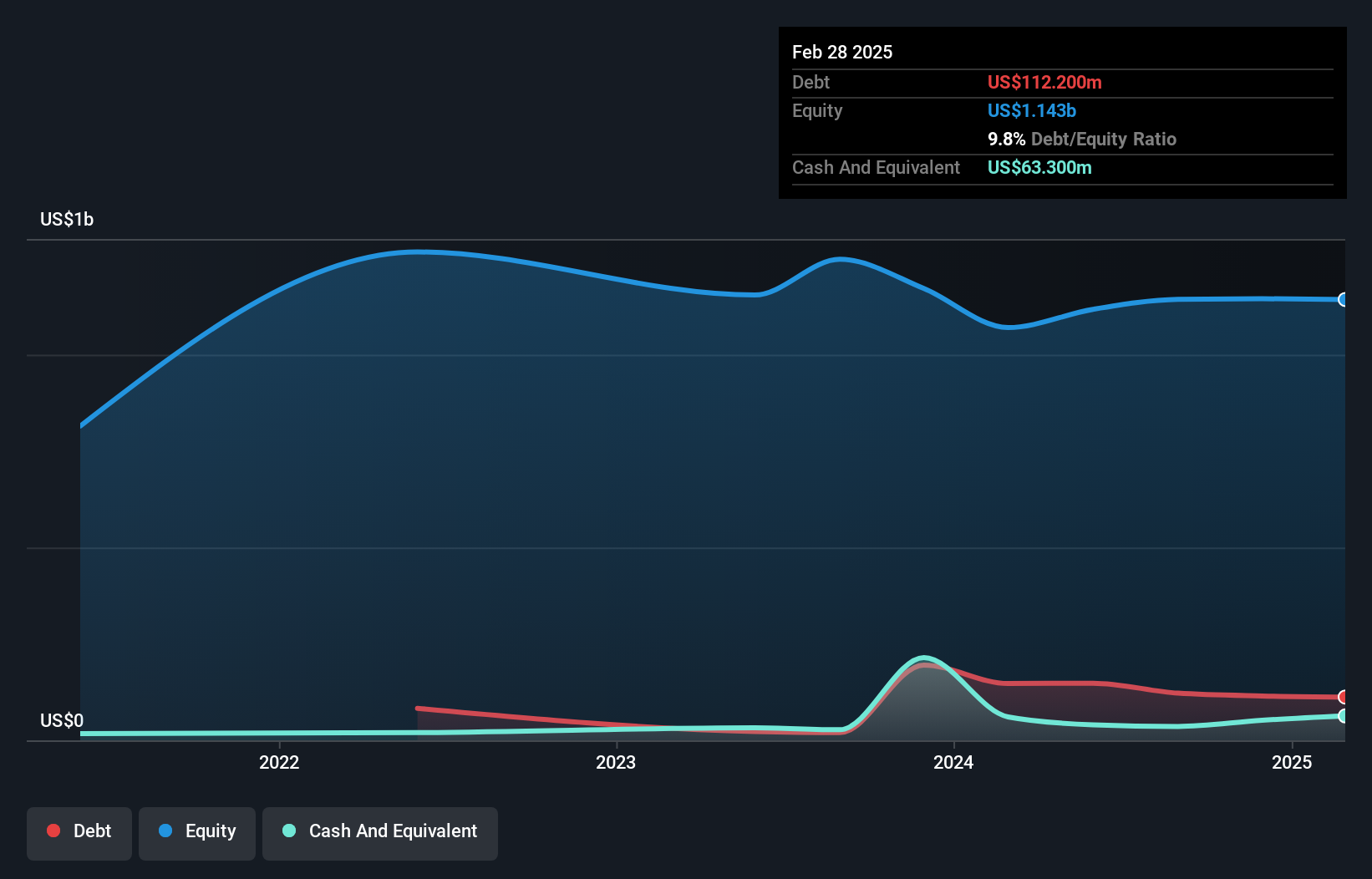

Worthington Steel has shown impressive earnings growth of 77.7% over the past year, significantly outpacing the Metals and Mining industry's -26.6%. For fiscal 2024, sales reached US$3.43 billion with net income at US$154.7 million, up from US$87.1 million in 2023. The company’s net debt to equity ratio stands at a satisfactory 9.6%, and its interest payments are well covered by EBIT (35.9x). Worthington also trades at a notable discount of 27.4% below estimated fair value.

- Click here to discover the nuances of Worthington Steel with our detailed analytical health report.

Assess Worthington Steel's past performance with our detailed historical performance reports.

Next Steps

- Explore the 224 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English