Undiscovered Gems In The United States For July 2024

Over the last 7 days, the market has dropped 1.7%, driven by a decline of 4.5% in the Information Technology sector. However, the market is up 17% over the past year and earnings are forecast to grow by 15% annually. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding. Here are three lesser-known stocks that could offer significant opportunities in July 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| River Financial | 131.04% | 17.59% | 20.70% | ★★★★★★ |

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Ligand Pharmaceuticals (NasdaqGM:LGND)

Simply Wall St Value Rating: ★★★★★★

Overview: Ligand Pharmaceuticals Incorporated is a biopharmaceutical company focused on the development and licensing of biopharmaceutical assets worldwide, with a market cap of $1.92 billion.

Operations: Ligand Pharmaceuticals generates revenue primarily from the development and licensing of biopharmaceutical assets, amounting to $118.31 million. The company has a market cap of $1.92 billion.

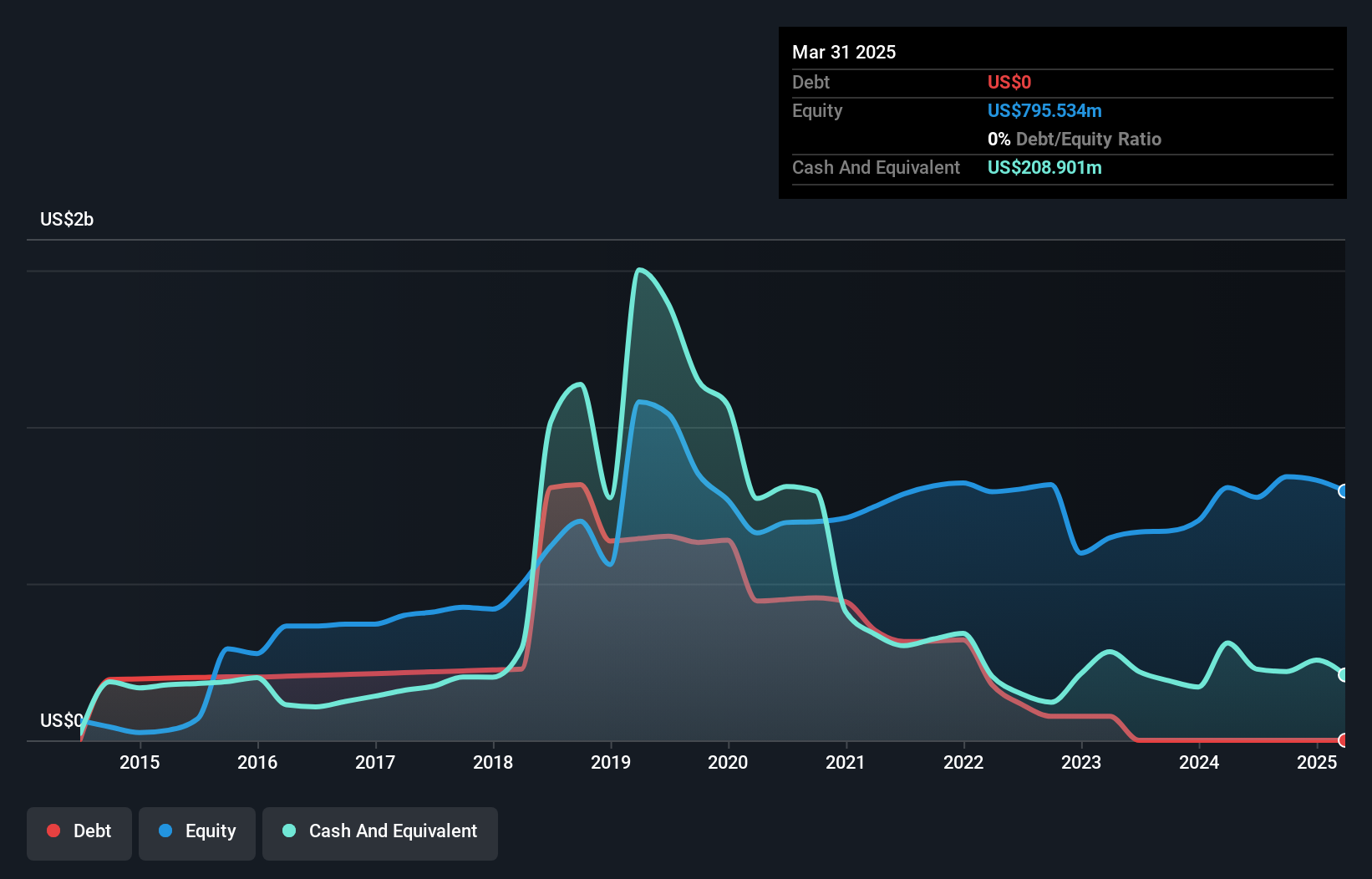

Ligand Pharmaceuticals has seen earnings grow by 87.7% over the past year, outpacing the industry average of 19.9%. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio was 59.6%. Despite recent insider selling and shareholder dilution, Ligand trades at 50.6% below its estimated fair value and forecasts a revenue growth of 19.8% annually.

Meta Data (NYSE:AIU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Meta Data Limited, along with its subsidiaries, provides K-12 after-school education services specializing in young children's mathematics training and FasTrack English services in China and internationally, with a market cap of $374.09 million.

Operations: Meta Data Limited generates revenue primarily from its educational services, amounting to $32.43 million. The company's market cap stands at $374.09 million.

Meta Data, a small cap stock, recently executed a 1:5 stock split and is currently facing legal challenges related to a $139 million term facility default. The company’s debt to equity ratio has ballooned from 41.1% to 2151.5% over the past five years, indicating significant financial strain. Despite these issues, Meta Data became profitable this year and its interest payments are well covered by EBIT at 4.4x coverage.

- Click here and access our complete health analysis report to understand the dynamics of Meta Data.

Evaluate Meta Data's historical performance by accessing our past performance report.

Yiren Digital (NYSE:YRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Yiren Digital Ltd. operates an AI-powered platform offering financial services in China, with a market cap of $403.38 million.

Operations: Yiren Digital Ltd. generates revenue primarily from its Financial Services Business (CN¥2769.36 million) and Insurance Brokerage Business (CN¥892.39 million), with additional income from the Consumption & Lifestyle Business (CN¥1625.62 million).

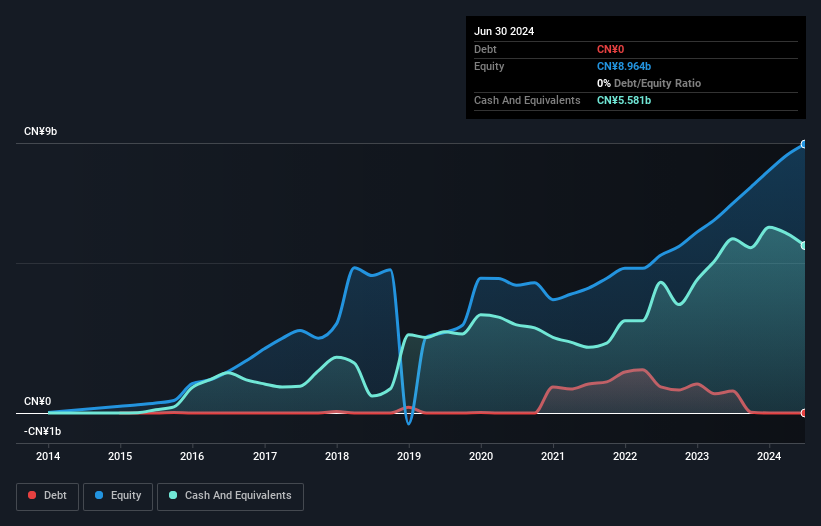

Yiren Digital, trading at 82.6% below its fair value estimate, has shown impressive growth with earnings up by 48.8% over the past year. The company is debt-free and reported a net income of CNY 485.88 million for Q1 2024, compared to CNY 427.17 million the previous year. Additionally, Yiren Digital repurchased 445,527 shares for $2.1 million in early 2024 and expects Q2 revenue between RMB 1.4 billion to RMB 1.6 billion with a healthy net profit margin.

- Click to explore a detailed breakdown of our findings in Yiren Digital's health report.

Explore historical data to track Yiren Digital's performance over time in our Past section.

Seize The Opportunity

- Access the full spectrum of 224 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English