Three Solid Dividend Stocks Offering Up To 4% Yield

As global markets navigate through a period of relative calm with anticipation for upcoming earnings reports and key economic updates, investors continue to seek reliable income streams amidst the shifting economic landscape. In this context, dividend stocks emerge as appealing options for those looking to balance yield and stability in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.68% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.59% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.15% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.30% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

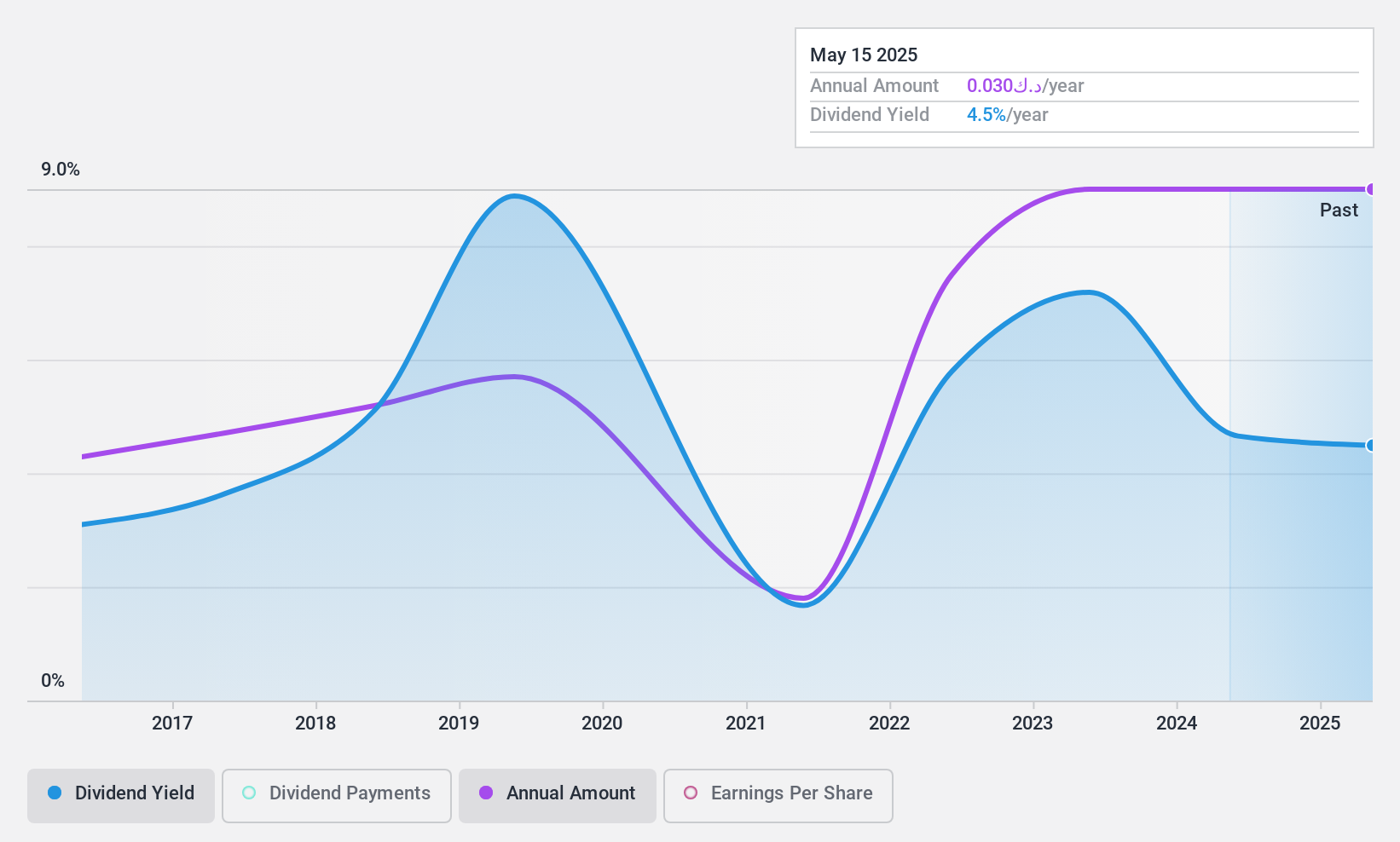

Combined Group Contracting Company - K.S.C. (Public) (KWSE:CGC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Combined Group Contracting Company - K.S.C. (KWSE:CGC) is a Kuwait-based entity specializing in construction and contracting services, with a market capitalization of KWD 127.39 million.

Operations: The revenue segments for Combined Group Contracting Company - K.S.C. are not specified in the provided text.

Dividend Yield: 4%

Combined Group Contracting Company's dividend sustainability is supported by a payout ratio of 51.1% and a cash payout ratio of 55.8%, indicating dividends are well-covered by both earnings and cash flows. However, the company's dividend track record shows volatility over the past decade, with significant annual fluctuations. Additionally, its current dividend yield of 4% is below the top quartile in its market, which averages 6.66%. Recent financial performance shows an increase in net income to KWD 3.22 million from KWD 2.3 million year-over-year for Q1 2024, suggesting some positive momentum in earnings despite a decline in sales from KWD 44.73 million to KWD 41.63 million.

- Click here to discover the nuances of Combined Group Contracting Company - K.S.C. (Public) with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Combined Group Contracting Company - K.S.C. (Public)'s current price could be quite moderate.

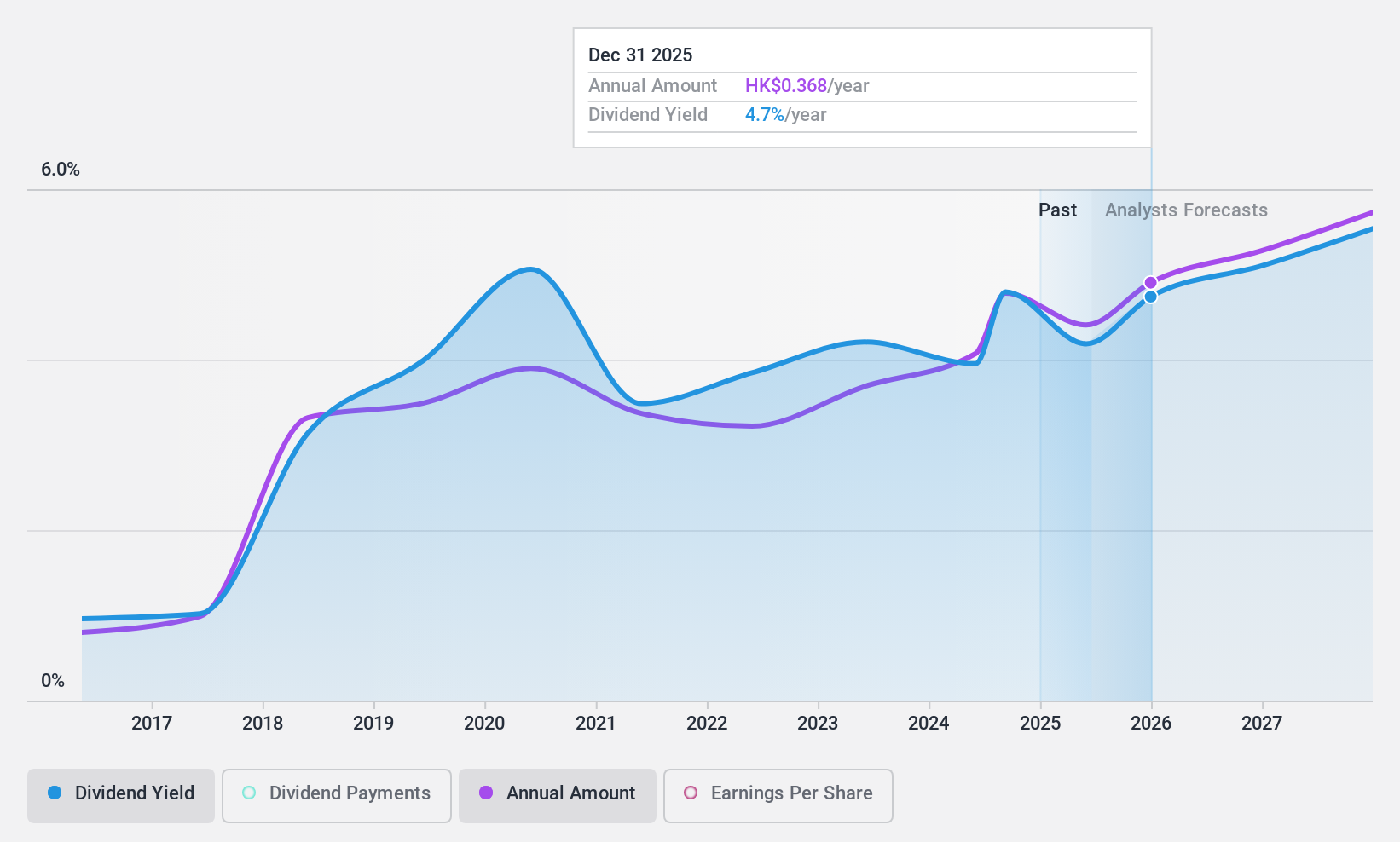

Kunlun Energy (SEHK:135)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kunlun Energy Company Limited operates primarily in the exploration, development, production, and sale of crude oil and natural gas, with a market capitalization of approximately HK$76.02 billion.

Operations: Kunlun Energy Company Limited generates revenue through various segments including natural gas sales excluding LPG (CN¥142.89 billion), sales of LPG (CN¥26.90 billion), LNG processing and terminal operations (CN¥12.17 billion), and exploration and production activities (CN¥0.91 billion).

Dividend Yield: 3.4%

Kunlun Energy's dividend sustainability is moderately secure with a payout ratio of 43.2% and a cash payout ratio of 26.6%, indicating that dividends are well-supported by both earnings and cash flows. However, the company's dividend history has been inconsistent, with volatile payments over the past decade despite recent increases. The current yield of 3.47% is considerably lower than the top quartile of Hong Kong market dividend payers at 8.02%. Recent executive changes and auditor withdrawal may introduce uncertainties affecting future performance and governance stability.

- Unlock comprehensive insights into our analysis of Kunlun Energy stock in this dividend report.

- Our valuation report here indicates Kunlun Energy may be undervalued.

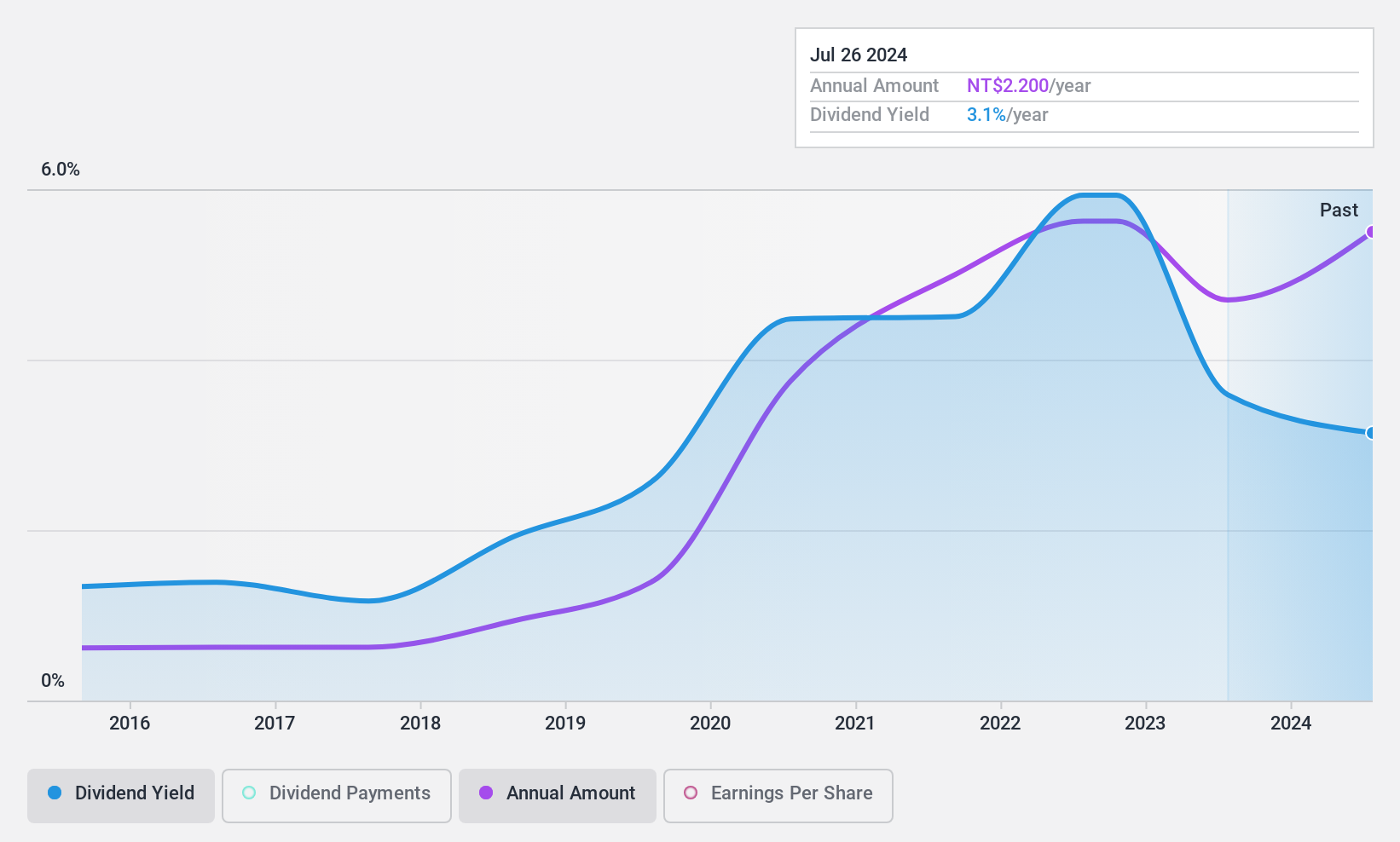

Jiin Yeeh Ding Enterprises (TPEX:8390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiin Yeeh Ding Enterprises Corp., based in Taiwan, operates in the recycling and refining of precious metals with a market capitalization of NT$6.81 billion.

Operations: Jiin Yeeh Ding Enterprises generates NT$3.71 billion in revenue from its waste management segment, focusing on the recycling and refining of precious metals.

Dividend Yield: 3.1%

Jiin Yeeh Ding Enterprises exhibits a mixed performance in its dividend metrics. While the company has shown a commitment to maintaining stable dividends over the past decade, its current yield of 3.1% trails behind the top quartile of Taiwanese market dividend payers. Notably, both earnings and cash flows do not adequately cover its high cash payout ratio of 367.7%, signaling potential sustainability issues despite a reasonable earnings payout ratio of 38%. Recent financial results indicate a slight decline in net income and earnings per share compared to the previous year, with sales showing modest growth from TWD 896.06 million to TWD 946.06 million as reported on May 15, 2024.

- Take a closer look at Jiin Yeeh Ding Enterprises' potential here in our dividend report.

- Our valuation report here indicates Jiin Yeeh Ding Enterprises may be overvalued.

Next Steps

- Navigate through the entire inventory of 1969 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English